[car home Information] Recently, Xpeng Motors released the latest sales data. In October, Xpeng Motors delivered 20,002 units, exceeding the 20,000 mark, with a month-on-month increase of 31% and a year-on-year increase of 292%, setting a new monthly delivery record. In terms of sub-models, (|) delivered 8,741 units in October, and the monthly delivery volume continued to increase.

As can be seen from the official sales figures, up to now, the delivery volume in Xpeng Motors has been steadily increasing in 2023, with the largest increase in October. On the just-concluded 1024 Tucki Science and Technology Day, He Xiaopeng announced the latest development of XNGP intelligent assisted driving system. The navigation assisted driving function of cities without high-precision maps will be opened to 20 cities in the first phase, and the public beta was officially opened that night, which will increase to 50 cities this year. The AI driving function will start a small-scale test, which will be open to some users during the year and complete national coverage in 2024. At the same time, Tucki X9, the fifth-generation Tucki intelligent cockpit Xmart OS Tianji, the next-generation electric drive system, Tucki flying car, and the brand-new robot PX5 were also unveiled at Tucki Science and Technology Day.

● The following is a complete review of the 1024 Tucki Science and Technology Day:

1. Tucki pure electric MPV-Tucki X9 was officially released.

During this period of time, the automobile circle is simply an "MPV meeting". Many brands such as Volvo, Ideality and Great Wall are betting on the electric MPV market, and Tucki X9 is Xpeng Motors’s answer sheet in this brand-new field.

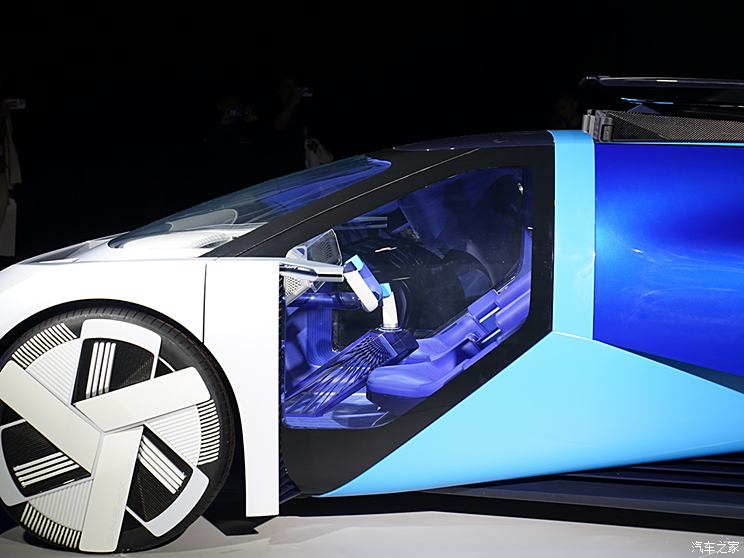

Tucki X9 is officially called a "new species", positioning the pure electric intelligent seven-seat MPV model.The car will be officially unveiled at the Guangzhou Auto Show.. It does stand out from the crowd in the design level, adopting many sharp lines and being very avant-garde. As always, the front of the new car uses penetrating daytime running lights and split headlights, and the front enclosure with borderless style is below. Just like Tucki G9, the black trim strip once surrounded and extended the car body, which enhanced the sense of grade of the whole car. In addition, this car places lidar on both sides of the front enclosure.

Different from the "Erffa-like" shape of many MPVs on the market and the "high-speed rail" design like the ideal MEGA, the body of Tucki X9 is more tough, which benefits from the application of many straight lines, such as A-pillar, roof, waistline and other details, and also shows another "science fiction" taste.

In terms of body size, the length, width and height of this car are 5293/1988/1785mm and the wheelbase is 3160 mm. Due to the suspended roof design, the car seems to have some space capsule feeling from the rear. Its taillights adopt a penetrating light group, and the license plate area adopts an inverted trapezoidal embedded shape, which is surrounded by bright black, and the overall visual layering is outstanding.

As the flagship model of the roll-up structure, Tucki X9 will undertake the core technologies of the roll-up structure such as global 800V, front and rear integrated aluminum die casting and XNGP, and become the only MPV model with rear wheel steering as standard in the world. As the first vehicle equipped with XOS Tianji intelligent cockpit system, Tucki X9 will bring users the application scenarios and service experience of the next generation intelligent cockpit.

