CCTV News:The Trouble of Young Werther is a novella by German writer Goethe, and the hero of the novel, Werther, finally chose to commit suicide. After the novel came out, it caused German teenagers to follow suit one after another. This kind of imitative suicide phenomenon is called "Witt effect". Nowadays, the "Witt effect" has spread in individual groups, post bars and games on the Internet, where people discuss suicide methods, invite or instigate others to commit suicide. A 23-year-old young man Xiaowei is one of the participants and victims. In May 2018, he met with two young people of similar age through online groups and committed suicide. Xiaowei’s father, Mr. Hu, therefore has a new identity — — Advise the living.

Mr. Hu: "Hello, how is the situation today? Are you all right?"? Very good, don’t have that idea, okay. "

This caller is Mr. Hu. Every day, he communicates with people from all over the country who have suicidal thoughts, hoping to help them relieve their psychological pressure and persuade these people to communicate more with their families. Prior to this, Mr. Hu was a businessman, a humorous and cheerful fan, and a father who was a good cook. Now, he has another identity — — Advise the living.

The change began in May last year, when Mr. Hu’s son Xiaowei suddenly passed away, and his tragedy actually caused many young people to follow suit in the online suicide group, which made Mr. Hu feel obligated to do some work in addition to grief.

Mr. Hu: "I have to pay back a little mentally. Since my child is gone, I hope the other children will live well. That’s it. I’m sure this is a normal reaction. If I don’t think so, any parent will do the same. Since their children are gone, why not let others live well?"

Then why did Mr. Hu’s son pass away? How did Mr. Hu find this group that committed suicide together? This starts with a trip by his son Xiaowei last May. Mr. Hu’s family lives in Hebei. His son Xiaowei is 23 years old. After graduating from middle school, he began to work. He has experienced two ventures but both ended in failure. At present, he is the customer service of an online shop. Xiaowei once did something that amazed people around him, that is, in half a year, he reduced his weight from 170 kg to 130 kg through running and fitness.

Mr. Hu: "I lost 40 pounds at once. In half a year, I think my child is inspiring enough."

