Country Garden’s crisis is more representative than Evergrande’s, and it is by no means a family facing such a problem.

In the adjustment period, the government needs to introduce various relaxation policies more quickly to reduce the pain of private enterprises and avoid systemic risks.

In the long run, the official determination to restore confidence is obvious, and the crisis in Country Garden is expected to be properly resolved.

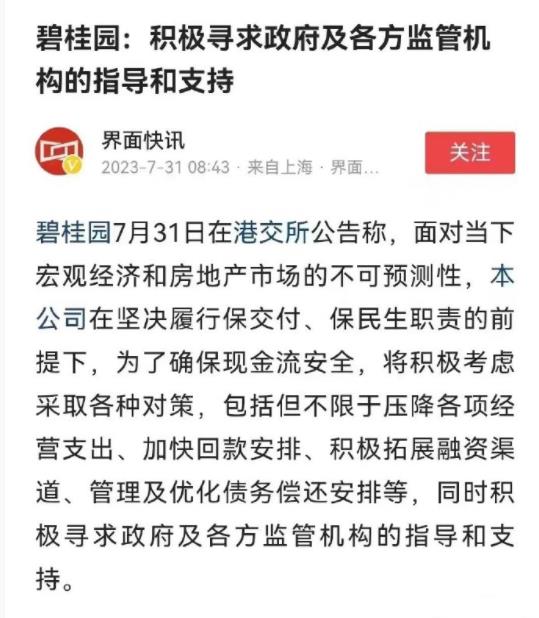

On July 31, Country Garden announced that it expected to record an unaudited net loss in the half year ending June 30, 2023.

The Board of Directors of Country Garden said that in order to ensure the safety of cash flow, it will actively consider taking various countermeasures, including but not limited to reducing various operating expenses, speeding up payment arrangements, actively expanding financing channels, managing and optimizing debt repayment arrangements, and actively seeking guidance and support from the government and various regulatory agencies.

Seeing such wording, I believe many people will question: Will Country Garden become the next Evergrande?

01

Country Garden is in danger, and there are early signs.

Seeking support openly generally includes these two meanings:

1. If something goes wrong with me, the social impact will be very great;

2. This is a problem of economic environment and industry, and it is not entirely my responsibility. Under normal circumstances, no matter how hard I try, I can’t solve the problem.

In fact, the crisis in Country Garden had a clue a few days earlier.

On July 21st, four domestic bonds issued by Country Garden all fell by more than 20%, and many overseas bonds also fell to varying degrees.

On July 25th, it was rumored that KPMG had been invited to conduct due diligence on the assets and liabilities of Country Garden. There are also some rumors about Yang Guoqiang, the founder of Country Garden, and Yang Huiyan, his successor.

At that time, Country Garden’s response was that the rumor of "being transferred by the accounting firm" was not true, and both Yang Guoqiang and Yang Huiyan were working normally at the headquarters.

On July 30th, Country Garden Service, a Hong Kong stock company, revealed in the announcement that Yang Huiyan, Chairman of the Board of Directors, intends to donate 20% of his equity to Guoqiang Public Welfare Foundation (Hong Kong) Co., Ltd..

This incident caused the stock price to plummet, which also caused public concern.

Some people think that this is the Yang family’s donation to "transfer core assets". Because the founding member of Guoqiang Public Welfare Fund is Yang Huiyan’s sister Yang Ziying, and this fund promises not to sell the donated shares within 10 years, and the voting right is entrusted to Yang Huiyan, that is to say, this donation will not affect Yang Huiyan’s actual controller status.

However, professionals pointed out that Guoqiang Public Welfare Fund is indeed a qualified public welfare organization, and it is impossible to transfer core assets by donating shares.

Results On July 31st, Country Garden announced the cash flow crisis. So it seems that Yang Huiyan’s move will not be a simple donation. Of course, it is also true that Yang’s father and daughter are enthusiastic about public welfare. Over the past 20 years, they have participated in social charity donations totaling over 10.5 billion yuan.

In the past two years, Country Garden has really made great efforts and costs to solve the cash flow crisis.

In 2021, Country Garden achieved revenue of 523.06 billion yuan, gross profit of about 92.78 billion yuan, and core net profit attributable to shareholders of the company was about 26.93 billion yuan.

In 2022, Country Garden achieved an operating income of 430.37 billion yuan, only less than 90 billion yuan in 2021, but its gross profit fell to 32.88 billion yuan, and its core net profit attributable to shareholders fell to 2.61 billion yuan. It can be seen that in 2022, in order to pay off debts, Country Garden basically ignored profits.