According to the application information, the car will provide single-motor and dual-motor versions for consumers to choose from. The former has a maximum power of 235 kW. The maximum power of the latter is 235kW in front motor and 135kW in rear motor.

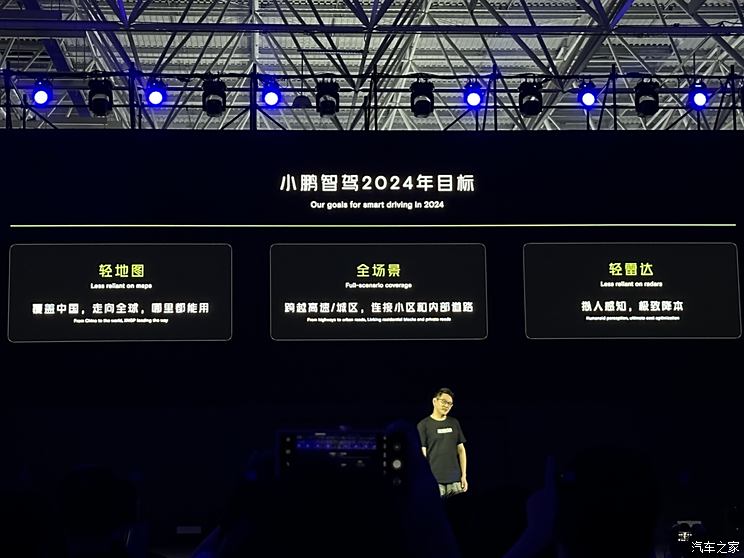

2. The latest development of XNGP intelligent driving in Tucki.

Thinking about the future, Tucki thinks that the automobile category will gradually evolve from software-defined cars to AI-defined cars. Xpeng Motors, as a smart car brand in China, deeply applies AI big model, empowering many fields such as R&D, design, intelligent driving and intelligent voice.