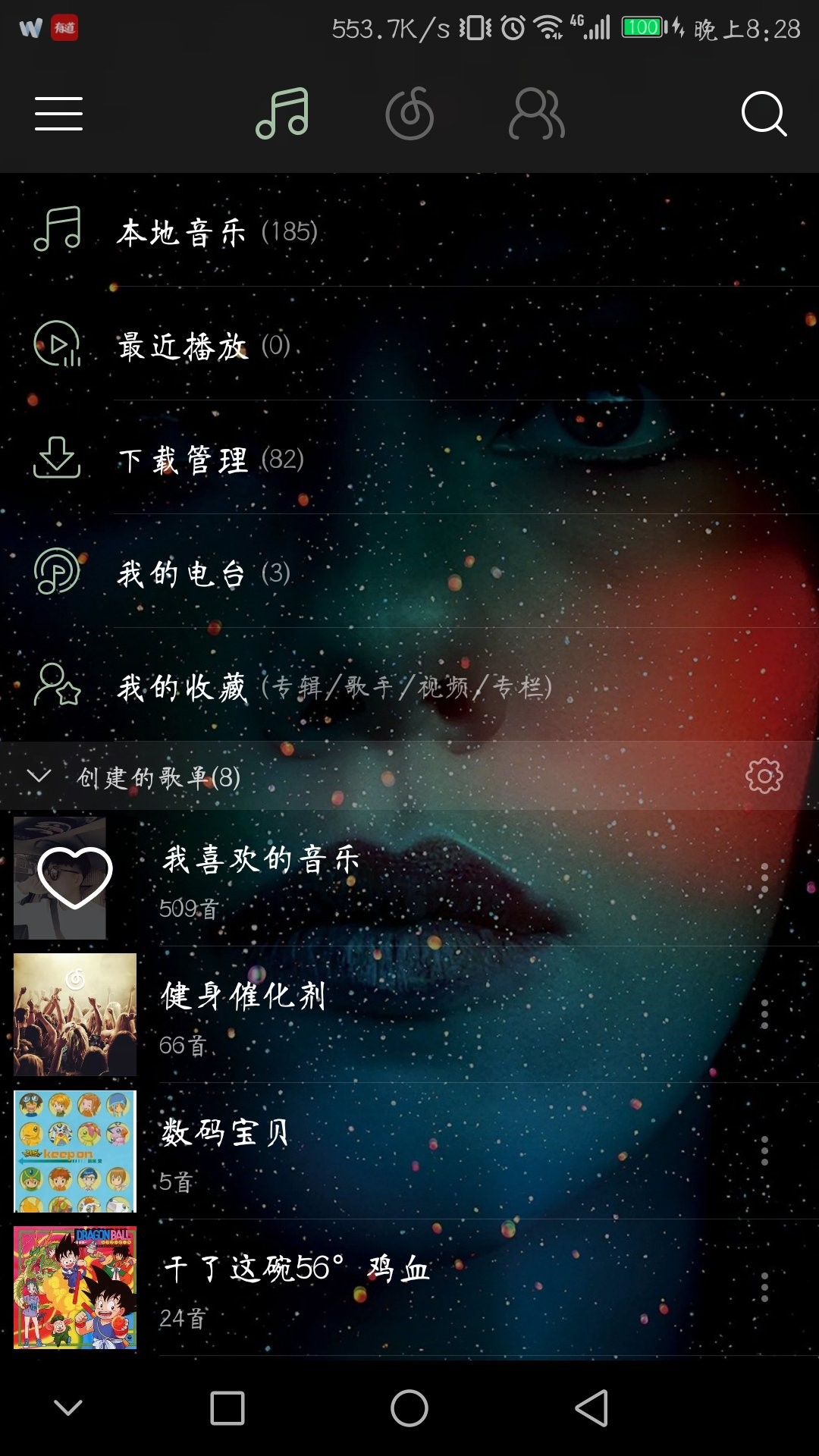

In Mr. Hu’s eyes, Xiaowei is sunny and handsome, and his self-discipline can also be seen through losing weight. Mr. Hu watches him punch in his mobile phone software every day. However, from the end of May 2018, the sports ranking on Xiaowei’s mobile phone fell to the end, less and less until it finally returned to zero, and people lost contact.

According to Mr. Hu’s memory, on the evening of May 22, 2018, he was preparing dinner at home. Xiaowei came home and took a bath. He went out again without coming and taking a bite of his cooking.

Mr. Hu: "I said I would come back for dinner, but he said I wouldn’t come back. It will take two or three days to meet a friend in Beijing."

Mr. Hu said that he thought his son went to Beijing to meet his girlfriend, so he didn’t ask much. But two or three days passed, and Xiaowei didn’t go home and there was no news. On the sixth day after Xiaowei left home, Mr. Hu learned that Xiaowei didn’t go to Beijing to meet his girlfriend, because her girlfriend was looking for him, and took some pictures from Xiaowei’s chat record and sent them to Mr. Hu, which made Mr. Hu vaguely have a bad feeling.

Mr. Hu: "What his girlfriend sent, what the children talked about, and what they talked about with others in the group were all about these issues."

Although Mr. Hu thinks there is something wrong with these chats, he still hopes that this is just a temporary emotional catharsis of the children. Because in his eyes, Xiaowei is a healthy and sunny big boy, and he has never shown the idea of suicide before.

However, when Xiaowei left home on the tenth day, he still couldn’t get in touch. Mr. Hu reported to the local public security bureau. According to the police investigation, on May 22, 2018, Xiaowei went to Beijing from Hebei, and took the high-speed train from Beijing to Wuhan the next day, and merged into an express hotel in Wuhan. Following this clue, Mr. Hu and his lover immediately rushed to Wuhan to find their son. With the help of the local police in Wuhan, Mr. Hu learned that Xiaowei’s hotel had been cancelled, and he had been to an Internet cafe and left. When the police searched for Xiaowei’s whereabouts, Mr. Hu and his lover went door-to-door to find their son near Xiaowei’s hotel, snack restaurants, Internet cafes and streets.

