Research Group of Propaganda Department of Hubei Provincial Committee of CPC 【Abstract: Newspaper literature and art propaganda is an important part of the party’s news propaganda work. Newspaper literature and art propaganda in the new era serves the overall situation of reform and opening-up, dares to explore, constantly develops and keeps pace with the times, and has made positive contributions to the prosperity and progress of the party’s literature and art and news propaganda. Literature and art are not only a reflection of the people’s ideology, but also a spiritual force that affects the people’s ideology. At present, profound changes have taken place in the ideological and cultural fields. Developing advanced socialist culture is an urgent requirement for promoting the coordinated development of socialist material civilization, political civilization and spiritual civilization and building a harmonious socialist society. The purpose of studying and analyzing the laws of newspaper literature and art propaganda is to actively and effectively guide literature and art propaganda public opinion, form and develop positive and healthy mainstream public opinion in the whole society, keenly grasp the trends of literature and art propaganda, improve the pertinence and effectiveness of newspaper literature and art propaganda, and make due contributions to accelerating the pace of building a well-off society in an all-round way and creating a good ideological and public opinion environment. Examining the historical evolution of newspaper literature and art propaganda in the new period for more than 20 years and discussing its advantages and disadvantages will help us grasp the laws of newspaper literature and art propaganda, guide the mainstream consciousness of newspaper literature and art propaganda in the future and improve the level of newspaper literature and art propaganda. 1. Serving the overall political situation: creating an atmosphere for ideological emancipation in the literary and art circles Literature and art in the new period are marked by the downfall of the Gang of Four. The literary and art circles, like other fields, are in a historical stage of bringing order out of chaos and cleaning up the roots. Literature and art, both in creation and theory, have distinct criticism and reflection. The newspaper literature and art propaganda in this period was keen and full of passion, which effectively cooperated with the ideological emancipation movement in the literary and art circles. Shortly after the end of the "Cultural Revolution", newspapers all over the country published a large number of reports and articles, criticizing the "conspiracy literature and art" of the Gang of Four and exposing its counter-revolutionary acts and counter-revolutionary lines of usurping the party and seizing power. Criticizing the theory of "black line dictatorship of literature and art" and denouncing extremely "left" cultural absolutism have rehabilitated many wronged writers and their works. The Gang of Four has always been used to using literature and art as a tool to carry out counter-revolutionary activities, and the literary and art circles have become the hardest hit areas. Therefore, the newspaper literature and art propaganda at this stage has played an important political role in the national struggle to expose and criticize the Gang of Four. The great discussion on the standard of truth in 1978 opened the prelude to the ideological emancipation movement in the new period. During the discussion on the standard of truth in the literary and art circles, the newspaper published a large number of reports and articles that combined literary creation and literary theory work practice to publicize the standard of truth, reflected on the historical and ideological roots of the Gang of Four’s promotion of cultural absolutism, summed up the historical lessons of the literary and art circles, and clarified the theoretical right and wrong. In December 1978, the Third Plenary Session of the Eleventh Central Committee of the Communist Party of China made a major decision to shift the focus of the Party’s work to socialist modernization, clarified the policy of reform and opening up, and pointed out the direction for the development of literature and art in the new period and the propaganda of literature and art in newspapers. In October, 1979, the Fourth National Literary Congress was held in Beijing. On behalf of the Party and the government, Deng Xiaoping declared in his "Congratulation": "The Party’s leadership over literary and artistic work is not to give orders, nor to require literature and art to be subordinate to temporary, concrete and direct political tasks, but to help literary and artistic workers obtain conditions to continuously prosper their literary and artistic undertakings, improve their literary and artistic level, and create outstanding literary and artistic works and performing arts achievements worthy of our great people and great times." Since then, he further pointed out in his speech "Current Situation and Tasks": We "will not continue to mention the slogan that literature and art are subordinate to politics, because this slogan can easily become the theoretical basis for arbitrary interference in literature and art. Long-term practice has proved that it will do more harm than good to the development of literature and art. However, this certainly does not mean that literature and art can be divorced from politics. Literature and art cannot be divorced from politics. " In July 1980, People’s Daily published an editorial "Literature and Art Serve the People and Socialism". The Fourth National Literary Congress and the editorial of People’s Daily established the "two-for-one" direction of "literature and art serve the people and socialism" and the "hundred flowers blossom and a hundred schools of thought contend" policy as the basic direction and policy of the party’s literature and art. The direction of "two for one" and the policy of "letting a hundred flowers blossom" are naturally the guiding principles followed by newspaper literature and art propaganda in the new period. While the literary and art circles are bringing order out of political thoughts and theories, writers and artists, with keen sense and artistic courage, begin to break the ideological shackles and theoretical dogmas that have bound artistic creation for decades, hold high the banner of realism and reflect the changes of the times and the aspirations of the people. During this period, the newspaper’s literary propaganda actively paid attention to the present situation of literary creation, reflected the new face of literary creation, commented on the new achievements of literary creation, and participated in the literary debate. In the debate about scar literature, newspapers published some representative articles on both sides of the debate, which is the embodiment of the "policy of letting a hundred flowers blossom" in literature and art propaganda in newspapers. It is worth mentioning that Lu Xinhua’s short story "Scar", a representative work of "Scar Literature", was published in Wen Wei Po (Shanghai, August 11, 1978), showing the importance of newspaper supplements in literary and artistic creation in the new period. Second, return to the standard: drum and shout for the prosperity of literature