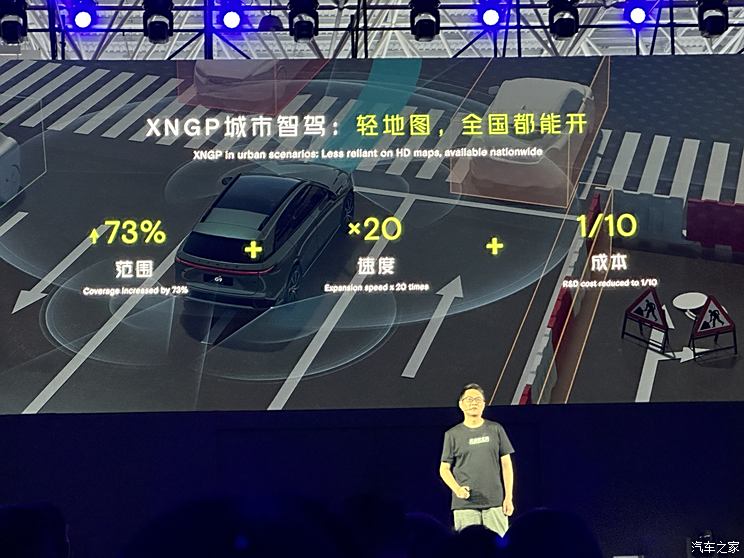

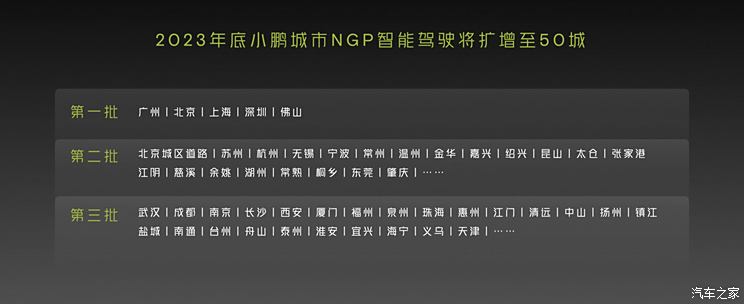

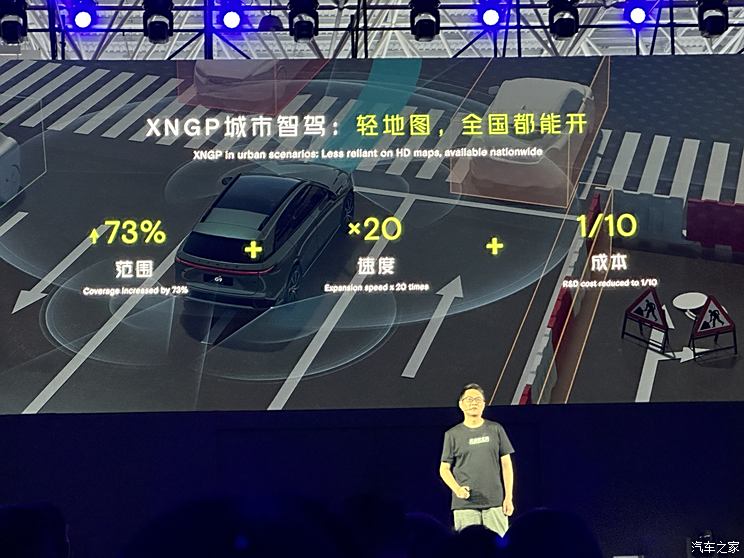

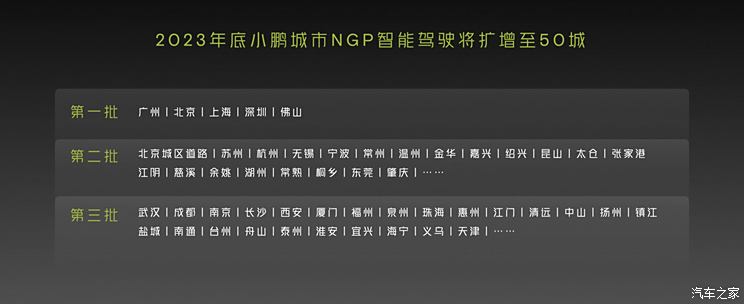

At the beginning of April, 2023, XNGP in Tucki fired the "first shot" of urban autonomous driving. If the first half of intelligent automobile opened users’ minds through simple scenes such as high-speed navigation, assisted driving and automatic parking, then the second half of intelligent driving was the competition of "urban intelligent driving". With the support of the previous generation of high-precision maps, Xpeng Motors realized intelligent assisted driving in five cities: Beijing, Shanghai, Guangzhou, Shenzhen and Foshan. Thanks to this, the latest generation of XNGP intelligent assisted driving system can be used and opened all over the country. Up to now, Tucki XNGP intelligent assisted driving system has covered 37% of the roads in the country.

In addition, the function of "AI driving" is another "sharp weapon" for Tucki’s intelligent driving. This function is not limited by the city. After the AI driving function is turned on, users can set the starting point and the ending point nationwide, and a memory map can be formed after manual driving once. After selecting the travel route, the AI driving function can be used to realize the city navigation-assisted driving of a single route/specific scene.