[Persuader] Three young people in the rental house died and left a suicide note.

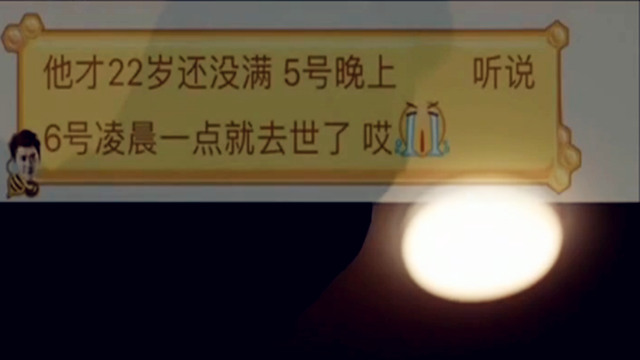

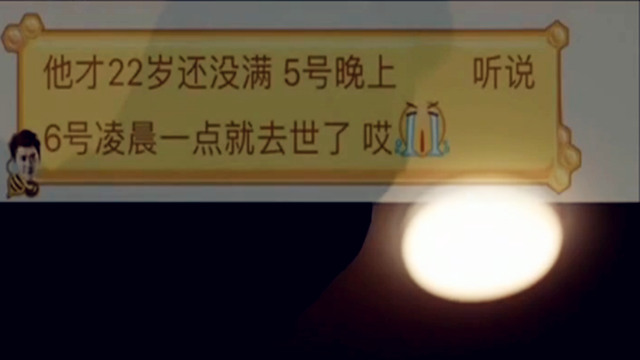

Mr. Hu and his wife spent four miserable days in Wuhan. On June 8, 2018, the couple finally waited for news about Xiaowei, but this was the last result they wanted to face.