and art Newspaper literary propaganda has the functions of publicizing the party’s literary principles and policies, transmitting literary information, and expressing people’s suggestions and opinions on literary creation. Its center and emphasis will inevitably be adjusted and shifted with the shift of the party’s work center and the adjustment of the party’s literary policy. In the early years of the development of literature and art in the new era, the propaganda of newspaper literature and art has a strong political color and played a unique political role in exposing and criticizing the crimes and harmfulness of the Gang of Four’s conspiracy in literature and art, and propagating and promoting the ideological emancipation movement in the literary and art circles. After the Third Plenary Session of the Eleventh Central Committee, the party’s work center gradually shifted to economic construction. After the Fourth National Literary Congress, the Party abandoned the slogan that "literature and art are subordinate to politics", constantly improved the Party’s leadership over literature and art, respected the laws of literary and artistic creation, created a relaxed environment and a harmonious atmosphere for literary and artistic creation, and literary and artistic creation gradually prospered. Since then, the focus of newspaper literature and art propaganda has turned to the normal track of propaganda and promoting the prosperity of literature and art. After the baptism of ideological emancipation, literary and artistic creation in the new era has gradually moved towards an open and diversified prosperity pattern on the basis of returning to realistic creative methods. Writers and artists have updated their literary concepts by learning from the May 4th new literary tradition and western modern literary concepts. New expression techniques and techniques have been applied, the subject areas of literature and art have been expanded, and many new literary and artistic creation trends have been formed. During this period, the newspaper’s literature and art propaganda closely followed the increasingly active and prosperous status quo of literature and art creation, and published a large number of pages about literature and art news, interviews with people and literary criticism, which contributed to the prosperity of literature and art in the new period and left a rich and complete record of the prosperity of literature and art at this stage. But at the same time, it can be seen that in the face of many-hued’s complicated new literary images, newspaper literary propaganda, as a public opinion, generally praised and affirmed the traditional creative style and traditional way of thinking, but maintained a cautious and vigilant attitude and even criticized the works and figures with innovative consciousness, especially drawing lessons from western art. In the late 1980s, the pattern of commodity economy was gradually formed in China. In the 1990s, the socialist market economy developed rapidly, and the mass consumption culture basically developed and formed, which became people’s main cultural needs and basically formed a set of industrial operation modes. With the "economic construction as the center", the publicity of newspapers’ literature and art is generally weaker than that of the previous period, and the number of important pages of literature and art reports is reduced, and the literature and art supplement is shrinking. At the same time, in order to adapt to the new social environment and the changes in readers’ interests, newspaper literary propaganda is constantly changing its concepts, innovating and perfecting its propaganda methods and techniques. Pay more attention to the public’s cultural consumption interest and demand in news reports, and the remarkable change in supplements is to enhance interest, practicality and life. Many newspapers have created various "star periodicals" and "weekend editions" in addition to the traditional literary supplements. The literary supplements that have survived are mainly essays that are close to readers’ daily life and full of life interest. In the pattern of mass consumption culture in the 1990s, the importance of newspaper literature and art has been highlighted, which has had an important impact on literary creation and criticism. The most obvious manifestations are the rise and persistence of the craze for prose essays and the attention paid to "media comments" (that is, the comments on writers and works formed by newspapers through news reports and published comments). Prose is the most popular literary genre among readers in the 1990s. The prosperity of prose creation and the formation of prose fever are important literary phenomena in the 1990s. The innovation and adjustment of the above newspaper supplements obviously played a decisive role in the emergence of this literary phenomenon. In the 1980s,The general readers’ understanding of literary and artistic works mainly depends on the opinions of critics, but in the 1990s, with the absence of (professional) comments and the aphasia of critics, readers’ understanding of writers and works depends on "media comments", and at the same time, more and more writers and artists use media propaganda to increase their market influence. With the deepening of reform and opening up, the press and publication, film and television broadcasting, literary performance market, books and periodicals market and mass cultural activities have gradually become active and prosperous since the mid-1980s, and the government’s cultural system and literary and artistic system reform have gradually begun, and the newspaper’s literary and artistic propaganda has continuously expanded the new field of propaganda, so that the scope of newspaper’s literary and artistic propaganda covers all fields and levels of social culture and literary life. In the open and pluralistic cultural and literary pattern of the 1990s, the newspaper’s literary and artistic propaganda adheres to the correct public opinion orientation, carries forward the main theme, advocates diversity, publicizes literary and artistic creation that goes deep into life, reality, the masses, reflects the requirements of the times and people’s voices, inherits the excellent national cultural tradition, has innovative character and the power to inspire people’s high spirits and optimism, and represents the direction of advanced culture, which has effectively promoted the healthy prosperity of literary and artistic undertakings. Characteristics of current newspaper literary reports Prosperity of literature and art is the need of the people and the needs of the times. The fundamental purpose of developing and prospering literature and art is to meet the people’s growing spiritual and cultural needs and promote people’s all-round development. Newspaper literature and art propaganda not only pays attention to socialist cultural construction, but also is an important content of socialist cultural construction. Therefore, literary propaganda and reporting must firmly grasp the direction of advanced culture, adhere to the direction of serving the people and socialism and the policy of letting a hundred flowers blossom and a hundred schools of thought contend, adhere to the policy of unity, stability, encouragement and positive publicity, sing the main theme