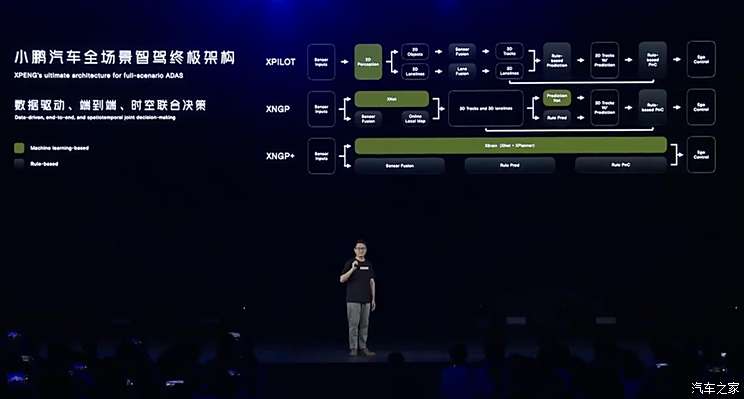

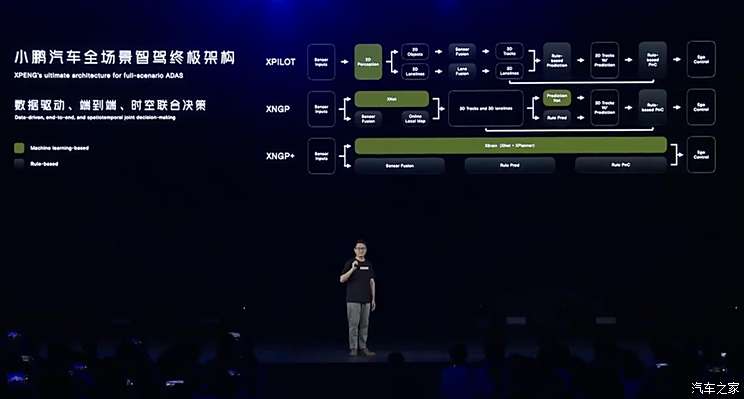

According to Tucki’s plan, the architecture of intelligent driving terminal oriented to the whole scene will realize data-driven, end-to-end, spatio-temporal joint decision-making. At the same time, Tucki also launched ——XBrain, the ultimate intelligent auxiliary architecture for the whole scene. XBrain is a clear vein from perception to understanding to cognition, which is formed by Tucki in the process of practice, just like human brain. XBrain consists of XNet 2.0, a deep vision neural network, and XPlanner, a control module based on neural network. XNet 2.0 integrates the industry’s highest precision pure vision occupation network, and realizes the integration of dynamic BEV, static BEV and occupation network. Xnet 2.0 is the industry’s first perceptual architecture with the ability to understand time and space by applying large models. At the planning and control level, XPlanner based on neural network can continuously analyze the motivation by combining the time series of minutes or more, and adapt in time according to the surrounding environment information to generate the best motion trajectory.

The core parts of XBrain: 1. XNet2.0 further improves the perception range by 200% and adds 11 types of perception. At the same time, it integrates the industry’s highest precision pure visual occupation network, and achieves the integration of dynamic BEV, static BEV and occupation network.

2. XPlanner: Planning and control based on neural network. Long time series can predict your prediction; Multi-object: decision-making is more comprehensive and anthropomorphic based on complete surrounding information (dynamic traffic+static environment); Strong reasoning: being flexible like a human being, you can take it one step at a time.

3. Using the big model, XNGP can understand time and space, read written information, have the concept of time and understand the traffic elements with different urban characteristics.

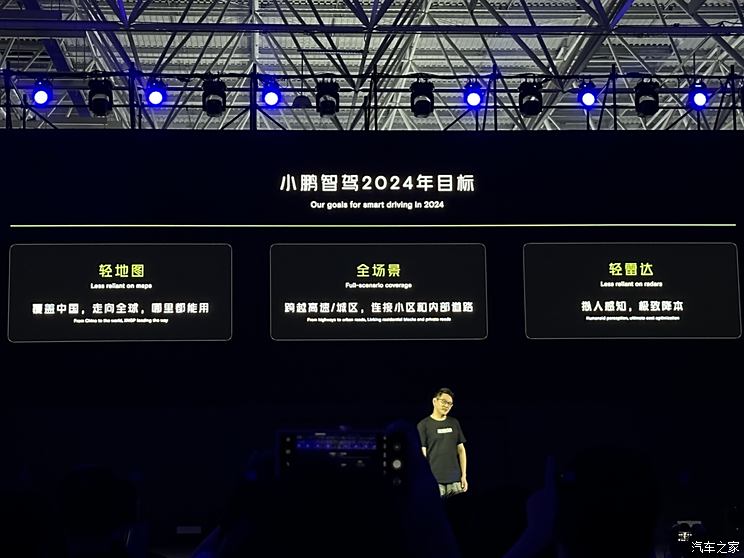

At the press conference, He Xiaopeng set a flag: It is necessary to challenge XNGP to achieve full coverage in the road networks of major cities in China (including Grade 1-4 roads) in 2024, and take the lead in applying X9 in Tucki.

At present, Tucki XNGP system has the technical ability to support urban intelligent driving nationwide, and it will be fully pushed to all XNGP users through OTA in the way of opening cities in batches. At present, five cities have been opened, which will increase to 25 cities by the end of November and 50 cities by the end of December. In the future, more areas will be covered, and the shadow mode will be launched to invite users to participate in the open plan, so as to improve more traffic lights, lane lines and intersection information with regional characteristics. Moreover, the Pro version of Tucki G6/G9/P7i will be greatly upgraded in the following aspects, and the public beta will begin on October 24th.