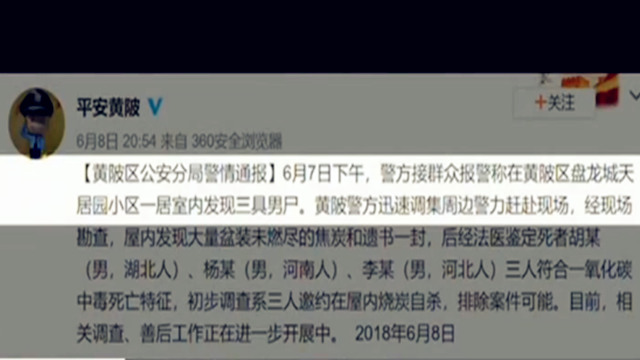

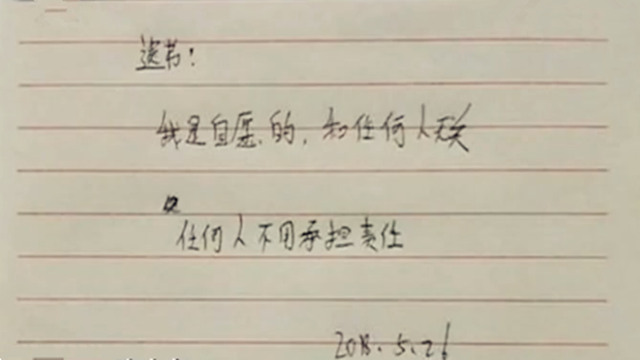

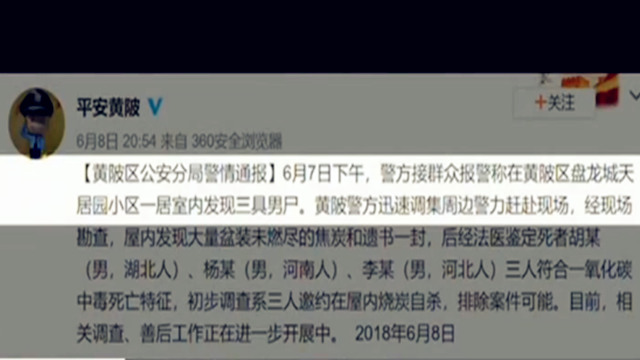

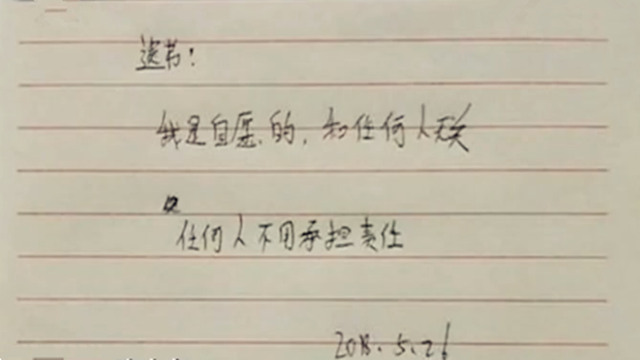

On June 8, 2018, Weibo, the official of huangpi district Branch of Wuhan Public Security Bureau, released a message saying that on June 7, 2018, he received an alarm from the masses and found three young men dead in a rented house in a residential area in huangpi district, Wuhan, leaving a suicide note signed by the three people. The police initially investigated that three people committed suicide by mutual agreement and ruled out the possibility of the case. The news was like a bombshell for Mr. Hu’s family, destroying their hopes. It was confirmed that one of the three suicide victims was his son Xiaowei, who was searching hard.

I dare not close my eyes. This is the state of Mr. Hu for a long time after Xiaowei’s accident, because when I close my eyes, my mind is full of the last time I saw Xiaowei. Twenty-three years ago, Mr. and Mrs. Hu brought their son to the world. Twenty-three years later, he died in such a way that his parents could not understand.

Looking back on Xiaowei’s growth track, he lives in a big family with four generations living under one roof and harmonious family relations. After graduating from high school, he followed his family out to do business and experienced two entrepreneurial failures. Usually, I don’t have much communication with my family, but I can talk with my peers. In Mr. Hu’s eyes, he is such a normal big boy. Why do you have the idea of suicide? When he didn’t have a clue, Mr. Hu suddenly thought of the chat software that Xiaowei usually used. Will there be any information that he ignored? So Mr. Hu decided to log in to this software with Xiaowei’s number to find the answer.

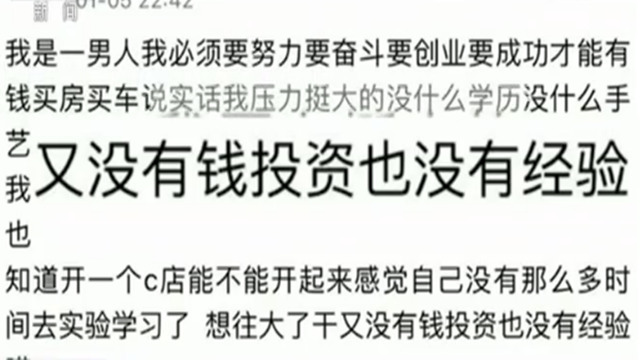

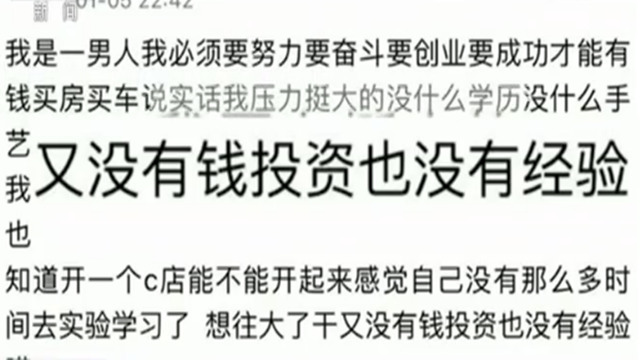

In Xiaowei’s personal space, Mr. Hu found that children with healthy eyes on the surface were under such great pressure in their hearts. Counting Xiao Wei’s words is full of confusion and anxiety.