of the times, actively advocate advanced culture, strive to transform cultural lag, and resolutely resist decadent culture, thus promoting the coordinated development of material civilization, spiritual civilization and political civilization. Literary and artistic reports should be "smooth and silent", and by creating a healthy cultural environment, they will constantly enrich the cultural life of the people and improve their spiritual realm in a subtle way. First, the opening characteristics of literary reports At present, with the cultural construction being mentioned in such an important position, literary and artistic reports are no longer just the "supporting role" of newspapers as before, but are paid more and more attention. With the increase of newspaper capacity, the major central newspapers, provincial party committee organ newspapers, metropolitan newspapers, etc. have obviously increased the weight of cultural reports while focusing on economic construction. Of the more than 140 evening newspapers in China, the vast majority have "cultural news" pages. In recent years, the importance of cultural construction and cultural function has been increasingly highlighted, and culture has penetrated into all aspects of economic and social life. All walks of life have more and more deeply realized the important position and role of culture in economic and social development, and the society has set off an upsurge of accelerating the development of cultural undertakings and cultural industries. The development of media, publishing, online culture, performance and entertainment industries has ushered in good opportunities for development. On the other hand, in the process of building a well-off society in an all-round way, the market economy provides a broad space for the development of literature and art: as recipients, the people’s spiritual and cultural needs are growing day by day, and their cultural consumption concepts and methods lead the direction of literary and artistic production; A variety of forces have entered the cultural field, and the diversification of creative subjects and input subjects, as well as the intervention of cultural operators, have injected great vitality into literary and artistic production, making literature and art truly present a situation of blooming. At the same time, with the progress of the times and society, new trends of thought and new ideas are coming one after another. The development of contemporary high-tech has also had a far-reaching impact on cultural construction. Many new scientific and technological elements have entered the field of literature and art, and the traditional literary form is undergoing tremendous changes. The unprecedented diversity of literary and artistic forms, the continuous updating of literary and artistic production methods and the widening of cultural horizons have made the field of newspaper literary and artistic propaganda unprecedented rich and broad. The vision of literary and artistic propaganda in this period is more open than ever before. The convenience and modernization of information communication provide unprecedented conditions for this openness, and literary information that occurs anywhere in the world may be published in newspapers in time. The Internet has made a qualitative change in the way of cultural communication, that is, it has broken through the limitations of time and space, and also broken the barriers between nations and races, and has become the most direct source of information for newspapers’ literature and art outside the territory. This reflects the idea of domestic opening to the outside world and the attitude of trying to catch up with the world literary trend, but on the other hand, we can also see the influence or aggression of the world’s powerful culture. This is the companion of global integration in the cultural field. Second, the regional characteristics of literary reports The openness of literary propaganda also determines the selectivity that literary propaganda must have. In the face of massive literary and artistic information, the limited capacity of a newspaper determines that it must choose and give up. Regionalization has become the most possible and reliable way for general newspapers to choose literary and artistic propaganda. The so-called regionalization means that newspapers choose the most acceptable literary information to publish according to the geographical distribution of audiences and the local characteristics of literature and art itself. Localization is determined by the localization of the newspaper itself. Any newspaper audience is a reader in a certain area. Literature and art in this region have many commonalities and cultural homogeneity, so the audience influenced by this homogeneous culture certainly has some common consistency in literary creation and appreciation, such as local operas, which can best explain the regional characteristics of literature and art. Newspaper literature and art propaganda will naturally focus on local literature and art, so Beijing local newspapers focus on "Beijing-style literature and art", Guangdong newspapers focus on "Lingnan culture" and Hubei newspapers focus on "Jingchu culture". Localization is localization. Localization is the inevitable requirement of "three closeness" in newspaper literature and art propaganda, which is close to people’s life and popular with them, and is also the emotional need of local people. The colorful literary and artistic life of the local area has become the protagonist of the newspaper’s literary and artistic propaganda, which can better inspire the people to enhance their national pride as local people and encourage them to participate in the creation and enjoyment of local literature and art. In the process of global integration, how to maintain cultural diversity is something that newspapers must think about in their literary and artistic propaganda. It is the unshirkable responsibility of newspapers to publicize local literature and art, and it is also to maintain the colorful diversity of Chinese culture. The coexistence of openness and regionality in literary and artistic propaganda is actually the blending of culture itself and the publicity of cultural individuality. This is not the melting of one culture into another, which leads to the disappearance of one culture or another, or weakens the local culture; On the contrary, it is in this blending that the local culture is more robust and vibrant by absorbing the beneficial contents of foreign cultures. The development of China culture fully proves this point. In the process of absorbing foreign cultures, China culture has not been replaced by foreign cultures, but has become deeply rooted and created a new and more dynamic China culture. The most fundamental purpose of newspaper literature and art propaganda is also here. Third, innovation has become the basic pursuit of literary reports. The law of history shows that any period of active cultural innovation must be a period of great cultural development and economic and social prosperity, while China’s backwardness in history is a period of closed mind and stagnant innovation. With the deepening of reform, opening up and modernization, innovation is the most real and profound driving force for cultural development in the process of establishing a socialist market