Since July, the central government has repeatedly reiterated the keynote of "housing and housing without speculation" and the goal of "three stability". After the Ministry of Housing and Urban-Rural Development clearly put forward the accountability of cities where housing prices have risen too fast, the real estate market has ushered in a new wave of regulation.

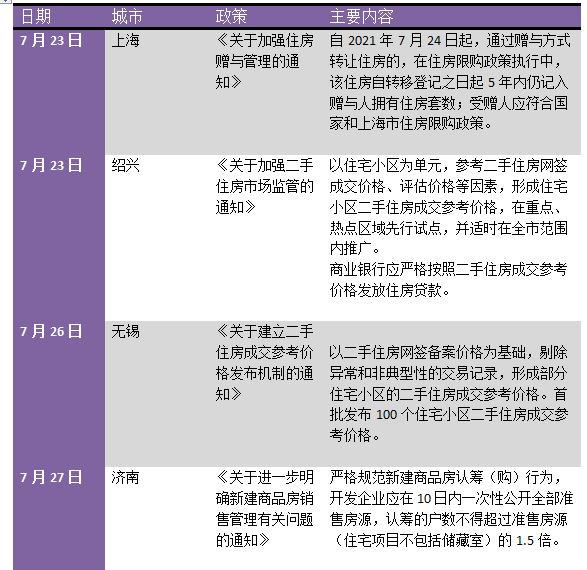

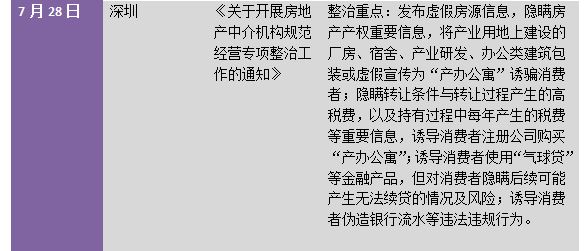

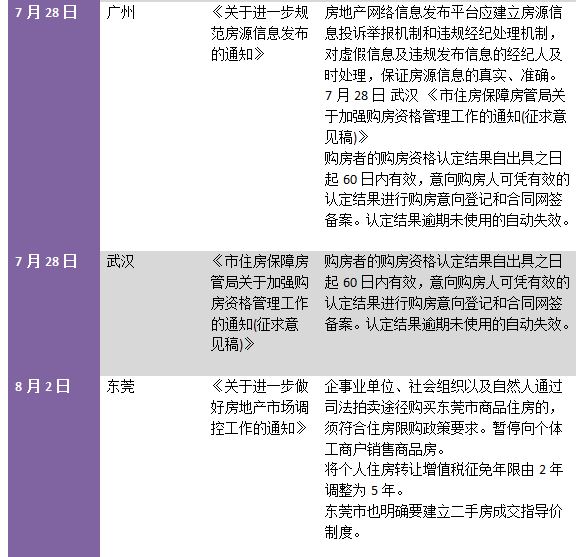

According to the incomplete statistics of The Paper, since July 22nd, the Housing and Construction Bureau has emphasized to further implement the main responsibility of the city government, strengthen the supervision and guidance responsibility of the provincial government, and resolutely hold the cities that are ineffective in regulation and control, and the housing prices are rising too fast accountable. At present, 13 cities have issued new policies on property market regulation to promote the stable and healthy development of the real estate market.

These cities include: Shanghai, Shaoxing, Hefei, Wuxi, Jinan, Guangzhou, Wuhan, Dongguan, Jinhua, Hangzhou, Beijing, Chengdu and Quzhou.

In these cities that have introduced the regulation of the property market, it has become an important content to rectify the intermediary’s standardized operation, introduce the guiding price of second-hand houses, limit business loans, purchase restrictions, sales restrictions and crack down on speculation in school districts.

Poor regulation and firm accountability

On July 22nd, the State Council held a teleconference on accelerating the development of affordable rental housing and further improving the regulation of the real estate market. The meeting pointed out that we should attach great importance to the new situation and new problems in real estate work, adhere to the positioning that houses are used for living, not for speculation, and do not regard real estate as a short-term means to stimulate the economy, fully implement the long-term real estate mechanism of stabilizing land prices, housing prices and expectations, and promote the stable and healthy development of the real estate market.

On the same day, the People’s Daily article pointed out that since the beginning of this year, due to various objective factors, coupled with the failure of some cities to fulfill their main responsibilities, the regulation of the real estate market has been relaxed, and the real estate market in some cities has warmed up, and some cities have overheated, which requires urban policies and precise policies to further increase the regulation and supervision of the real estate market. In this regard, Zhang Qiguang, director of the real estate market supervision department of the Ministry of Housing and Urban-Rural Development, said that the Ministry of Housing and Urban-Rural Development will work with relevant departments to further implement the main responsibilities of urban governments, strengthen the supervision and guidance responsibilities of provincial governments, and resolutely hold cities that are ineffective in regulation and control and whose housing prices are rising too fast accountable.

