In recent years, the new brand of beauty that has been popular on the internet has been inseparable from the label of "domestic products" at the beginning of its debut. It is not only suitable for Chinese skin, but also relatively low in price, and can be used as a cheap substitute for big brands. However, 79 yuan’s Hua Xizi eyebrow pencil sent Li Jiaqi to the forefront. Netizen said that although it doesn’t sound too expensive, the eyebrow pencil weighs only 0.08 grams.The price per gram is more expensive than gold.. So,Hua Xizi has become the latest currency unit on the Internet.There is a ridicule that "the exclusive monetary unit of migrant workers: 1 flower west =79 yuan".

With the continuous fermentation of Li Jiaqi’s remarks in the live broadcast room, the cost performance of some domestic beauty products has been pushed to the forefront. After a media reporter counted more than 30 eyebrow pencil products of 19 makeup brands on the market, the results showed that the price per gram of eyebrow pencil of 14 brands exceeded that of 100 yuan, and the eyebrow pencil products of Mao Geping ranked first among the domestic makeup brands, with the price per gram reaching 1,222.2 yuan. Even if the unit price is not mentioned,There is still a hidden trend behind this-cheap domestic makeup products are getting smaller and smaller.. Insiders pointed out that in the past, small weight was the advantage of domestic products, and consumers also had a good impression on small weight. Because the iteration rate of cheap domestic cosmetics is high, for consumers, the trial and error cost of small grams of products is low. However, when the cheap domestic make-up products are getting smaller and smaller, consumers’ feelings are:On the surface, the price advantage within 100 yuan has been maintained, but in fact it is a disguised price increase..

However, there is another voice on social media that it is unfair to look at the price per gram. Some people suggest that the cost of cosmetics is not only the internal material, but also the packaging design, etc. "We can’t rudely take gram weight as the basis of price comparison", "Overall parity is also parity.”。 Another practitioner said that although it is not wrong to calculate directly according to the figures, cosmetics can’t be completely calculated like this, because many local brands almost never trade at the original price, and these pricing are illusory. "You will see discounts in many brands all the year round. In the live broadcast room, some of them are buy one get one free, even buy one get two free, and there are other complimentary items. And such pricing combined with large discounts,In order to stimulate consumers to buy.. "

▌From the Light of Domestic Products to the "Price Assassin": "Abnormal Marketing" Behind Small Grams

From being praised as "good quality and low price" in the past to being repeatedly questioned as high price now, when did the change of domestic beauty products happen? Insiders pointed out that,The price increase began when Internet brands began to seize the share of offline brands.. In the past, the adjectives’ good quality and low price’ and’ cheap big bowl’ all referred to domestic products, such as Nature Hall and Baique Ling. As more and more Internet brands begin to advertise with the help of KOL and platforms, everything will be different. Some insiders also bluntly said,The rise of live e-commerce has actually disrupted the price system of domestic beauty products. To some extent, this is also one of the big backgrounds of the general price increase of domestic products..

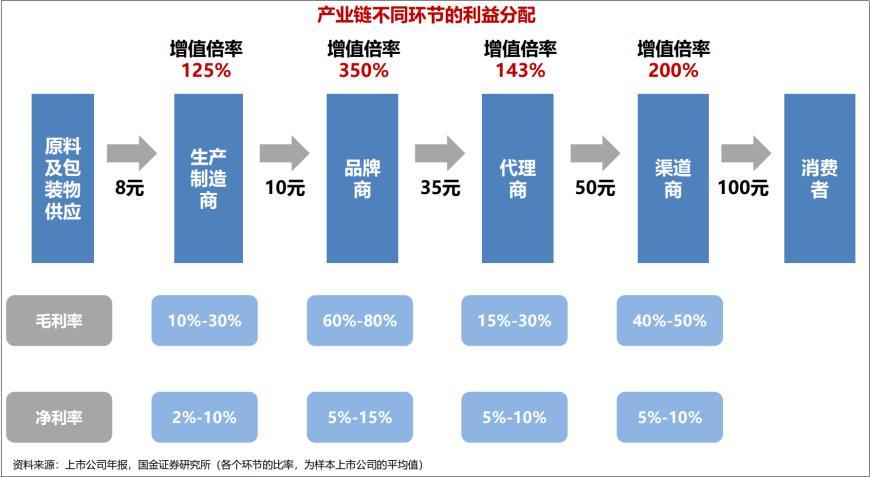

In fact, the raw materials and production technology of cosmetics only account for a small part of its cost. However, for the new domestic beauty brands that spend a lot of money on marketing,Often dubbed "working for KOL". Guojin Securities Research Institute has combed how the cosmetics industry chain distributes profits. A cosmetic, the brand takes most of the gross profit, and when it reaches the sales channel, it will be divided into a big slice. For the new domestic brands that started online, KOL, such as anchors and grass bloggers, must be given quite high profits. People in the industry bluntly say that, after all, high-priced cosmetics,More expensive in brand premium, marketing and sales. After these expenses are added, products with a cost of several dollars can sell for hundreds of dollars..

