The amount of land supply is related to the trend of the property market. According to the latest official data, the national land transfer income has turned from decline to increase, and the total supply of real estate land is approaching the same period last year, but the third-tier cities have fallen sharply.

According to the data of the Ministry of Natural Resources, from January to August this year, the national real estate land supply was 82,300 hectares, a slight decrease of 1.6% year-on-year. Judging from the data of real estate land supply in the last three months, although the supply of real estate and residential land in the country decreased year-on-year in the first eight months, the reduction rate narrowed month by month; Among key cities, the supply of real estate and residential land in first-tier cities maintained an increasing trend year-on-year, and the growth rate expanded month by month.

In terms of cities, real estate and residential land in first-tier cities have increased year-on-year. From January to August this year, 70 large and medium-sized cities provided 30,700 hectares of real estate land. The supply of real estate land in the first, second and third tier cities increased by 6.2%, 1.9% and 9.0% respectively, and the supply of residential land increased by 19.6%, 1.4% and 13.6% respectively.

According to the data of the Ministry of Finance, the national land transfer income in the first eight months of this year has exceeded 3.7 trillion yuan, and the year-on-year growth rate is further accelerated than that in July.

Ministries regulate the land market.

Throughout the year to date, the domestic land market has gone through several stages from downturn to rapid warming and falling, and the current signs of land market cooling are more obvious.

According to the data of the Central Plains Real Estate Research Center, in August this year, 70 large and medium-sized cities in China (corresponding to 70 housing price cities announced by the National Bureau of Statistics) had a total of 1057 land transactions, with a land transaction amount of 250.1 billion yuan, and the land transaction premium rate was only 8%, which was significantly lower than that in previous months. Judging from the land market situation, the recent expectation of tightening financing in the real estate sector gradually affected the land market.

Zhang Dawei, chief analyst of Zhongyuan Real Estate, believes that, on the whole, the land markets in various places were relatively depressed in January and February this year. With the increase of credit market after the Spring Festival, the financing difficulty of housing enterprises has decreased. In April, the land markets in some cities showed signs of recovery, and the land markets in first-and second-tier cities continued to heat up, with the monthly land transaction amount of more than 300 billion yuan and the premium rate maintained at around 20%.

Stabilizing land price is an important goal of real estate regulation and control in 2019. The rapid warming of the land market since the second quarter has attracted the attention of the regulatory authorities, and relevant ministries and commissions have successively taken action.

In April this year, in order to achieve the goal of city-specific policy and classified regulation, maintain a stable supply of residential land, and guide market expectations, the General Office of the Ministry of Natural Resources issued a notice requesting that the "five categories" of residential land regulation targets be formulated and implemented in 2019.

The notice requires that land supply should be stopped in cities above prefecture level, counties (county-level cities) with a population of more than one million, and commodity housing inventory digestion cycle is more than 36 months; For 36 to 18 months, the land supply should be appropriately reduced; For 18~12 months, maintain a flat level of land supply; 12~6 months, to increase land supply; For those less than 6 months, the land supply should be significantly increased and accelerated.

Another Ministry of Housing and Urban-Rural Development, which is responsible for the regulation of the real estate market, also began to warn some cities where land prices and house prices rose too fast in April and May.

In July, the new policies on real estate trust and overseas financing were introduced continuously, which had a certain impact on the real estate land acquisition policy. Since then, the premium rate of hot land began to decrease. In August, the number of operating land in 70 major cities increased significantly, with a total of 72 cases being the highest in the year.

"The land market, like the property market, is only allowed to appear in Xiaoyangchun, but not in summer. Once the land market is overheated, the possibility of upgrading the policy is not ruled out. " Zhang Dawei said that since August, the land market has entered a stage of rapid fever reduction.

According to the data of Zhongyuan Real Estate, the data of land acquisition by real estate enterprises also showed a significant decline. In August, the land acquisition by major real estate enterprises decreased significantly. Only eight domestic enterprises acquired more than 5 billion yuan, the highest of which was Vanke’s 15 billion yuan, followed by Poly’s 9.2 billion yuan, Jinmao’s 6.8 billion yuan, Sun Hung Kai’s 6.6 billion yuan and China Resources’ 6.4 billion yuan.

Yan Yuejin, research director of the think tank center of Yiju Research Institute, also believes that in the second quarter of this year, the central government paid great attention to the overheating of land prices in some cities, and the policy fundamentals were tightened again, especially the tightening characteristics of the financing market were the most obvious, which made it more rational for real estate enterprises to purchase land in the third quarter.

Third-and fourth-tier cities have obviously cooled down.

