From March 2021 to the present, the three-year contract of Xiaomi Automobile has finally arrived. On the evening of 28th, Xiaomi SU7, the first model of Xiaomi Automobile, officially announced the price: 215,900-299,900 yuan. According to Xiaomi’s official Weibo, four minutes after the price was announced, this new car broke 10,000 sets, 20,000 sets in seven minutes and 50,000 sets in 27 minutes.

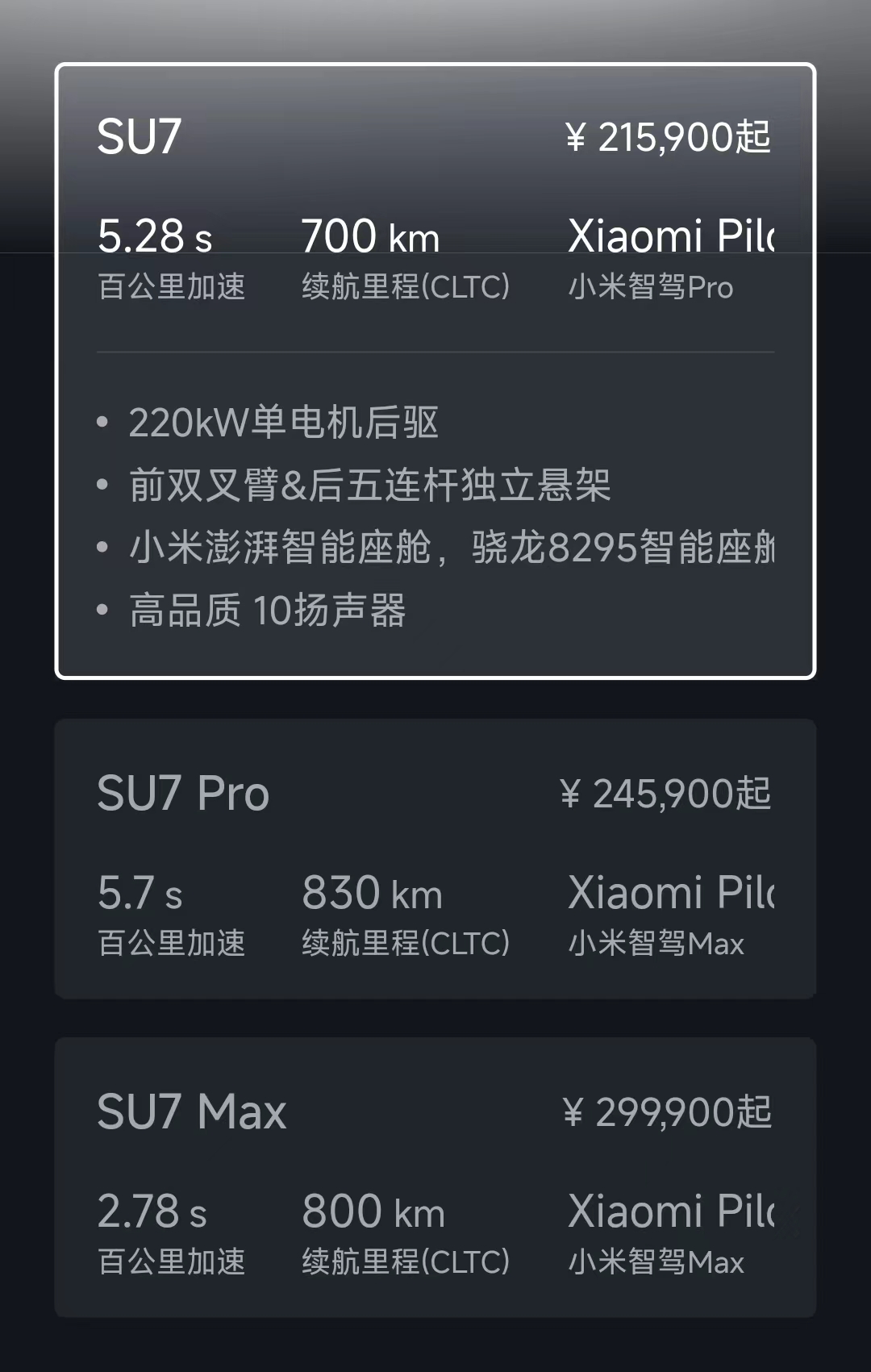

There are three versions of Xiaomi SU7, namely standard version, Pro version and Max version, in which the standard version is 215,900 yuan, the Pro version is 245,900 yuan and the Max version is 299,900 yuan. In addition, there is the founding version of Xiaomi SU7 (also divided into standard version and PRO version, with the same price), with a limited edition of 5,000 units nationwide. Before April 30, the car will also be sent to the car refrigerator, luxury stereo, leather seats, etc., and the Pro version and Max version will be sent to the electric tail and plum hub respectively.

The price of Xiaomi SU7 can be said to be the biggest suspense in recent months. Since the end of last year, netizens have been speculating about it, with various prices ranging from 99,000 to 199,000 and 299,000, but Lei Jun, founder, chairman and CEO of Xiaomi, denied it.