Mr. Hu: "We really didn’t expect the child to have such great pressure, so we didn’t think about it from his point of view, because after all, although the child is young, he has been out of society for too long. He has been out of society since he was 15 years old, and it has been seven or eight years, so he is under great pressure without any achievements."

Mr. Hu said that now, recalling that Xiaowei lost 40 pounds in half a year, it shows that the child is a person who has high demands on himself, and he has worked hard in the society for several years, but his career has not improved, which makes him feel pressure. By logging into Xiaowei’s social software, Mr. Hu gradually approached his heart. Not only that, but also by logging into Xiaowei’s number, Mr. Hu made a more unexpected discovery.

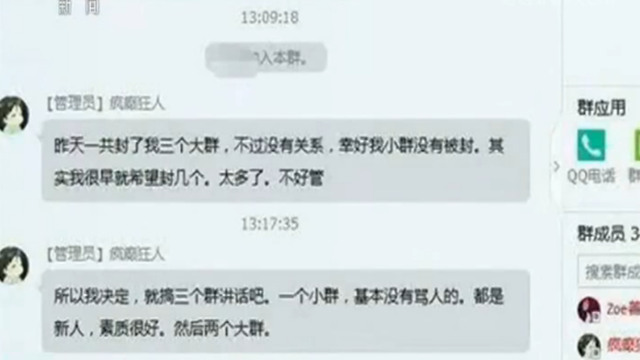

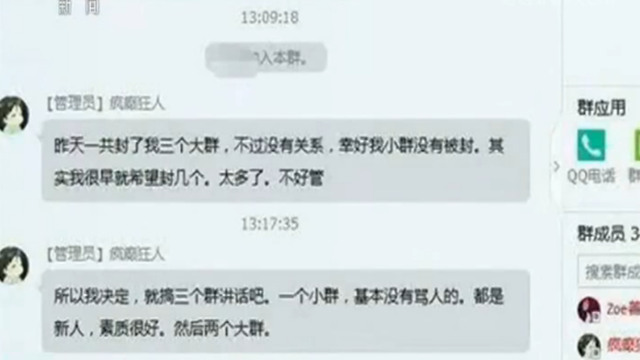

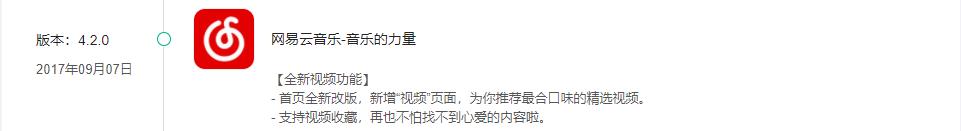

Mr. Hu: "When I logged in, I found someone to add him. Do you want to make an appointment? Let’s go together, brother, it’s all in this language. There are many people who take the initiative to add him. Later, I took the initiative to add another person. He said that there was a group, so he pulled me a 475. The moment I joined the group, there were 475 people. There was communication death in it. How to do it, I felt a little unimaginable. "

This group, which is unimaginable to Mr. Hu, mostly focuses on discussing suicide methods and committing suicide by appointment. It was in this group that his son Xiaowei found a partner who committed suicide. Even after his death, his experience was widely circulated in the group and became the object of imitation. After observing in the online chat area for a period of time, Mr. Hu joined several such groups one after another. He found that most of the group members were young people aged 15 to 30, and the reasons for the suicidal thoughts were illness, unsatisfactory studies, family conflicts, lovelorn, inability to repay loans and so on. So Mr. Hu tried to communicate with them. Mr. Hu used his own experience to persuade the young people in the group to know where someone planned to commit suicide and contacted the local police, and repeatedly reported these suicide groups and group owners to the online platform.

[Persuader] Should the network platform bear legal responsibility?

Adolescence is a period when a person’s ability to imitate is the strongest. When young people with suicidal thoughts meet with "suicide groups", tragedy arises. Then, should the network platform, relevant organizers and members of the group bear legal responsibility? We interpret it through a real case.

