Use digital RMB coupons and spend digital RMB to ride bike-sharing … … Digital RMB is increasingly integrated into people’s lives. However, many people still have some questions about this new payment method, so listen to the authoritative response from the People’s Bank of China.

The picture shows the audience walking past the sign of digital RMB in Shougang Park of the International Trade Fair on September 5th. Xinhua News Agency reporter Wu Weishe

1. How big will the issuance scale of digital RMB be?

After several years of efforts, China’s digital RMB pilot has formed a "10+1" pattern, including 10 pilot areas and the Beijing Winter Olympics scene. As of October 8 this year, there have been more than 3.5 million pilot scenarios of digital RMB, and 123 million personal wallets have been opened, with a transaction amount of about 56 billion yuan.

At present, digital RMB is still in the pilot stage of research and development, and its distribution scale is relatively limited. However, with the continuous expansion of the pilot scope in the future, can the issuance scale of digital RMB meet the needs of the people?

"We have always stressed that the use and promotion of digital currency, the central bank, should follow the principle of marketization. In other words, how much people need to exchange, how much we will issue. " Yi Gang, governor of the People’s Bank of China, gave a clear answer in a video speech at the 30th anniversary of the founding of the Institute of Emerging Economies of the Bank of Finland.

Digital RMB and physical RMB are issued in parallel. Some people are worried: if you want as much as you want, will it cause the problem of "currency overshoot"?

Don’t worry, the People’s Bank of China has fully considered such issues when designing relevant system regulations.

First of all, the digital RMB adopts a two-tier operation system, and the People’s Bank of China implements centralized management. Yi Gang said that the commercial banks and payment institutions that consumers contact when using digital RMB are only "intermediaries" to exchange digital RMB for the public and provide payment services. The People’s Bank of China is still in a central position in the process of launching digital RMB, ensuring the ability to regulate and control currency issuance and monetary policy can avoid the problem of "currency over-issuance" of designated operating institutions.

At the same time, the digital RMB is mainly located in cash payment voucher (M0), excluding interest, so people will naturally not convert a large amount of deposits into digital RMB, nor will it cause financial disintermediation and reduce the transmission efficiency of monetary policy.

In addition, setting the upper limit of digital wallet balance and transaction amount can effectively reduce the risks such as bank run.

The picture shows the staff of Bank of Communications Beijing Branch (left) guiding the tourist Ms. Li to open a digital RMB wallet on June 16. Xinhua News Agency reporter Chen Zhongyu photo

2. How long will RMB cash last?

Some people think that with the increasing inclusiveness and availability of digital RMB, it will gradually replace cash. Will RMB cash withdraw from people’s lives?

"China has a vast territory, a large population and great differences in regional development. These factors and residents’ payment habits determine that cash will still exist for a long time in the foreseeable future." Yi Gang made it clear that as long as there is demand for cash, the People’s Bank of China will not stop the supply of cash or replace it with administrative orders.

At present, the "digital divide" dilemma of the elderly in the field of mobile payment cannot be ignored, and it is difficult for a considerable number of elderly people to enjoy the efficiency and convenience of digital RMB. At the same time, in some relatively remote or poor areas, it is difficult to achieve full coverage in the layout of electronic payment machines. Therefore, many people still need to use RMB cash, and their payment choices should be respected.

It can be seen that the physical RMB has the irreplaceable characteristics of other payment methods, and the physical RMB will coexist with the digital RMB for a long time.

3. How to protect the privacy of digital RMB?

In recent years, mobile payment has developed rapidly. Last year, China’s mobile payment amount increased by nearly 25% year-on-year, and the current penetration rate has reached 86%.

"But the current electronic payment tools are mainly provided by the private sector, and there may be risks such as market segmentation and privacy leakage." Yi Gang believes that the central bank’s digital currency (CBDC) can enable the central bank to continue to provide credible and safe means of payment for the public in the digital economy era, and maintain the stability of the payment system while improving the payment efficiency.

So, how does digital currency handle the relationship between privacy protection and crime prevention? Yi Gang introduced that there is a basic consensus in the international community that CBDC cannot be completely anonymous, otherwise it will aggravate the risk of illegal transactions such as money laundering and terrorist financing and harm the public interest. Therefore, the digital RMB has the characteristics of controllable anonymity.

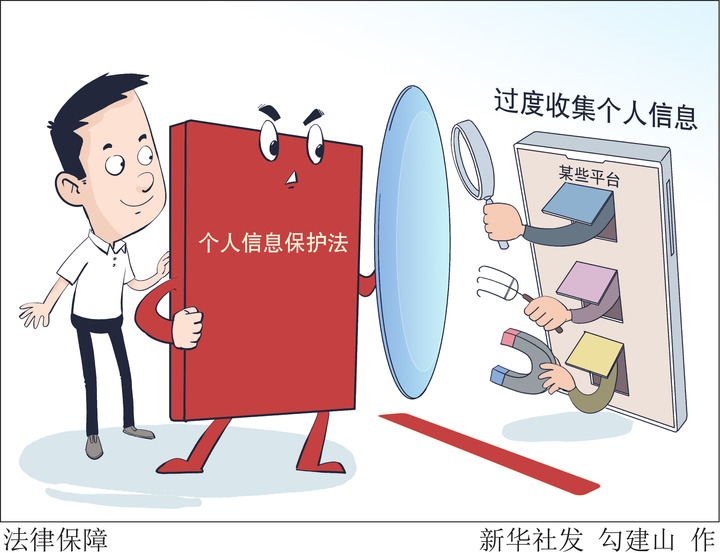

"We attach great importance to the protection of personal information of digital RMB and have adopted corresponding institutional arrangements and technical designs." Yi Gang introduced that digital RMB adopts the principle of "anonymity in small amount and traceability in large amount according to law" and follows the principle of "minimum and necessity" when collecting personal information, and the amount of information collected is less than that of existing electronic payment tools. At the same time, strictly control the storage and use of personal information. Unless there is a clear legal requirement, the People’s Bank of China shall not provide relevant information to any third party or government agency. In addition, the data security law and personal information protection law recently promulgated in China have also strengthened data security and privacy protection from the legislative level.

4. When will the digital RMB be used across borders?

At present, more than 110 countries have carried out CBDC related work to varying degrees. When can digital RMB be used across borders?

"In view of the complexity of cross-border use, digital RMB is currently mainly to meet domestic retail demand." Yi Gang said that cross-border and international use is relatively complicated, involving legal issues such as anti-money laundering and customer due diligence, which are being discussed in depth internationally. The People’s Bank of China is willing to strengthen cooperation with central banks and international institutions in digital currency.

Previously, the digital currency Research Institute of the People’s Bank of China, the Hong Kong Monetary Authority, the Central Bank of Thailand and the Central Bank of the United Arab Emirates jointly launched the digital currency Bridge research project of multilateral central banks to jointly study the role and technical feasibility of the central bank digital currency in cross-border payment. The People’s Bank of China also conducted technical exchanges with the European Central Bank on the design of CBDC.

Yi Gang said that in the future, the People’s Bank of China will continue to discuss the standards and principles of CBDC with central banks and international organizations in an open and inclusive manner, and properly deal with various risk challenges in the process of promoting the development of the international monetary system. (Reporter Wu Yu)

关于作者