economic system. In the report of the 16th National Congress of the Communist Party of China, Comrade Jiang Zemin once again emphasized cultural innovation, pointing out that we must focus on the forefront of world scientific and cultural development, actively carry out cultural innovation, and constantly enhance the attraction and appeal of Socialism with Chinese characteristics culture. Therefore, it is not surprising that innovation is the focus of attention and performance in newspaper literary propaganda in the new period. Generally speaking, although there are differences in expression techniques, language forms and styles, newspapers always capture, speculate and guide new concepts and phenomena in the development of cultural undertakings and cultural industries with a keen sense of smell. Concept innovation. In the past, we only paid attention to the ideological attribute of culture, but we didn’t know enough about the industrial attribute of business culture, which became the main ideological obstacle to the development of culture. Now, this traditional concept is being broken through, giving literary reports a different perspective from the past. Institutional innovation. In order to connect with the socialist market economy system and meet the opportunities and challenges after China’s entry into WTO, it has become an urgent task for cultural development to reform the management system and innovate the operating mechanism. How to straighten out the relationship between the government and cultural units? How do public cultural units realize the transformation from "nurturing people" to "nurturing things"? How do business cultural units cultivate market subjects, face the market and enhance their vitality? At present, the wave of cultural system reform is overwhelming, affecting all fields of culture and producing a series of new things and phenomena, which have become fresh materials for literary and artistic reports. Innovation in content, form and means. With the increasing level of material life and spiritual and cultural life in today’s society, the types of culture and art have greatly increased, showing a new look of vigorous development. At the same time, the combination of cultural development and scientific and technological progress has sprouted new vitality. For example, high-tech industries such as direct broadcast satellite, terrestrial digital TV, high-definition TV and streaming media appear in the radio, film and television industry; The digitalization and networking of editing, publishing, printing and distribution of modern publishing industry have changed the traditional format, and so on. Innovation has become an inexhaustible "news treasure house" for newspaper literature and art propaganda. Fourth, the entertainment characteristics of literary reports Entertainment tendency is another distinctive feature of current literary reports. This trend even gradually spread from citizen newspapers to the mainstream media which used to be famous for its authority and seriousness. The performance of entertainment tendency is that many newspapers have increased the coverage ratio of interesting stories, daily events and even "lace news" of celebrities in the literary and art circles; In the layout, let the masters of Chinese studies, literary giants or famous artists and Hollywood, Hong Kong and Taiwan stars complement each other; Try to "soften" serious news from the reporting form and performance skills, such as emphasizing story and plot, and strengthening the emotional or suspenseful factors of news events. On the one hand, the entertainment of literary reports is due to the increasingly obvious entertainment characteristics of literary activities themselves; On the other hand, literary and art newspapers are also in it. This tendency has its positive side. To some extent, it helps to highlight the different characteristics of literary and artistic reports from other reports, and is closer to life and the masses. The richness of culture and art itself makes the coverage of literary reports very deep and wide, and it is rich in knowledge, interest and aesthetics, which can not only meet readers’ demand for information, but also bring them different levels of aesthetic enjoyment. Moderately entertaining news reports, adding human factors, can narrow the distance with the audience and better play a subtle role. The tendency of entertainment sometimes reflects a humanistic concern for life. In the past, some literary reports were mainly ideological and educational, but now they pay more attention to the aesthetic needs of audiences at different levels, and report literary figures, literary events and literary phenomena from the perspective of fun and entertainment. For example, many times in newspapers, the image of celebrities is no longer high and out of reach, but extends the brush strokes to their inner world and emotional life, showing full and true three-dimensional characters. In the past, archaeological reports on cultural relics were very professional, and now they are becoming popular and interesting, satisfying the curiosity of citizens and their desire to explore human history and culture. This entertainment tendency of literary reports reduces the functions of literature and art in cultivating sentiment and purifying the soul, and dilutes the style difference between elegant literature and popular literature. At present, some citizen newspapers are not interested in regular and healthy literary news, but when they encounter the gossip or privacy of stars, they will make full use of it, which will cause "idolize fever" among readers intentionally or unintentionally, and even the wind of money worship and hedonism. Some newspapers have generously provided pages for promoting western culture, but they are indifferent to excellent national culture and art, making literary and artistic reports unconsciously become promoters and advocates of western values, lifestyles and behaviors. If you blindly cater to the tastes of some audiences, it will not only lead to low-level tastes, kitsch and other phenomena from time to time, but also may lead to exaggeration, news distortion and other consequences. In order to prevent these bad signs, newspaper literature and art reports should always adhere to the correct propaganda orientation, not only achieve "three closeness", but also express the literature and art news loved by the people in a vivid, flexible and interesting form, and also be popular but not vulgar, and actively guide the audience to establish a healthy and correct aesthetic taste while meeting their entertainment needs. The present situation of literary supplement Supplement is an important position for newspaper literature and art propaganda. The supplement of China newspaper has a history of more than 100 years. As a unique variety of China newspapers, the supplement shows its strong vitality. Looking back on the history of supplements for more than 100 years, from the publication of Zilin Shanghai Newspaper Leisure Newspaper in 1897 to the end of the Cultural Revolution, the contents of newspaper supplements have naturally changed with the changes of the times, but only in its form, but there has not been much change. In the next twenty years, the content and form of newspaper supplements have changed greatly, so that the definition of "supplement" has been debated at almost every academic seminar of supplement. The various supplements appearing in more than 5,000 kinds of newspapers are far from being summarized by our traditional concept of supplements. Aside from the debate on concepts, we can see a basic phenomenon, that is, no matter how its content and form change, supplements still occupy a place in every newspaper. In this sense, the great changes in supplements after the Cultural Revolution are a subject worthy of study. First, the literary supplement is an indispensable part of the newspaper’s literary propaganda. The original supplements can be said to be literary supplements, because the supplements at that time were places where literati spread chess, piano, calligraphy and painting. The literary supplement mentioned today refers to supplements related to literature and culture, which is different from other supplements and special issues in newspapers, such as theoretical weekly and automobile weekly. Literary supplement is not only the ancestor of supplement, but also the authenticity of supplement. Even when it comes to supplements, people often think of literary supplements. In the History of China Literature and Art Supplement, Feng He said: "The unique social function of the supplement is indeed its enduring internal driving force. Without this driving force, even if there is a bud, it will not grow fast, or at most it will become a real tail. " So what is the "unique social function" of the supplement now? This is the inheritance of advanced culture. From another point of view, the spread of advanced culture needs the unique role of literary supplements. Supplement is relative to the main issue, but generally speaking, the two complement each other, promote each other and are two wings of each other, which can be described as a perfect combination of pearls and milk. Even from the perspective of news dissemination, although the supplement seldom undertakes the task of "reporting the recent facts", it can continue the news facts, expand the news content, deepen the news connotation and analyze the news background through in-depth features, scanning, perspective, comments and other forms, which are difficult for the news edition to bear and carry. In addition, the newspaper supplement has the unique quality of keeping pace with the times, colorful regional characteristics, rich knowledge, thoughtful service, rich artistry, healthy entertainment and elegant interest, which condenses into the attraction and appeal of "moistening things quietly". In particular, the newspaper supplement follows the principle of "close to reality, close to the masses and close to life", permeates social life extensively, participates in, evaluates and guides social hot spots and difficulties in time, and pays close attention to the people’s food, clothing, housing, transportation and even "rice, oil, salt, vinegar, tea, calligraphy, piano, chess and poetry" and the emotional world, which has created her advantages of being able to read, read, endure and read. The competition of newspapers is becoming more and more fierce, but the information is becoming more and more transparent and convenient to spread, which makes it more and more difficult to report new literary news information, and most of them are similar; The characteristics of literary supplement determine that it has a vast world of innovation. The phenomenon that the supplements of more than 5,000 newspapers in China are similar to each other is rare. Every newspaper strives to create the originality of supplements, making it an important means to create the uniqueness of newspapers. Well-known supplements such as Dadi and International Supplement of People’s Daily, Pen Club of Wen Wei Po and Flower Land of Yangcheng Evening News have all become important "identification codes" of their parent newspapers. Second, the characteristics of newspaper literary supplements in the new period 1. Super-stable "Boss Newspaper" supplement. Since the Yan ‘an period, communist party has successively created a number of newspapers, which have gradually grown and matured, and built a contemporary news pattern in China. So far, they are the mainstream newspapers in China. The supplements developed by these "old newspapers" have been familiar to readers for decades. The supplement of "Boss Newspaper" can be divided into two levels. The first level is the supplement of old national newspapers, such as The Earth and International Supplement of People’s Daily, Night Cup of Xinmin Evening News, Pen Club of Wen Wei Po, Flower Land of Yangcheng Evening News and Liberation Daily. These supplements have the highest quality and the greatest influence. The mother newspapers of many supplements are regional, but their supplements are national in terms of their readers and authors. The second level is the supplements of the organ newspapers of provincial and municipal party committees, such as Donghu in Hubei Daily, Jianghua in Changjiang Daily, Huashan in Guangxi Daily, Yalu River in Liaoning Daily, etc. These supplements all have high standards, local characteristics and great regional influence. Of course, after the Cultural Revolution, the contents of the supplements of these long-standing newspapers have changed greatly, but in terms of their forms, they have all maintained a strong stability. The main reasons are: a, the forms of these supplements are quite mature; B, they all put the quality and layout content of the article in the most important position; C, this is also due to the need to keep consistent with the style of the journal. Most importantly, because these supplements have become a part of the uniqueness of their parent newspaper, they can’t change easily. 2. The supplement of "New Newspaper" seeking novelty and novelty. More than 20 years of reform and opening up have witnessed the rapid development of journalism in China, which has produced a large number of new newspapers, among which a few have emerged as major newspapers with national influence. Such as Beijing Youth Daily, Southern Weekend, Southern Metropolis Daily and Chutian Metropolis Daily. The supplements of these "new newspapers" have also played an important role in their success. They have changed greatly from content to form with traditional supplements. The common feature of these "new newspapers" supplements is that they constantly stimulate readers’ reading interest in new forms. Beijing Youth Daily adjusts the layout of its supplement almost every year. At present, there are 16 literary supplements in the newspaper, such as Very Feeling, People Online, Urban Tribe, Green Life, Viewpoint Square, People Detective, and so on. Just the name of its publication gives people a refreshing feeling. The supplement of Southern Weekend appeared in the form of a column, which was obviously influenced by Taiwan, Hong Kong and overseas newspapers. Shen Hongfei opened a column in Southern Weekend for several years, which earned him a lot of popularity. 