Mr. Hu believes that he should bear the responsibility for the tragedy of his son Xiaowei, but if Xiaowei did not join this online group and no one met him, could this tragedy be avoided?

From a legal point of view, what is the legal relationship between online platforms and suicide groups?

Wang Sixin, deputy dean of School of Politics and Law, China Communication University: "The relationship between this person on the platform and the platform is actually a relationship between a person who provides the platform and a person who uses the platform in relatively simple legal terms, or just like I am a car owner, I offer my bike or car for your use, so they are still a contractual relationship."

Then, if such a group meets and commits suicide, which leads to a tragedy like Xiaowei, should the network platform bear legal responsibility? In fact, there was a similar case as early as 2010. Two young people, Fan and Zhang, committed suicide in Lishui City, Zhejiang Province through chat software. Zhang gave up halfway and Fan died. Fan’s parents took Zhang, who gave up suicide, and Shenzhen Tencent Computer System Co., Ltd., the operator of chat software, to court.

The liandu People’s Court of Lishui City, Zhejiang Province held in the first instance that the defendant Xiao Zhang had repeatedly publicly announced the invitation to commit suicide to unspecified objects in different groups for a long time, and the defendant Shenzhen Tencent Computer System Co., Ltd. had never taken measures against this harmful information that might infringe on the life and health rights of others, which led Xiao Fan to meet with the defendant Xiao Zhang and commit suicide. If the actions of the two defendants are indirectly combined to cause damage, they shall bear the corresponding liability for compensation according to the size of the fault and the proportion of the causes. The court of first instance sentenced the defendant Xiao Zhang to bear 20% of the liability for compensation. Defendant Shenzhen Tencent Computer System Co., Ltd. shall be liable for 10% compensation.

Shenzhen Tencent Computer System Co., Ltd. appealed the verdict of the first instance. Another defendant, Zhang, withdrew the lawsuit after appealing.

In February 2012, the second instance of the Intermediate People’s Court of Lishui City, Zhejiang Province changed the judgment of the case. The court held that when network users use chat software to communicate, operators only provide network technical services and communication platforms. Operators have the obligation to passively review and supervise the group chat information after the network users have posted information in unspecified groups for many times, that is, they should take necessary measures after receiving the notice from the relevant right holders or knowing the existence of infringement facts, but it is difficult to actively review and supervise the group chat information in advance through manual and technical means. The court of second instance held that there was no causal relationship between Shenzhen Tencent Computer System Co., Ltd. and Fan’s death in this case. Therefore, it does not have the constitutive requirements of tort liability.

Zhu Wei, deputy director of the Communication Law Research Center of China University of Political Science and Law: "At the second trial, it was made clear that Tencent, as a network service provider, was wrong to let him take responsibility without receiving the previous notice or finding that he had violated the security obligations."

[Persuader] Some experts say that the website is not completely out of the way.

But experts also pointed out that this does not mean that websites can completely stay out of this kind of incident. According to the second paragraph of Article 36 of the Tort Liability Law, "if a network user uses network services to commit infringement, the infringed party has the right to notify the network service provider to take necessary measures such as deleting, blocking and disconnecting the link. If the network service provider fails to take necessary measures in time after receiving the notice, it shall be jointly and severally liable with the network user for the expanded part of the damage. " In other words, the website should take necessary measures immediately to avoid the occurrence and expansion of the damage when it is notified and reported by such harmful information as "suicide by meeting".

In 2017, the National Network Information Office issued the Regulations on the Management of Internet Group Information Services and the Regulations on the Management of Internet Users’ Public Account Information Services, emphasizing the need to strengthen supervision over Internet service providers of Internet groups and public accounts, that is, network platforms. If illegal information is found to be published or disseminated, measures such as elimination should be taken immediately to prevent the spread, keep relevant records, and report to the relevant competent authorities.

Not only that, the case in Lishui, Zhejiang Province occurred in 2010, and now nine years have passed. With the wide application of big data and the popularity of artificial intelligence, network platforms can also use more means to strengthen supervision and avoid similar incidents.