After the price of Xiaomi SU7 was announced on the evening of 28th, netizens were still arguing endlessly. Some people say that this pricing is expected, but others say that the final pricing is higher than their own expectations. In the face of competing models such as Tesla Model 3 and Extreme Krypton 001, Xiaomi SU7 has no obvious competitive advantage. However, the Xiaomi Auto APP was opened around 10 pm on the 28th, showing that the original version of Xiaomi SU7 was sold out.

For Lei Jun, no matter what the outside world thinks, Xiaomi finally handed over his first job in the automobile industry on schedule.

At the press conference of Xiaomi’s official announcement of building a car three years ago, Lei Jun said that this was his "last venture in life" and he was willing to "put all my reputation on the line". On March 25th, he said at the Weibo that the listing of Xiaomi SU7 "is the first step of Xiaomi Automobile and the beginning of the last battle of my life." He even made it clear that the goal of Xiaomi SU7 is "the best-looking, best-driving and most intelligent car within 500,000."

215,900 started, did you guess right?

In terms of building cars, Lei Jun and the Xiaomi car he led belong to the out-and-out "rookie", but as a leading brand in the digital industry, Xiaomi understands traffic. With Lei Jun’s frequent appearance on social media, since he announced his entry into the automobile industry in 2021, almost every node of Xiaomi Automobile will attract netizens to watch whether it is production qualification or design drawings, whether it is the price of new cars or the arrival of new cars. It can be called the "traffic star" of the automobile industry.

Especially around the pricing of the first model, Xiaomi SU7, people are even more heartbroken, and various rumors are constantly emerging in the workshop, but they are all officially rumored by Xiaomi. Lei Jun even made a public statement: "The price of Xiaomi SU7 will not be 99,000, 149,000 or 199,000." He also said that "the pricing of Xiaomi SU7 is indeed a bit expensive, but it will make sense."

It seems that in order to give a shot in the arm for the higher-than-expected pricing, Lei Jun sent a message to Weibo on March 20th: "The standard version of Xiaomi SU7 is far more configured than Model 3, with solid materials and high procurement cost at the initial stage of product launch. There is indeed some pressure on pricing, I hope everyone understands. "

However, for Xiaomi SU7, its official pricing is really not easy. It is necessary to consider both its own cost and the satisfaction of rice noodles, as well as the challenge of competing products. Before the listing of Xiaomi SU7, the price war in the domestic auto market, especially in new energy vehicles, has been prolonged. Not only BYD, Tesla, Ideality and other new energy vehicle companies are involved, but also traditional joint venture vehicle companies such as Beijing Hyundai, Buick and FAW-Volkswagen’s oil vehicles and trams have frequently defended their "territory" through price adjustment. Among them, Tesla China promoted the new version of Model 3 Huan and Model Y through price reduction, subsidies and limited-time concessions for four times in a short period of three months.

In this context, it is undoubtedly a considerable challenge for Xiaomi SU7 to make its price meet the requirements of "both ……………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………………

On the evening of the 28th, as the price was announced, netizens quarreled again. Some people think that "this price can kill all sides", some people think that "this price is ok", and some people call Lei Jun, "Why not just start with 199,900 yuan?"

I don’t know what you think?

Young people’s first Porsche? Have been involved in appearance disputes.

In addition to pricing, Xiaomi SU7 triggered a hot discussion among netizens about its design.

Since the shape of Xiaomi SU7 was exposed, this car has been controversial. Although Xiaomi officially claimed that its design was inspired by "water droplets in zero gravity blown by the wind", the headlights were designed in the shape of water droplets, and the taillights were inspired by Saturn’s halo, but the appearance was very similar to that of Porsche Taycan, which was dubbed by netizens as "time-keeping meter".

What’s more, a Porsche Paramera owner in Guangxi "exploded" his car into a Xiaomi SU7, which caused onlookers and heated discussions among netizens.

However, regardless of whether Xiaomi borrowed Porsche’s design or not, the face value of Xiaomi SU7 is really attractive: the low-lying front face, penetrating taillights, semi-hidden door handles, petal-shaped wheels, colored brake calipers, electric tail fins … all of them step on the aesthetic line of young people.

Specific to the product level, Xiaomi SU7 has a length, width and height of 4,997 * 1,963 * 1,440 (1,455) mm and a wheelbase of 3,000 mm, and is positioned in a medium and large-sized pure electric car. The car is equipped with a 16.1-inch 3K central control panel, in addition to a 56-inch HUD head-up display and a 7.1-inch rollover instrument panel. The operating system of the locomotive adopts the surging OS operating system, which matches the Qualcomm Snapdragon 8295 cockpit chip.