3. Closeness and readability are enhanced. Whether it is the "old newspaper" or the "new newspaper", there is a common development thread, that is, the closeness and readability of the supplement are constantly increasing. "Fake big sky" has hardly appeared in the supplement, and the emotion and life of ordinary people have become the protagonist of the supplement. Many essays face social life directly, expose darkness, and dispel doubts, which are well received by readers. On the other hand, some negative things have appeared in the literary supplement of newspapers. Some supplements hype vulgar lace news such as "privacy" and "gossip" in pursuit of selling points, and the style is not high; Some unilaterally pursue entertainment and ignore artistry; Some supplements blindly expand the edition, which is full of water and lacks famous brand columns and masterpieces. Third, the reasons for the decline of literary supplements It is worth noting that literary supplements have been declining in recent twenty years. The decline of literary supplements has become a hot topic in many academic seminars of supplements. Feng He pointedly said in the History of China Literary Supplement: "At present, some newspapers’ cut off’ or’ crowded out’ comprehensive literary periodicals and literary supplements, which is not desirable, and it is also an abandonment of the progressive supplement tradition since the May 4th Movement." This decline has three manifestations: first, the "territory" of many literary supplements, especially literary supplements, has decreased; Second, compared with the continuous expansion of the news edition and various special editions in recent years, the status of literary supplements in newspapers has shown a downward trend, and the "literary spirit" of newspapers is weakening; Third, the readers and authors of literary supplements are shrinking and aging. The reason for the decline of literary supplements, we must first see that this is not an isolated phenomenon, but a social phenomenon. Before the reform and opening up, the social status of literature was once raised to an inappropriate height. We attach too much importance to the social value of writers and literary works, and literary publications are often distributed in hundreds of thousands and millions. A work with personality will attract social discussion. After the reform and opening up, with the establishment of "one center" centered on economy, people’s lives gradually diversified and the status of literature began to decline. This decline, we can understand it as a rational regression. The decline of literary supplement is the product and part of this "rational return". It is normal that newspapers should also focus on economic work and naturally increase the layout and weight of the economy. The development of science and technology leads to the development of information. In the past, newspapers were the absolute first media, and the number of newspapers was relatively small. Its great social influence made newspapers the first choice for the first-class cultural people in China to publish their works. With the introduction of television into thousands of households and the rapid rise of the Internet, cultural people have more "choices of expression". This has led to the diversion of writers and readers of newspaper literary supplements, which has had a negative impact on the influence of the newspaper. In this sense, the decline of literary supplements is a manifestation of social progress, and it can even be said that this decline is almost irreversible. For literary supplements, there is no need to lament this decline. What we should see more is that as long as the paper media exists, the supplement will have its place, because the society will always need literature and art. The key is to cultivate this limited garden carefully and make it blossom brilliantly. This "meticulous farming" method should be: individuality, innovation and high quality. Problems and Countermeasures in Current Newspaper Literary Propaganda Every period of newspaper literature and art propaganda has its own characteristics and problems. An objective analysis of the main problems and their causes in the current literary propaganda and an active search for countermeasures to solve the problems will enable us to continue to better grasp the orientation of literary propaganda in the future, represent the direction of advanced culture, and make national scientific popular culture the main theme of newspaper literary propaganda. First, the main problems The unprecedented active cultural ecology brought by the open cultural environment. Faced with such an ecological environment, some of our literary and artistic reports are biased, that is, the weakening of national literary and artistic propaganda reports. Under the label of so-called "cultural integration", they worship the western culture, especially American culture, and lack due vigilance against American cultural hegemonism. In the open literary propaganda, all American cultures seem to represent the world literary trend, and there are few reports on other cultural forms. Under the background of globalization, we must maintain cultural diversity, especially strengthen the propaganda of our excellent culture. This is closely linked to maintaining national independence. The basic feature of culture is nationality, which is the cornerstone of this nation’s foothold in the world’s national forest. National culture is the symbol of national existence. When any culture loses its "nationality", it will cease to exist as an independent culture. Vulgarization tendency is another problem of current literary propaganda. Murdoch said that if the style of the newspaper was lower, the number of readers would be larger. The media going to the market regard the audience as consumers, even as God, and strive to satisfy them. What’s more, in order to attract readers, some newspapers’ entertainment news do not hesitate to violate professional ethics, catch shadows, hearsay and deliberately create false news, which greatly damages the credibility of the media and causes bad social impact. In fact, these media have misjudged the aesthetic taste of the audience, and the masses are extremely disgusted with this vulgar and even vulgar entertainment news. In fact, in today’s increasingly prosperous literary and artistic undertakings, there are a large number of literary and artistic news that can be reported and worthy of great efforts to track and study, and literary and artistic news can also be organically combined with interest and thought. This will be of great benefit to guide the healthy development of literature and art and to enhance the people’s artistic appreciation ability and aesthetic taste. Second, enhance the self-confidence of national culture The Chinese nation has always been full of cultural self-confidence, although our cultural self-confidence has been worn away in the storms of history. Without cultural self-confidence, there will be no consciousness of cultivating national spirit. The national spirit is the national self-consciousness, which is a lasting fundamental spirit that maintains national unity and survival and runs through the long history of national development. It is an inherent and continuous historical tradition in national culture and a spiritual force that promotes national prosperity and continuous progress. Fundamentally speaking, the national spirit is the national humanistic spirit and cultural spirit. Culture is pervasive, and dripping water wears away stones. People’s thoughts, hearts, consciousness and spirit are always occupied by a certain culture. The only difference lies in what kind of culture this culture is and to