In recent years, the regional characteristics of China property market have become more and more obvious, the trend of the real estate market has been divided, and the pricing of non-quality land by housing enterprises has been lowered. But the competition for high-quality cities and high-quality land is still fierce. Although the regulation policies of first-and second-tier cities are strict, for housing enterprises, in order to increase sales, they will still concentrate on land acquisition.

While the first-and second-tier land markets maintain a high degree of heat, the land markets in third-and fourth-tier cities show signs of falling back. According to some statistics, since 2019, the land market in third-and fourth-tier cities has not performed as well as last year due to the tightening of shed reform scale and the early overdraft of some demand.

According to the data of the aforementioned Ministry of Natural Resources, the supply of real estate land in third-tier cities decreased by 9.0% from January to August this year, and the supply of residential land decreased by 13.6%.

Shanghai Yiju Real Estate Research Institute’s latest issue of "China Baicheng Homestead Transaction Report" shows that from January to September 2019, the transaction area of residential land in 64 third-and fourth-tier cities was 144.88 million square meters, down 7.1% year-on-year. Compared with the trend of first-and second-tier cities, the cooling characteristics of the homestead market in third-and fourth-tier cities are obvious. At the beginning of the past two months, the cumulative homestead transaction area has continued to expand year-on-year, further reflecting the characteristics of market cooling.

Yan Yuejin, research director of the think tank center of Yiju Research Institute, said that from January to August, due to the influence of policy control and market expectations, the growth curve of related land purchases declined slightly, which fully reflected the cooling trend of the homestead transaction market. From the structural point of view, the cooling trend of third-and fourth-tier cities is more obvious, which is related to the problem that such cities are facing inventory backlog again.

"From the reason, the current residential transaction market in third-and fourth-tier cities has cooled down and is facing the pressure of destocking again, which will dampen the enthusiasm of housing enterprises to replenish homesteads; At the same time, it also affected the capital withdrawal of housing enterprises and continued land purchase. " Yan Yuejin said.

The growth rate of land sales revenue accelerated.

The stabilization of real estate land supply at the national level has also affected the change of land transfer income.

Since April this year, the Ministry of Finance has no longer disclosed the specific amount of revenue from the transfer of state-owned land use rights in the monthly financial revenue and expenditure, but only released the year-on-year changes. Judging from the data of the past few months, the land transfer income has achieved year-on-year growth in July after experiencing a decline at the beginning of the year, and it showed an accelerated growth trend in August.

According to the data of the Ministry of Finance, from January to August this year, the national land transfer income increased by 4.2% year-on-year. From January to July this year, it was a year-on-year increase of 3.1%.

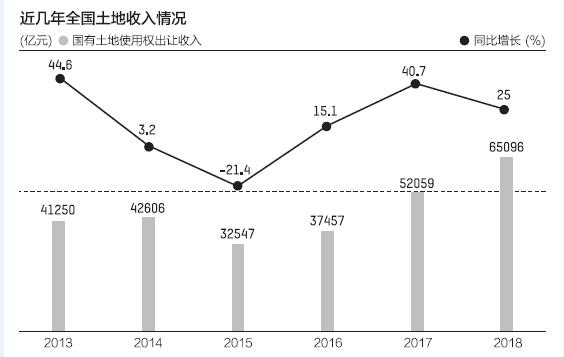

In the first eight months of 2018, the income from the transfer of state-owned land use rights was 3.7 trillion yuan. In 2018, it reached 6,509.6 billion yuan, a year-on-year increase of 25%, and the total amount reached a record high.

At the beginning of this year, due to the "worry" that the land market started in the second half of 2018 was cold and the phenomenon of land auction increased, many places also lowered their land transfer income expectations this year when preparing the government fund income budget for 2019.

Yan Yuejin said that the current control of stable land prices is very strict. Recently, some hot cities have also actively carried out major inspections of the banking system. One of the contents is to check whether there are illegal funds entering the land purchase market.

"It is expected that the residential land market will be characterized by cooling in September, especially considering that the current financial pressure of housing enterprises has begun to increase, so it is expected that housing enterprises will be conservative and tend to be rational. Of course, we need to look at September ‘ General drop+targeted cuts to required reserve ratios ’ The effect of policy. If the activity of residential transactions increases significantly, the enthusiasm of housing enterprises to subscribe for residential land in the fourth quarter may increase. " Yan Yuejin said.

From 2011 to 2018, the national land transfer income was 3,316.6 billion yuan, 2,842.2 billion yuan, 4,125 billion yuan, 4,294 billion yuan, 3,254.7 billion yuan, 3,745.7 billion yuan, 5,205.9 billion yuan and 6,509.6 billion yuan respectively.

There are still four months before the end of the year. If the current situation can be maintained, the income from land sales in 2019 is expected to exceed 6 trillion yuan again.

关于作者