Subsequently, on July 23rd, eight departments, including the Ministry of Housing and Urban-Rural Development, issued the Notice on Continuously Rectifying and Standardizing the Order of the Real Estate Market. The Notice clearly stated that the "policy based on the city" highlighted the key points of rectification, including real estate development, house sale, housing lease and property services. At the same time, the "Notice" mentioned that we will strive to achieve a significant improvement in the order of the real estate market in about three years. Violations of laws and regulations have been effectively curbed, the supervision system has been continuously improved, the supervision information system has been basically established, and the work pattern of joint management by departments has gradually taken shape, and the number of complaints from the masses has dropped significantly.

5 cities were interviewed

As soon as the voice of "Resolutely hold accountable the cities that are ineffective in regulation and control and whose housing prices are rising too fast ….." fell, five cities with significantly rising housing prices were interviewed by the Ministry of Housing and Urban-Rural Development.

On July 29th, Ni Hong, Vice Minister of Housing and Urban-Rural Development, interviewed the responsible comrades of five cities, namely Yinchuan, Xuzhou, Jinhua, Quanzhou and Huizhou, and demanded that the decision-making arrangements of the CPC Central Committee and the State Council be resolutely implemented, that the house be used for living, not for speculation, that the real estate be not used as a short-term means to stimulate the economy, that the city’s main responsibility be effectively fulfilled, and that, in view of the new situations and problems in the real estate market in the first half of the year, the regulation and supervision should be strengthened to promote the stable and healthy development of the real estate market.

In the first half of this year, the sales price of new commercial housing and the price of residential land in these five cities increased too fast, and the market expectation was unstable, which aroused widespread concern in society. At the same time, the Ministry of Housing and Urban-Rural Development announced that Yinchuan, Xuzhou, Jinhua, Quanzhou and Huizhou will be included in the list of key cities for real estate market monitoring.

After the interview, late at night on August 2, Jinhua City Housing and Urban-Rural Development Bureau of Zhejiang Province issued the Notice on Further Promoting the Stable and Healthy Development of the Real Estate Market in our City, becoming the first city to introduce property market regulation after being interviewed by the Ministry of Housing and Urban-Rural Development.

The "Notice" clearly implements ten aspects, such as residential sales restriction, notarized lottery sales, and requirements for strengthening second-hand residential price supervision, strengthening financial supervision, strictly renaming management, and implementing the main responsibility.

According to the Notice, newly-built commercial housing and second-hand housing purchased in Jinhua City (Wucheng District, Jinyi New District < jindong district > and the whole area of Jinhua Economic and Technological Development Zone, the same below) can only be listed and traded after obtaining the Property Ownership Certificate for three years. The confirmation time of obtaining the Property Right Certificate is based on the issuing time of the Property Right Certificate.

At the same time, the "Notice" mentioned that the dynamic monitoring of the listing price of second-hand houses should be strengthened, and houses with obviously abnormal listing prices should be removed in time. In Jinhua city, we will launch a pilot project to release the transaction reference price of second-hand housing in hot areas, and timely promote and implement the application of the transaction reference price in finance and credit.

Eight cities have implemented the reference price of second-hand housing transactions.

It is worth mentioning that, in the industry’s view, the promotion of the reference price system for second-hand housing transactions has become the most important policy in the second-hand housing market this year, further embodying the orientation of all-round supervision of real estate.

In order to cope with the chaotic listing price of the second-hand housing market and some owners’ "holding the group to raise prices", more and more cities began to control the price of the second-hand housing market, and explored the establishment of a reference price release mechanism for second-hand housing to curb the spread of the "virtual fire" in the property market.

In addition to Jinhua mentioned above, according to the incomplete statistics of The Paper (www.thepaper.cn), eight cities in China, namely, Shenzhen, Ningbo, Chengdu, Xi ‘an, Shaoxing, Wuxi and Dongguan, have proposed to implement the reference price system for second-hand housing.

In addition to the reference price system for second-hand housing transactions, since the beginning of this year, some key cities have also introduced various kinds of regulation and supervision measures to promote the stability of second-hand housing prices and market expectations.

According to the incomplete statistics of Yiju Research Institute, at least nine cities in China have focused on regulating and controlling the price of second-hand housing, which involves cracking down on the behavior of owners to drive up housing prices, establishing a mechanism for releasing information on second-hand housing prices, and increasing the verification of price information.

For the prospect of 2021, the Blue Book of Real Estate 2021 jointly issued by the Institute of Ecological Civilization of China Academy of Social Sciences, China Real Estate Appraisers and Real Estate Brokers Association points out that the real estate industry is still the ballast stone and stabilizer of China’s economy. Real estate financial supervision will continue to be strengthened, and the tone of policy regulation will continue to be "stable", and the regulatory policies will be more refined and complete. The development of the leasing market has been further enhanced by the policy. Affected by the global monetary easing and low interest rate policy, the real estate market will face greater upward pressure in 2021. The market risk is increasing, the differentiation trend is becoming increasingly obvious, the real estate industry is facing a reshuffle, and the tightening of policy regulation will also curb the market overheating impulse.

关于作者