3. The fifth generation Tucki intelligent cockpit Xmart OS Tianji.

Tucki officially released the fifth generation intelligent cockpit system-XOS Tianji System, which is a cockpit system developed by Tucki to serve the "man-machine co-driving era" by deeply combining the intelligent driving ability and the application scenarios of the next generation intelligent cockpit. The system will be equipped with Snapdragon 8295 chip for the first time, with brand-new visual upgrade, dynamic effect upgrade and greatly improved interactive efficiency. Support split-screen multi-tasking, XDock, full-scene car sense SR, and intelligent voice access to XGPT Linxi model developed by Tucki. It is reported that XOS Tianqi system will be launched in Xiaopeng X9, and G6, G9, P7i and P7 will be upgraded to XOS Tianqi through OTA.

In the aspect of voice interaction, Xpeng Motors developed the XGPT model and connected it to the voice system, leading the voice interaction into the era of big model. The new AI small P skill has been further upgraded, with more than 800 skills, and it can be accurately conveyed by adding "small P" when the demand is raised, and the interaction is more natural. At the same time, AI Xiao P’s perceptual understanding and reasoning ability have been greatly improved, and it can actively recommend services during the car use process. In the future, Xiao P will also log on to Xpeng Motors Mobile App, where users can remotely command Xiao P to realize some functions of remote vehicle control. It is worth mentioning that, in addition to training and improving the intelligent driving ability and improving the understanding and reasoning ability of intelligent voice, Xpeng Motors also applies the large model to vehicle design and code development, enabling multiple business sectors and R&D fields to further improve efficiency.

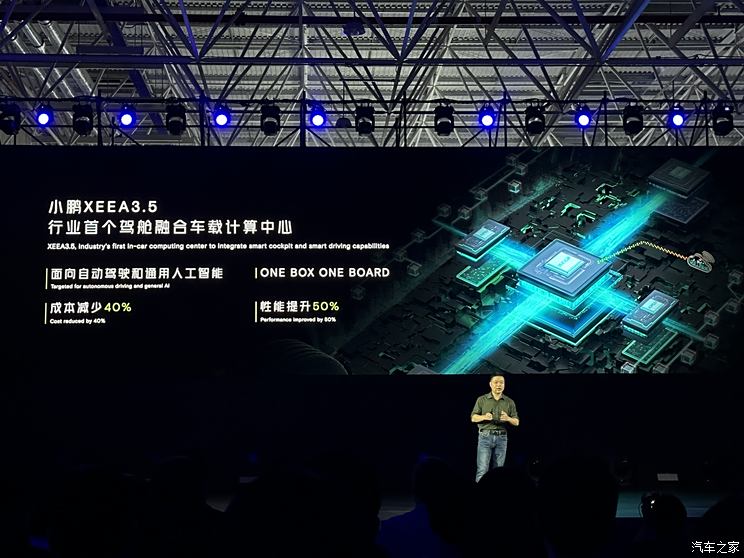

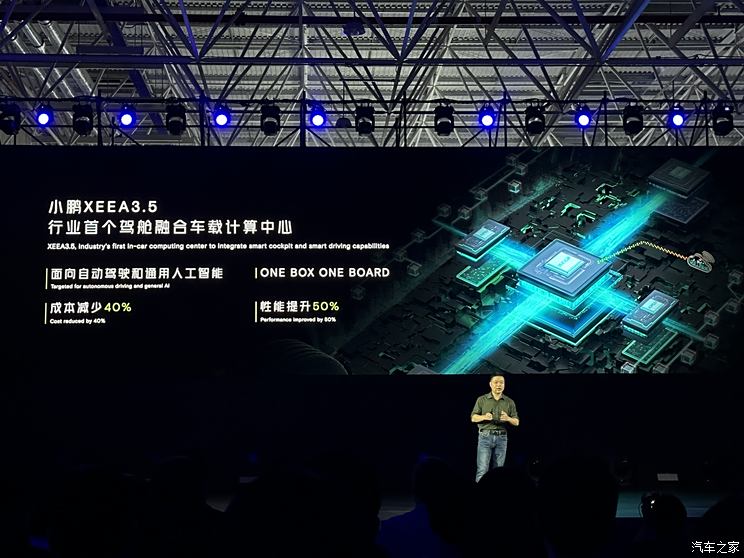

4. Tucki XEEA3.5, the first onboard computing center with integrated cockpit.

At present, the AIGC production model is becoming increasingly popular. Among many applications, Tucki has built the first vehicle-mounted computing center with integrated driving, cockpit, instrumentation, network management, IMU, power amplifier and other functions. It is the core computing node of the EEA3.5 electronic and electrical architecture in Tucki, and it is also the vehicle-mounted data center in Tucki facing the future era of autonomous driving and general artificial intelligence. Compared with the previous generation of central computing architecture, XCCP achieved 40% cost savings and 50% performance improvement.

