"Boom, boom", a deep voice came from the darkness, like the roar of the Yellow River, rapid and powerful. When the light came on, a yellow river covering the whole field of vision suddenly appeared in the air. It came from the sky and poured down in trembling, as if the waves were carrying sediment, rolling the Gangfeng and shaking the Tiangu. At this time, one, two, three, and a group of people "jumped" into the river one after another, went upstream in the rolling of turbid waves, and ran forward in the roar of wild waves … …

On August 17th, a large-scale symphonic dance epic "Yellow River", which was secretly rehearsed for half a year and directed by the famous artist Zhang Jigang, finally showed its true colors for the first time. The reporter of Shanxi Evening News visited the class exclusively and watched the first official serial of Yellow River in the Yellow River Theater of Shanxi Song and Dance Theater.

The performance of more than 90 minutes presents a subversion of artistic imagination! The unprecedented expression of stage art has long gone beyond the scope of "viewing", but brought "immersive" feelings. Surprisingly, the whole performance didn’t rely on high-tech means such as LED and holographic projection to present visual effects, and it was all done by manpower and the expression of the actors’ body language, which really achieved — — Return to dance noumenon.

Dance can jump in the air?

Can the "water of the Yellow River" flowing on the ground come from the sky?

… …

How many fantastic ideas, unprecedented and unparalleled are there in The Yellow River? As the first audience, please follow our line of sight, "fresh" to see!

"Yellow River" is not only a river, but also a dance epic with a huge vision.

The opening of The Yellow River is quiet and grand.

An old ship that has been drifting on the river for nearly ten thousand years, in the form of inner monologue, slowly revealed the huge "vision" of this work — — This is a river of life, a river of heroes and a river of vigorous spirit.

As a river of life, the Yellow River has nurtured Chinese civilization, is the mother river of Chinese people at home and abroad, and has made irreplaceable contributions to world civilization. Therefore, there are many stories in The Yellow River, starting with canoes 10,000 years ago, matriarchal society 6,000 years ago, and China civilization 5,000 years later. Generation after generation have multiplied their lives and nurtured their growth along the Yellow River.

As a river of heroes and a river of vigorous spirit, the symphony dance epic Yellow River also has epic emotions. From encountering foreign national aggression to defending the Yellow River, the sons and daughters of the Yellow River have a national spirit and revolutionary spirit of going forward bravely after disasters. Now, at the moment of the great rejuvenation of the Chinese nation and the recent Chinese dream, the sons and daughters of the Yellow River are still high-spirited dreamers … …

Shanxi Evening News reporter saw in the first row that "Yellow River" presented three major movements — — Wan Li Sand in the Yellow River, how the Yellow River’s waters move out of heaven, Dream Catcher in the Yellow River. There are 11 programs in the three movements: Nine Songs of the Yellow River, Wan Li Sand, Lullaby, Yellow River Beach, Pulling the Yellow River, Yellow River Boatman Music, Ode to the Yellow River, Yellow River Anger, Defending the Yellow River, Yellow River Dreamcatcher, Red Silk Dance and Yellow River My People,My Country, in which dance forms such as solo, duet and group dance are interspersed.

If you are sitting under the stage at the moment, you will be deeply attracted by the 11 stories in the Yellow River, and follow the river from distant history, rushing through the vicissitudes of life, flowing endlessly in the war, and rushing around the world with great momentum … …

For the artistic theme of "Yellow River", Zhang Jigang made a brand-new interpretation and creation this time. He led the team to travel through time, trying to find the source and soul of "Yellow River" and create a greater emotion of "Yellow River". He summed up the essence of the Yellow River in two sentences — — "Tian Xingjian, the gentleman is constantly striving for self-improvement; The terrain is Kun, and the gentleman carries things with virtue. " Self-improvement and virtue are also the spirit of "Huang Heren".

The "Yellow River" falls from the sky, and actors dance in the air, which is an unprecedented stage art expression.

Zhang Jigang’s Yellow River has a magical "magic" that seeing is believing! For example, you can instantly "sculpt" a "real clay figurine" full of muscles and strength, or you can let actors dance while "going upstream" in the pouring Yellow River water.

The opening dance of Yellow River is full of muscles and hormones! Let you fall in love with this river and Huang Heren from the first sight. A group of Yellow River men crowded into the embrace of the river, or rolled, or kissed, or played, or swam, and the dance movements were extremely simple and beautiful, with softness and rigidity. Many actions such as stretching arms and bending legs seem to challenge the "stretching" limit and "twisting" limit of human body, and convey emotions and strength from the inside out through body language. After a while, the yellow river man rolled in the sand and instantly became a "clay sculpture", and his muscle lines became more and more eye-catching. Interestingly, these "live" clay sculptures, in the most primitive physical expression, can stir up more swaying and boiling of the Yellow River water … … It also stirred the hearts of the audience!

How the Yellow River’s waters move out of heaven, the second movement of the Yellow River, is even more amazing — —

The tune of "The Yellow River Boatman Song" sounded, and the rushing and tumbling "Yellow River" poured down … … Very spectacular! It is worth mentioning that this "Yellow River" is not an illusory image produced by high technology, but a "real" existence. People’s minds can’t help but think of Liu Yuxi’s poem "Nine bends of the Yellow River, sand in Wan Li, waves sweeping from the horizon". What’s even more amazing is that some Huang Heren people have jumped into the "Yellow River" with a steep slope in front of them. They run "upstream" and "downstream" in the river, sometimes tumbling in the air and sometimes chasing in the water, expressing Huang Heren’s attachment, reluctance and intoxication to the Yellow River. When the special period came, helmets and rifles poured down from the Yellow River. At this time, the raging Yellow River and the surging Huang Heren merged into one, showing a picture of vitality … …

These dances are extraordinary!