Overall, analysts said,There are only three ways to increase the price of domestic beauty products: product upgrading, "taking the opportunity" to increase the price; The discount is reduced and the hand price is increased; Directly push high-priced products or product lines.. Polaiya is a "typical" price increase by upgrading. According to the relevant research report of Ping An Securities Research Institute, in February 2020, the company launched Ruby Essence 1.0 at a price of 249 yuan /30ml, with an average 8.3 yuan per ml. In February, 2021, Ruby Essence 2.0 came out at a price of 279 yuan /30ml, with an average increase of 12.48% per milliliter of 9.3 yuan. At the same time, there are also brands that raise prices in disguise by reducing discounts. Some insiders said that consumers are very sensitive to the price of brands that have a certain popularity or often appear in the live broadcast room of the head anchor. Therefore, brands generally do not directly raise prices.Instead, the cost is reduced by reducing discounts, reducing/changing gifts, etc., or indirectly increasing the terminal price..

Finally, it is the "ultimate magic weapon" of price increase: directly pushing high-priced product lines. Considering that most domestic products are started by soliciting customers at low prices, they want to open up new high-end customers without incurring spit.Opening a separate high-end line is the best choice.. Among this kind of players, analysts pointed out that the typical ones are the high-end product line AOXMED launched by Betani, and the cutting-edge brands that directly locate the high-end, such as Chapter 14 and Wenmo.

In addition, with the rapid outbreak of the domestic cosmetics market and the increasingly fierce competition, it is obvious that consumers can’t be retained by marketing alone, and the general OEM model of domestic cosmetics has also led to many problems such as product homogeneity and poor quality control. Only products that are really easy to use can retain consumers. As a result, domestic makeup brands have made great efforts in research and development. Analysts said that several head make-up brands have also invested a lot of money in R&D. From the marketing war to the R&D war, domestic make-up began to adhere to the "long-term doctrine" and went to the second half.Facing the increasingly complex market environment, self-built factories have become a key step for domestic cosmetics brands to seek "transformation", but it is not easy to build a complete and efficient supply chain.This means that the brand has changed from a light asset model to a heavy asset operation, with high cost, long payback period and various problems in production management, all of which need to be dealt with by enterprises one by one. Even so, for domestic makeup brands, the transformation is imminent.Only by producing and developing products with better quality can we retain consumers with more mature minds and finally break through..

▌Head players stage "ranking" to chase the future market or only accept "all-round fighters"

Statistics from the National Bureau of Statistics show that in the first half of 2023, the total retail sales of cosmetics in China increased by 8.6% year-on-year to 207.1 billion yuan, which is more than the total retail sales of cosmetics in 2015. The rapid expansion of the market has made China the largest overseas market for international beauty groups, and also allowed many local beauty companies to taste the fruits of victory. But,It is impossible for any industry to stay in a high-speed growth environment all the time.. Some analysts said that although the development of the industry has matured, consumer demand has always been difficult to meet expectations. After experiencing a rush from 0 to 1, local beauty began to slow down and enter a cyclical adjustment.

In addition,Domestic beauty companies began to stage a ranking chase.The scale of head enterprises continues to grow, but the gap is narrowing. According to the revenue scale of the semi-annual report, shanghai jahwa, which owns many skin care brands such as Yuze and herborist, still ranks first with 3.629 billion yuan. At the same time, the latest revenue of Polaiya, a latecomer, reached 3.627 billion yuan, only 2 million yuan behind shanghai jahwa. Huaxi Bio, on the other hand, bit behind with a scale of 3.076 billion yuan. Betani’s 2.368 billion yuan is not far from Shuiyang’s 2.29 billion yuan.

Analysts pointed out that domestic beauty companies that have gained market share in the past few years,Began to scramble to get out of the comfort zone. Huaxi Bio, Polaiya, shanghai jahwa and other track head players make new decisions at this crossroads. In the short-term interests and long-term benefits, the latter is chosen to seek a more stable chassis to confront possible opportunities and shocks. Under the background that the domestic consumption market is still in the recovery stage and the traditional cosmetics giants still firmly grasp the advantages of the industry,High-margin products have also become a "breakthrough" weapon for domestic beauty products..

Shanghai jahwa said in the semi-annual report that since the second quarter, the company has adjusted its business strategy and increased the investment in brand fees.Skin care products with high gross profit and rapid development have achieved recovery growth, which has promoted the structural optimization of gross profit margin.And digested the pressure brought by overseas business. Polaiya said that during the reporting period, the company wasContinue to consolidate the "big single product strategy", focusing on the three family series of Shuangkang, Ruby and Yuanli.

Obviously, under the impetus of these head enterprises,The cosmetics market in 2023 is opening a "hardcore war" of speed and strength.. Enterprises are faced with a comprehensive test of hematopoietic capacity, channel capacity and independent scientific research capacity. The upper limit of an enterprise’s development will no longer be determined by the longboard, but by its comprehensive strength. According to analysts, it can be seen from the interim report that China cosmetics enterprises are constantly refreshing their performance in each other’s "involution", forming a benign industry competition environment. But in the future cosmetics market,The future market may only accept "all-round fighters"In order to go to a broader world stage and compete with international beauty giants.

This article comes from Cailian Association.

关于作者