5. Tucki Next Generation Electric Drive System

At present, Tucki is developing the next-generation electric drive system. It is reported that the next-generation electric drive system adopts a more efficient electromagnetic scheme, and the comprehensive efficiency exceeds 93% when driving at a high speed of 120km/h, breaking through the current "ceiling" of the industry. In addition, the further optimized silicon carbide scheme can reduce the key cost by 50% while ensuring the power efficiency, so that users can enjoy higher performance products at better prices.

6. Front-rear integrated die casting technology

This time, Tucki also released the only integrated die casting technology before and after mass production in China. And Tucki is also the only brand in China that has integrated die-casting body before and after production, and is pre-researching the next-generation CIB+ mid-floor integrated die-casting technology, which will further improve the vehicle life and reduce the vehicle manufacturing cost in the future.

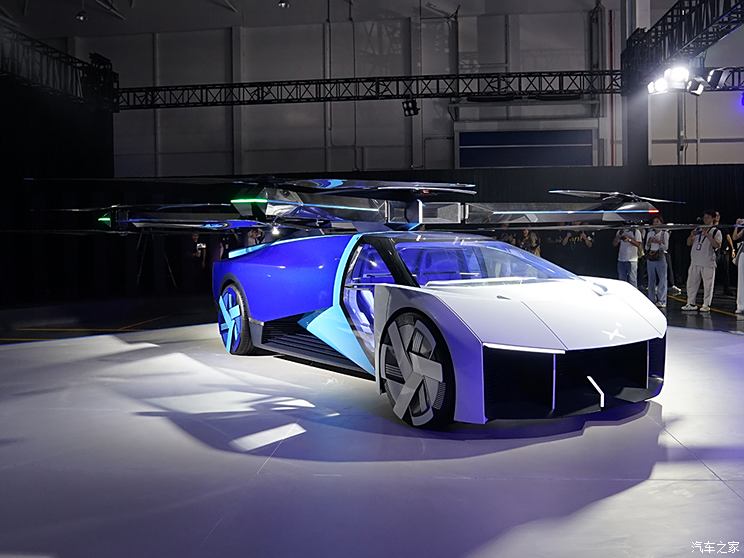

7. Flying cars in Tucki.

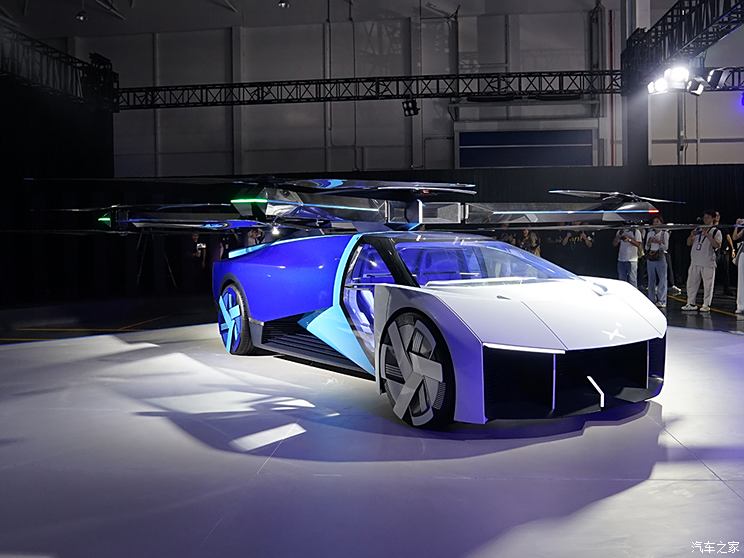

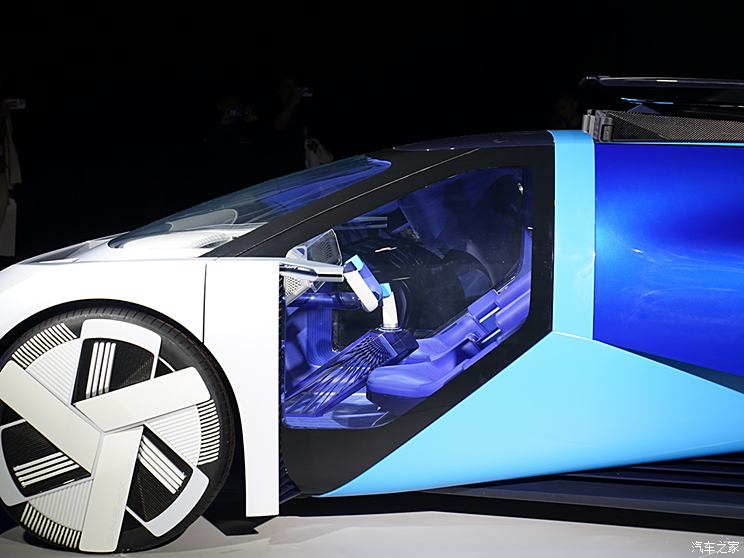

"Air-land integrated flying car"

Besides cars, Tucki has been exploring more possibilities of future travel modes. At this year’s 1024 conference, Tucki Huitian made clear two development paths of flying cars, namely, air-land integrated flying car and split flying car. Among them, the land-air integrated flying car adopts a dual-mode cockpit, which is further optimized on the basis of the styling announced in the previous two years, and adopts a super-running styling design, which has a more scientific and technological aesthetic appearance; The flight systems such as rotor and boom can be completely folded and stored in the car, which greatly reduces the wind resistance coefficient when landing.

『Split flying car』

Split flying car is called "land carrier", which is the next direction of mass production in Tucki. It consists of a land-going vehicle (mother ship) and a flying vehicle. The land-going vehicle has a cockpit for 4-5 people, and adopts an extended-range hybrid power system, which can carry the flying vehicle and continuously replenish energy for the flying vehicle. The flying body with pure electric vertical take-off and landing technology is equipped with a 270 panoramic double cockpit, which supports manual/automatic driving modes and can be automatically separated/combined with the land-based body. According to He Xiaopeng, the split flying car has a very wide range of application scenarios: it can not only vertically expand the travel boundaries of individual users, but also serve public utilities such as emergency and rescue, so that technological exploration results can benefit more public fields. In view of the key safety technology of flying cars, it can still fly safely after the "double rotor failure", and it is the world’s first ultra-low altitude multi-parachute life-saving system.