whom it belongs. In the international environment where various thoughts and cultures are stirring each other, once the national culture is weakened, other cultures will take advantage of it. We need to strengthen the self-confidence of national culture in newspaper literature and art propaganda. On the one hand, our national spirit and socialist ideology are being seriously challenged. On the other hand, we must take corresponding cultural security and cultural protection measures in the face of the infiltration of western culture. This is the need to adhere to the direction of China’s advanced culture, to carry forward and cultivate the national spirit, to compete for comprehensive national strength on a global scale, and to build a well-off society in an all-round way and realize socialist modernization. Only by strengthening the self-confidence of national culture can we keep Chinese culture awake in the process of communication and blending with foreign cultures and make it work for us, so that Chinese culture can constantly gain new motivation in the communication and blending of different cultures, thus making the cultures of all ethnic groups colorful and full of vitality, showing more distinctive cultural diversity and making new contributions to world civilization. Third, improve the means of literary and artistic propaganda Literature and art is an aesthetic grasp of objective life, and life is the only source of literature and art. The richness of objective life determines the diversity of literature and art itself. On the other hand, from the perspective of audience studies, our propaganda objects are very different in terms of cultural level, life experience, hobbies and appreciation ability, which objectively requires our newspaper’s literary and artistic propaganda to be diversified in terms of subject matter, variety and form, or style and mood. Therefore, our literature and art propaganda and reporting should be full of flowers and colorful. But on the other hand, we must have a main theme and a through line in grasping. The main theme requires that all our propaganda content should reflect the national spirit and the times. Without the diversity of the main theme, the whole literary propaganda will become chaotic and even deviate from the correct political direction. The main theme of literary and artistic propaganda is not to limit the scope of material selection for literary and artistic propaganda and reporting, nor to cancel the appreciation and entertainment of literary and artistic propaganda and reporting, and to make all programs a "high-profile door". Theme and diversity are not mutually exclusive and diametrically opposed, but complement each other. Literary news should pay attention to current affairs reporting, reflect news, broaden the field of literary reporting, comprehensively, fairly, objectively and accurately report the overall dynamics of literary and cultural circles, so that the audience can get relevant information in time; With a brand-new concept and unique perspective, we pay attention to and analyze the events and phenomena in the literary and cultural circles, and guide the audience to correctly understand and understand. One problem that can’t be ignored in literary news is entertainment. Entertainment is not vulgarization, but includes four factors: suspense, humor, passion and surprise. What we have suffered once is that we pursue elitism too much and ignore the needs of the public. If the most popular readers are blocked from our reports, then our reports and even newspapers will be blocked by readers. On the premise of grasping the main theme, we must attach importance to enriching people’s spiritual life and satisfying people’s requirements for enjoying entertainment. We must advocate healthy and progressive cultural entertainment and noble artistic taste, and we must never simply talk about entertainment and ignore ideology and tendency. For foreign countries, The literary and artistic programs of Hong Kong and Taiwan must not be blindly praised, not only for their artistry and freshness, but also for their selection according to the principle of putting social effects first. Give necessary guidance and inspiration to the appreciation and entertainment of the masses. Fourth, improve the quality of the literary and art propaganda team Our news propaganda includes literary and artistic propaganda, which conveys the voice of the party and the government, reflects the will and demands of the people and represents the fundamental interests of the people. It is the responsibility of every journalist to publicize scientific theory, spread advanced culture, shape a beautiful mind, advocate scientific spirit and promote social integrity in our reports. Hold high the great banner of Deng Xiaoping Theory, thoroughly publicize and implement Theory of Three Represents, firmly and consciously keep in line with the CPC Central Committee with Comrade Hu Jintao as the general secretary, closely focus on economic construction, serve the overall situation of the whole party and the whole country, thoroughly publicize the party’s basic theory, line, program and experience, safeguard the overall situation of stability and unity, inspire and mobilize the whole party and the people of all ethnic groups throughout the country to keep pace with the times, blaze new trails, and create a new situation in the cause of building Socialism with Chinese characteristics with a promising spirit. This is what we should always do in the news propaganda work. News and public opinion work is the work of the future and destiny of the party and the country. The correct orientation of public opinion is the blessing of the party and the people; The wrong direction of public opinion is a disaster for the party and the people. To firmly grasp the correct direction of public opinion, we must implement the principle of unity, stability, encouragement and positive publicity, vigorously reflect the bright, positive and healthy things in social development, and always adhere to the correct guidance of public opinion. Literary and artistic reports should also help and not add chaos. During the period of social transformation, various literary and artistic trends of thought emerge, and it is easy to produce hot spots. Literary and artistic reports should be well guided by hot spots. News focuses on hot spots and hot spots produce effects, which conforms to the inherent law of news propaganda. The problem is how to guide the hot spots correctly. Treat hot spots with political firmness, clear-headed, correct analysis and proper guidance. What should be hot should be hot, what should be stable should be stable, what should be cold should be cooled down, and what should not be hot should not be heated up. Which should be hot, which should be stable and which should be cold should not be determined by whether there is a sensational effect, but should be determined from the overall situation of the work of the party and the government and the fundamental interests of the broad masses of the people, and never from the interests of small groups or personal feelings. The key work of the party and the government and the major reporting tasks deployed in a unified way should be heated up purposefully, forming a strong public opinion and producing propaganda effects; You can’t speculate and