In 2022, the number of employees of listed real estate enterprises was reduced by 159,100. Among them, the number of employees in Country Garden decreased by 30,773, with a year-on-year decrease of about 30.56%, ranking first in the downsizing of housing enterprises in 2022.

In terms of land acquisition, Country Garden’s land acquisition in 2019 was 130.3 billion yuan, while in 2022, Country Garden’s land acquisition was only 6.1 billion yuan. In the first half of this year, Country Garden’s land acquisition amount was only 5.8 billion yuan. Taking so little land for two consecutive years is definitely unable to support the continuous business operation of such a huge enterprise in Country Garden.

Therefore, the layoffs in Country Garden are understandable. At this point, what work can the development team and sales team do? From the cliff-taking decline, it can be seen that Country Garden is really saving its life by breaking its wrist.

At the same time, Country Garden’s share price is also falling all the way. In recent years, Yang Huiyan has repeatedly increased its holdings of Country Garden shares. In December last year, Yang Huiyan sold Country Garden service shares, and cashed in about HK$ 5 billion to lend it to Country Garden.

Country Garden takes the sinking route. The projects developed by Country Garden cover more than 1,000 counties. It is the only national real estate brand that people in many fourth-and fifth-tier cities and counties can get, which allows ordinary people to enjoy relatively high-quality houses.

It can be said that Country Garden has contributed to the urbanization of China. Yang’s father and daughter also tried their best to save the crisis. At the same time, because Country Garden sinks widely, if it collapses due to cash flow, the impact will indeed be very broad.

02

Yang Guoqiang, it’s too early to be optimistic

On February 16th, Country Garden Group held its 2023 annual working meeting. Mo Bin, the president and veteran of the group, said: "We paid a great price and won the’ Tieyuan Defence War’ which is related to the survival of the enterprise. This war has made us more mature and more powerful to face the long-term development this year and in the future. This is a valuable asset we have gained."

"Tieyuan Defence War" is one of the key battles to resist US aggression and aid Korea.

Why did Mo Bin say that the battle for survival had been won? This is because last October, a series of favorable policies for real estate were introduced.

Yang Guoqiang said at the meeting: "Two months ago, we were still walking in a dark tunnel. Today, two months later, we saw some light at the mouth of the tunnel."

Now look, their words are too early.

In the first quarter of this year, consumption, foreign trade and other data were very good-looking, and the property market transactions rebounded sharply. However, in the second quarter, the data became more severe, and the property market transaction also turned cold. From January to June 2023, the national investment in real estate development increased by -7.9% year-on-year, and the decline continued to expand by 0.7 percentage points compared with last month. Yang Guoqiang saw the dawn, seemingly fleeting.

But this does not mean that there is no hope to solve the problem, because after the economic restructuring is completed, China’s economy still has the opportunity to enter the expansion period again.

Only in this adjustment period, many enterprises will have a very painful life. Country Garden’s crisis is more representative than Evergrande’s, and it is by no means a family facing such a problem.

In the adjustment period, the government needs to introduce various relaxation policies more quickly to reduce the pain of private enterprises and avoid systemic risks.

Recently, various high-level meetings have given signals of relaxation.

The the State Council executive meeting held on July 31st emphasized that it is necessary to adjust and optimize the real estate policy, introduce policies and measures conducive to the stable and healthy development of the real estate market according to different needs and cities, and accelerate the research and construction of a new development model of the real estate industry.

But although the official signal to relax the property market is clear, it will take time for people’s confidence to recover. After all, they are worried that once house prices return to the upward trend, will the policy be tightened again? If so, isn’t it a pit to buy a house now?

Some time ago, a retired official issued a document saying that the real estate tax will be introduced immediately after the economy prospers again. Now that the economy is still in the process of recovery, just say that you will give it a stick when it prospers. Then, will the economy still dare to prosper? Do ordinary people still dare to have confidence?

In response to the concerns of ordinary people, the government has continuously released the signal that the relationship between supply and demand in the property market has changed. This signal is actually telling the people that the current adjustment of the property market policy is based on "changes in the relationship between supply and demand" and has certain stability.

However, ordinary people need time and look at the actual policies to understand this hint.

In the long run, the official determination to restore confidence is obvious. I believe that with the recovery of the economy and the property market, the crisis encountered by real estate enterprises such as Country Garden will also be properly resolved.

关于作者