Whether the Internet platform should bear legal responsibility needs to be analyzed in combination with the specific case and whether it constitutes a causal relationship in law. However, experts pointed out that legal responsibility is the most basic responsibility that the network platform should bear, and on this basis, the social responsibility and moral responsibility that the platform should bear should be emphasized.

Zhu Wei, deputy director of the Communication Law Research Center of China University of Political Science and Law, said: "Now we are talking about the subject responsibility, and legal responsibility is only one part of the subject responsibility. In addition to fulfilling this piece, you are too big. So you have to take social responsibility. Therefore, I think that through this case, for the platform, we should consider how to guide and psychologically intervene when this kind of problem occurs again in the future. I think this is a big topic. "

In the case of suicide by appointment, in addition to the online platform, should a person who issued a death invitation similar to Zhang in the case of Lishui, Zhejiang, but finally terminated his suicide be held responsible? Experts believe that it can be analyzed from the perspective of civil law and criminal law according to different situations.

Zhu Wei, deputy director of the Communication Law Research Center of China University of Political Science and Law, said: "From the perspective of civil law, he is responsible for such a responsibility caused or obligated by a prior act. Because of your initial behavior, to commit suicide with him, you have strengthened the confidence of the other party to commit suicide. Because of this behavior, you have the obligation to stop others from committing suicide in the end. If it is not legally blocked, he will bear the responsibility of tort law, that is, the family of the deceased can ask him for such tort liability including compensation for mental damage. "

Experts pointed out that from the perspective of criminal law, the situation is more complicated. It is necessary to distinguish what kind of mentality people who invite suicide are at first, whether they want to end their lives together or have the mentality of instigating others to commit suicide. If it is the second case, it belongs to the category of instigation and needs to bear criminal responsibility. And those who set up suicide groups on the internet also need to bear corresponding legal responsibilities.

Zhu Wei, deputy director of the Communication Law Research Center of China University of Political Science and Law: "The National Network Information Office has special regulations. For this kind of community, including some post bars, including some QQ WeChat groups, the person who forms the group is called the group owner. The responsibility of the group owner has a management obligation for all the contents of this discussion in the group. At the same time, the purpose of the community he formed must be clearly defined by law. For example, it must not violate public order and good customs. Suicide certainly violates public order. Therefore, the responsibility lies with the owner of the group and he should be obliged to stop some discussions about illegal information in the group. When this tendency is found, he should stop it in time. "

How to guide the needy positively has become an important issue.

How to guide and intervene people in trouble is also an important topic. At present, there are some professional institutions devoted to the research and exploration of suicide intervention, which have become "advocates" in a broader sense.

During Mr. Hu’s time as an advocate, some people gave up the idea of suicide under his persuasion, while some people may still be talking to him today and will die suddenly tomorrow. At this time, Mr. Hu will be hit hard and he will often be in a state of walking on thin ice. Mr. Hu hopes that there will be more specialized organizations and professionals involved in the society to help those in need and their families resolve the crisis.

Nowadays, when keywords such as suicide are entered in some search engines, a psychological assistance hotline is displayed first. This hotline is a 24-hour free crisis intervention hotline set up by Beijing Psychological Crisis Research and Intervention Center.

Tong Yongsheng, deputy director of Beijing Psychological Crisis Research and Intervention Center: "Our hotline was made earlier. There are many hotlines all over the country aiming at this and helping people solve their psychological problems. Then it can play a wide-ranging role. Of course, we also mentioned some interventions of the school, including the goalkeeper plan, including the medical system I know now, and the suicide prevention plan. Of course, we have other institutions, such as public security and civil affairs. Many of them have their own systems, and as long as they are related to mental health, they can play some roles in this prevention. "