It is worth mentioning that on October 20th, Tucki Huitian announced the success of its self-developed 50-meter ultra-low altitude parachute opening experiment of the whole multi-parachute lifesaving system. It is understood that this technology fills the gap in the field of ultra-low altitude safety and lifesaving at home and abroad. When X2, a passenger of Tucki Huitian Flying Car, flew at a height of 50 meters, several groups of large parachutes were ejected and deployed rapidly. X2 landed smoothly at a grounding speed of 5.2m/s, and the body was intact.

8. Robots are not only available in Tesla-a brand-new robot in Tucki.PX5be published

What will the next generation of robots look like? During last year’s Science and Technology Day, Tucki demonstrated its quadruped robot. This time the robot has evolved again. In order to complete the service of enabling robots to go to the public and the family, Tucki will explore the quadruped next. In the past five months, Tucki has completed stable biped walking, and developed a biped robot to achieve the industry’s top biped walking and obstacle-crossing ability. Through the self-developed high-performance joints, the robot has achieved high-stability walking ability, which can complete indoor and outdoor walking and obstacle crossing for more than 2 hours.

Not only that, the robot has ultra-light humanoid arms, humanoid dexterous hands: one hand has 11 degrees of freedom, and the holding power of two fingers is 1kg. The rigid-flexible hybrid drive scheme is adopted to provide grasping and covering postures for objects with different shapes. Drive and control are integrated, and one hand weighs only 430g, with terminal tactile perception ability. The ultra-light humanoid manipulator can realize 7 degrees of freedom and the repetitive positioning accuracy is 0.05 mm. The maximum load of a single arm (3kg)/ the self-weight of the mechanical arm (5Kg), the self-weight ratio of load exceeds 0.6, and the maximum terminal linear velocity is 1m/s.

In the future, Tucki Penghang will apply XNGP, XEEA electronic and electrical architecture, XPower, XGPT Linxi big model, XOS and other smart car homologous technologies to intelligent robots, and try to apply them to scenes such as factory production and sales service, so as to deeply link intelligent robots with AI cars and drive to the next stop of auto companies. (Compile/car home Duandi)