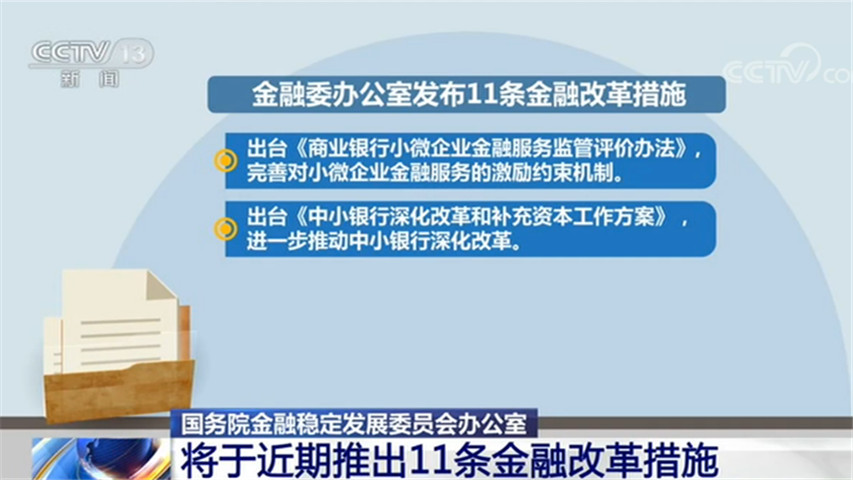

Cctv newsThe Office of the State Council Financial Stability and Development Committee announced on the 27th that it will launch 11 financial reform measures in the near future.

These 11 financial reform measures include:

The Measures for Supervision and Evaluation of Financial Services for Small and Micro Enterprises in Commercial Banks were promulgated to improve the incentive and restraint mechanism for financial services for small and micro enterprises.

The Work Plan for Deepening Reform and Replenishing Capital of Small and Medium-sized Banks was issued to further promote the deepening reform of small and medium-sized banks.

The "Guidelines for Industry Performance Evaluation of Government Financing Guarantee and Re-guarantee Institutions" was issued to promote government financing guarantee institutions at all levels to focus on supporting agriculture, reduce guarantee rates, give full play to the role of risk sharing, and help enterprises to resume work and tide over difficulties.

Four regulations, such as the Administrative Measures for the Registration of Initial Public Offerings of Growth Enterprise Market (Trial), and eight main rules, such as the Listing Rules of Growth Enterprise Market, were issued to promote the reform of Growth Enterprise Market and pilot the registration system.

The "Guiding Opinions on the Listing of Listed Companies in the National Small and Medium-sized Enterprise Share Transfer System" was issued to accelerate the reform of the New Third Board.

The Measures for the Administration of Standardized Bills was promulgated to standardize the financing mechanism of standardized bills.

Issued the Rules for the Identification of Standardized Creditor’s Rights Assets, steadily promoted the transformation and development of asset management business, and enhanced the ability of financial services to the real economy.

The "Guidelines on Bond Business of Foreign Government Institutions and International Development Institutions" was issued to encourage issuers with real demand for RMB funds to issue bonds and steadily promote the development of the panda bond market.

Promote the credit rating industry to further open to the outside world, allow qualified international rating agencies and private rating agencies to carry out bond credit rating business in China, and encourage domestic rating agencies to actively expand their international business.

Guide the standardized and orderly development of the CPA industry, introduce measures for the record management of accounting firms engaged in securities services, and cancel the qualification examination and approval of accounting firms engaged in securities services.

The Opinions on Strengthening Administrative Penalties for Financial Violations was issued, which clarified the criteria for the punishment of financial institutions for illegal acts and the determination of illegal income, strictly investigated the responsibilities of financial institutions and intermediaries, and strictly investigated the personal responsibilities of those responsible for violations according to law, and intensified the crackdown on financial violations, effectively deterring offenders and effectively protecting the legitimate rights and interests of financial consumers.

关于作者