In the car, Xiaomi SU7 adopts many humanized designs, such as two umbrella storage slots under the front door panel storage compartment and the rear seat, which are convenient for drivers and passengers to store umbrellas in rainy days; An ecological expansion interface is set on the instrument panel, which is convenient for inserting the mobile phone bracket; Super-large canopy glass is treated with double-layer silver plating, which effectively isolates ultraviolet rays and infrared rays (ultraviolet rays isolate 99.9% and infrared rays isolate 99.1%), avoiding the exposure experience brought by glass canopy to drivers and passengers in summer …

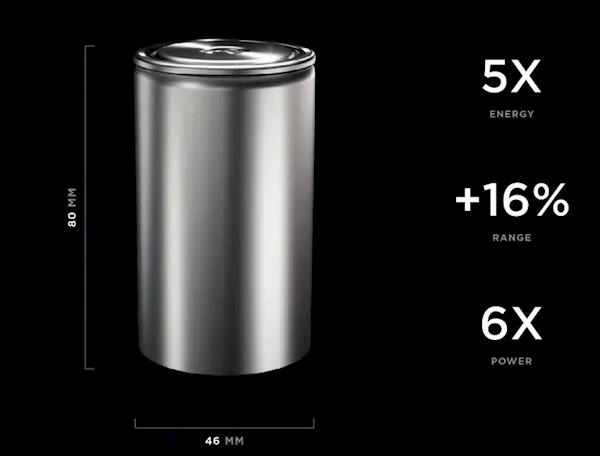

In terms of power, different versions of Xiaomi SU7 provide different batteries, of which the standard version uses a rear-drive 220KW motor and a 73.6KWh Ferrous lithium phosphate blade battery, and the pure battery life is 700 kilometers under CLTC working conditions; Pro version adopts rear-drive 220KW motor and 94.3kWh Ningde Shenxing iron-lithium battery, with pure battery life of 830 kilometers under CLTC working condition; Max version is equipped with four-wheel drive 495KW motor and 101kWh ternary lithium battery, and its pure battery life is 800 kilometers under CLTC working condition.

It is not easy for Xiaomi SU7 to be surrounded by "heroes".

As a high-heat model, Xiaomi SU7 has earned enough attention recently. Since March 25th, Xiaomi SU7 has started offline static car viewing in 59 stores in 29 cities across the country. It is said that all the stores are full of people, and many rice noodles are also eager to try, indicating that they will book cars as soon as the price is right.

However, it remains to be seen whether consumers will buy this "the best-looking, best-driving and most intelligent car within 500,000" in Lei Jun’s eyes. At least in many aspects, Xiaomi SU7 did not completely surpass competing products as advertised.

At present, in the range of 200,000-350,000 yuan, pure electric cars with both performance control and intelligence mainly include Tesla Model 3, Kykrypton 001, Weilai ET5 and Tucki P7. Take the new Krypton 001, which was just launched a month ago, as an example. The whole system comes standard with 800V overcharge and lidar, while the low-profile model of Xiaomi SU7 adopts 400V architecture. The Krypton 001 WE version is equipped with a 140-degree battery, and its pure battery life exceeds 1000 kilometers. In order to surpass other opponents equipped with 100-degree batteries, Xiaomi SU7 MAX version is deliberately equipped with a 101kWh battery, with a pure battery life of 800 kilometers. The Qualcomm Snapdragon 8295 cockpit chip carried by Xiaomi SU7 has also been used in models such as Extreme Krypton 007, Extreme Yue 01, Galaxy E8 and Zero Run C10, especially the price of Geely Galaxy E8 started at 175,800 yuan.

Xiaomi SU7 claims that acceleration, steering, suspension height, suspension damping, front and rear drive distribution and kinetic energy recovery can all be adjusted, and it can be combined into as many as 1.68 billion driving modes. However, for users, too many choices are more gimmicky than practical significance. How many people really need so many driving modes? In the words of the insiders, I feel that Xiaomi is racking his brains to fight for the "first".

In addition, Xiaomi SU7 claims to be equipped with intelligent assisted driving as standard in all departments, including high-speed pilotage that can be started all over the country. However, the urban pilotage assistance (city NOA) will not be opened nationwide until August this year. Compared with Huawei, Tucki and Jiyue, which have already opened the city NOA, Xiaomi SU7 has no advantage.

In fact, many consumers are full of expectations for Xiaomi SU7 because of Lei Jun’s "full ecology of people, cars and homes". The so-called "the whole ecology of people, cars and homes", Xiaomi’s official statement is that it can link all Xiaomi intelligent terminals together, with no sense of interconnection and synergy. However, according to Lei Jun’s introduction at the press conference, the so-called millet equipment collaboration is only that all kinds of millet smart terminals at home can be displayed on cars and mobile phones, and there is not much practical significance. As for how to form an ecological circle and how to develop in the future, Lei Jun did not introduce it.

Many car buyers have previously revealed that they are optimistic about Xiaomi SU7. On the one hand, they are attracted by the product strength of Xiaomi SU7, but more importantly, they expect Xiaomi, the price killer in the field of digital products, to bring you surprise pricing, so they are all waiting to announce the price on the evening of 28th.

With the announcement of the price of millet SU7, rice noodles seem to be quite satisfied. According to the official Weibo of Xiaomi Automobile, this new car broke through 10,000 in 4 minutes, 20,000 in 7 minutes, and 50,000 in 27 minutes. The limited edition of 5,000 founding models was sold out early.