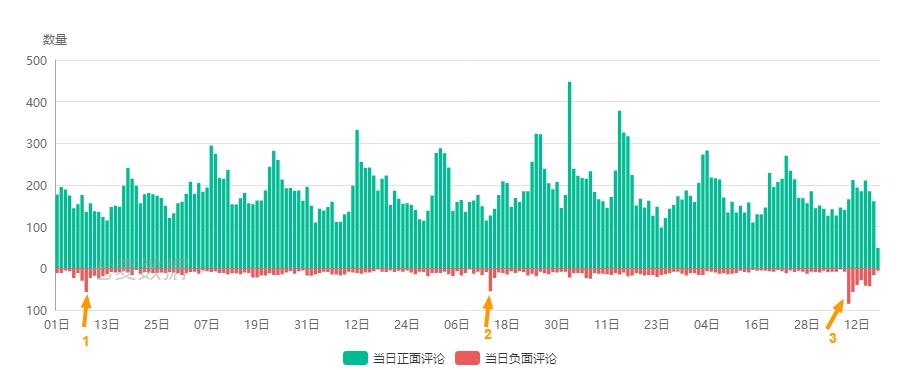

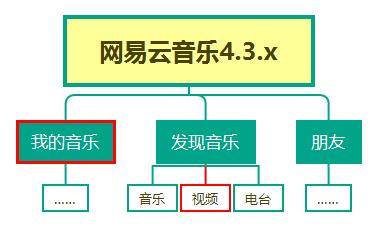

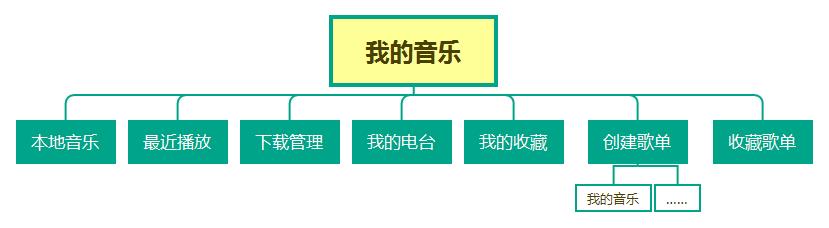

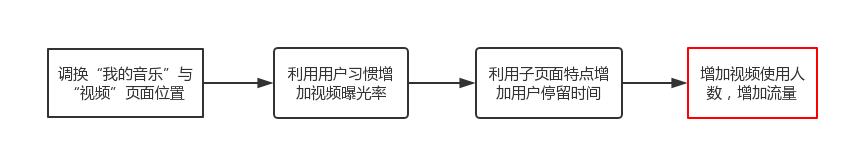

However, in the work of suicide intervention, there is still a problem, that is, after some people have problems, they may not necessarily ask for help or call the psychological counseling hotline. So how can we identify such people and intervene to help them solve their problems as soon as possible? The team led by Zhu Tingshao, a researcher at the Institute of Psychology, Chinese Academy of Sciences, is currently committed to the study of online suicide intervention. His team has focused on social software on the internet. Some people may not talk to people around them about their inner troubles, but they will show it on social software such as Weibo, and the online suicide intervention model of Zhu Tingshao’s team is developed based on this situation.

Experts pointed out that for those who are in a difficult life and are suffering from inner pain, to take a step back, we must dare to speak out and learn to ask for help, and know where to ask for help. And people around you should also lend a helping hand and act together to prevent suicide.

Experts also pointed out that it is easy for a person like Mr. Hu who has not been professionally trained to engage in the work of persuading students for a long time to have a negative impact on himself. The best way is to recommend professional institutions and personnel to intervene after discovering problems.

Now, Mr. Hu has gradually shifted his life focus to family and work, but he always has a concern in his heart. During the Mid-Autumn Festival last year, a 23-year-old netizen Xiaoqiu sent him a message, saying that he had been in the suicide group and had an exchange with Mr. Hu’s son Xiaowei. He said that he had suicidal thoughts, but he didn’t want his parents to be as sad as Mr. Hu. Mr. Hu said that there is love when there is concern. Xiaoqiu replied: I love my family.

Mr. Hu: "Any problem, any difficulty, everyone has a positive attitude, communicate with parents more, think about the sunny side, and don’t touch something harmful."

Some situations in which the annex allows to relax the overall control target of medical service price

Some situations in which the annex allows to relax the overall control target of medical service price