Dancers dance in mud, water and even in the air, presenting a multidimensional space and three-dimensional expression for the audience, which is an unprecedented stage art expression! It also subverts people’s previous artistic imagination! Zhang Jigang said that artistic creation is the most taboo. "When looking at a work, first look at how much new content it has, and then look at the quality."

"Yellow River" swept through with a brand-new look and growling. Before you see it, you can’t imagine that dance can jump in the air! After seeing it, you can believe "how the Yellow River’s waters move out of heaven"!

Zhang Jigang’s Yellow River achieved this feat.

Teacher Zhang’s homework can’t be wasted every minute, so he must go all out.

After the performance, the curtain call applause of "Singing the Motherland" was still in my ears, and the actors were still panting on the stage, so "Teacher Zhang’s after-class comments" came — —

Zhang Jigang standing in the audience, microphone in hand, without a word. The theater was quiet and the atmosphere became tense. Actors are very hard, many injuries, all of which are in Zhang Jigang’s eyes. He loves these children dearly, and he knows that countless eyes on the stage are full of affirmation. But there are some problems that must be said now.

"What is your reason? Too hard! I thought (while watching the performance), just stop, but you didn’t stop. There are three injuries, all of which occurred in this part … …”

"I didn’t wronged you when you didn’t raise your head in the section of Defending the Yellow River, did I?" "When dancing in pairs, who is the penultimate girl in the back vertical row (group)? You keep moving! You can’t move your head or your feet. "

… …

Zhang Jigang, who has always been demanding of his works, is rigorous in every detail of his work and every actor’s performance. He originally planned to return to Beijing after the first platoon, and decided to postpone the plan and stay in Taiyuan to take command, because there were still too many problems waiting for him to solve. Although there is still some time before the premiere on September 14th, Zhang Jigang demanded that all problems must be solved before September 1st. This means that there is only a week left for all the work such as clothing, props, lighting debugging and taking publicity photos.

"Every minute can’t be wasted, you must go all out."

Zhang Jigang, who is standing under the stage, has a firm tone. He clearly knows that the children who are resting on the stage need an opportunity too much, an opportunity to change their destiny by dance art. At the same time, it is also an opportunity to change the fate of the theater.

"The Yellow River" has only 38 actors, which is completely unlike Zhang Jigang’s previous "big hand"! But this time, it is Zhang Jigang’s exclusive work "tailor-made" for the mother group. According to the existing actors in the theater, give full play to everyone’s potential, "38 actors, everyone is a fire, they can burn the audience." Considering the difficulties faced by the literary and art troupes in going to the market, Zhang Jigang thought about this issue from the beginning of the arrangement. "To create short and capable works, the performance time should be controlled at about 7090 minutes, that is, the time for the audience to watch a movie, so that they will not feel tired." He also hopes to change a consumption concept of the local performance market with the help of Yellow River: "Why do people get used to watching performances ‘ Free ’ And? It is necessary to break the habit of sending tickets in the past. " One month before the three performances in Taiyuan, all the first-class tickets have been sold out. Hearing the news, Zhang Jigang’s always serious face smiled.

In three weeks, the eyes of the whole world will be focused here.

The muddy yellow river will show its elegance and be famous all over the world with its majestic momentum.

Written by Shanxi Evening News reporter Li Pei

Photography Shanxi Evening News reporter Ma Liming

![[MD: Title]](http://www.bjsjbj.cn/wp-content/uploads/2023/03/NfC70uN8.jpg)

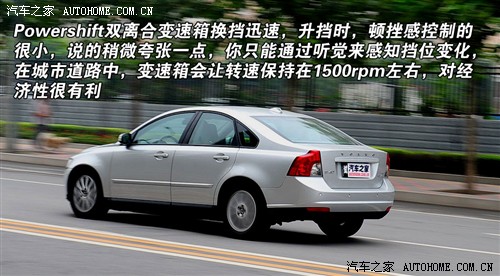

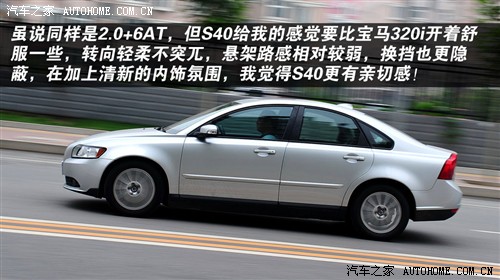

![[MD: Title]](https://img1.mydrivers.com/img/20231221/b8c51188-89a5-4c3a-b8f9-c1bcc4e5e210.png)

![[MD: Title]](https://img1.mydrivers.com/img/20231221/3d08f8e3-9733-4dbe-93ad-ddebe0fe599a.png)

![[MD: Title]](https://img1.mydrivers.com/img/20231221/1a330603-62fc-4d4d-9b37-d20a6963aa8e.jpg)

![[MD: Title]](https://img1.mydrivers.com/img/20231221/765a0030-f219-4e0b-8a9b-ba6a381714d3.jpg)