render at will. It is necessary to guide incorrect public opinion with correct public opinion and influence non-mainstream media with mainstream media. It is necessary to control the propaganda style. Style and taste are also oriented, indicating what we advocate and what we oppose. High style and high taste can stimulate people’s fighting spirit, inspire people’s spirit and send people beautiful spiritual food; Low style and taste will distract people’s fighting spirit, paralyze people’s spirit and instill ugly and filthy things in people. It is necessary to achieve ideological, artistic and ornamental unity, and to appeal to both refined and popular tastes. In order to dedicate the best spiritual food to readers, journalists must strive to improve their journalism level and pay attention to propaganda art in order to enhance the propaganda effect. In order for correct public opinion to play a guiding role effectively, it is necessary to make news propaganda attractive and appealing. News propaganda can’t force readers to accept it, and it can’t rely on blunt preaching and indoctrination. Instead, it needs vivid facts and flexible forms to attract readers, so as to guide readers and improve their guidance level. The propaganda and reporting of literary news should combine the correct political direction with superb propaganda art. In order to achieve higher publicity art, journalists and editors engaged in literary news propaganda must improve their professional level in the following aspects: to have a solid foundation of journalism, we must make great efforts to lay a solid foundation of journalism. We should seriously study news theory, news knowledge and news editing skills, strive to improve the level of language and writing, practice the basic skills of news business, and master various news genres and means skillfully, so as to continuously improve the news propaganda effect; Have a good knowledge accomplishment. Journalists and editors of newspapers are involved in a wide range of knowledge when collecting and writing reports and editing manuscripts. If they want to cope with them freely, they must have extensive knowledge. Journalists and editors engaged in literary and artistic news reports should have extensive knowledge of politics, economy, history, society, law, culture, science and so on, and constantly learn all kinds of new knowledge to meet the requirements of journalism. At the same time, if journalists and editors have a high level of knowledge, the manuscripts and edited newspapers will be more knowledgeable and readable, which will arouse readers’ interest and meet their needs, thus enhancing the influence of news propaganda and improving the publicity effect; We must have a strong sense of innovation and quality, and dedicate more excellent news works to readers. Journalists and editors of newspapers must have the spirit of continuous innovation and the awareness of producing more quality products, and have new ideas, new ideas, new pursuits and new features in news propaganda, constantly exploring new reporting forms and constantly adopting new reporting methods.It is more important to constantly explore new themes, constantly write innovative works, and engage in literary news reports. It is more important to create new colors in form, and to reflect colorful literature and art with colorful reports; We must have strong news acumen and news discrimination, and work hard to be innovative, profound and lively, so as to make literary and artistic propaganda and reporting closer to life and readers. At the same time, the overall planning, layout design, column setting and other aspects of the newspaper’s literary news also require novelty, and strive to achieve the perfect unity of content and form, so that the newspaper’s literary news propaganda can be more loved by the readers, and consciously accept the correct literary orientation and entertain and educate. Journalists engaged in literary and artistic propaganda must seriously arm their minds with Deng Xiaoping Theory and Theory of Three Represents, constantly improve their ideological and theoretical level and professional accomplishment, be politically strong, professionally competent and have a correct style, constantly devote themselves to study, boldly explore and be brave in innovation, so that literary and artistic news propaganda can play a greater role in promoting the construction of socialist material civilization, political civilization and spiritual civilization. (Author: Jiang Zuosu Yang Gengyun Xiong Jiaojun Liu Shu ‘e Jing Wong Han Xiaoling) (Editor: Xu Changui)

Changes of Newspaper Literary Propaganda in the New Period

Discussion on the law of newspaper literature and art propaganda in the new period

Changan Automobile: The land and house assets of Yubei factory are planned to be expropriated, and the total compensation is estimated to be 2.558 billion yuan.

On the evening of December 17, Chongqing Changan Automobile Co., Ltd. (Changan Automobile, 000625.SZ) announced that due to the need of public interest, according to the relevant provisions of the Regulations on Expropriation and Compensation of Houses on State-owned Land, the Regulations on Expropriation and Compensation of Houses on State-owned Land in Chongqing and the Detailed Rules for the Implementation of the Regulations on Expropriation and Compensation of Houses on State-owned Land in Chongqing, the People’s Government of Yubei District, Chongqing plans to grant compensation to the company’s land and land located at No.579 Konggang Avenue, Yubei District, Changan Automobile intends to sign the Agreement on Expropriation of Houses on State-owned Land in Yubei District of Chongqing with the Housing Construction Committee of Yubei District. It is estimated that the total compensation for this expropriation is RMB 2.558 billion, and the final compensation amount is subject to the expropriation agreement formally signed by both parties. On December 17th, the company held the 33rd meeting of the 9th Board of Directors, deliberated and passed the Proposal on Disposal of Land and House Assets of Yubei Factory and Signing the Expropriation Agreement, and agreed to sign the above agreement with the Housing Construction Committee of Yubei District.

Jinhua Jaguar XEL is being discounted, and the discount is 110,000! The car is sufficient

On the Autohome Jinhua Promotion Channel, this luxury sedan is launching a high-profile promotion. At present, the model is undergoing a significant price reduction in the Jinhua area, with a maximum discount of an astonishing 110,000 yuan. The Jaguar XEL, which was originally sold in the price range from 209,800, now undoubtedly offers consumers a very attractive car purchase opportunity. If you are interested in this model, be sure to seize this opportunity and click "Chatti Car Price" in the quotation form to get more favorable car purchase conditions.

The Jaguar XEL’s elegant and unique design style brings out the outstanding appearance charm. The front face is sharp and powerful, and the iconic Jaguar front air intake grille features a delicate chrome trim, which is connected to the headlight set to create a broad and deep visual effect. The overall body lines are smooth and sporty, blending classic and modern elements to show the style of a modern urban driver. No matter which angle you look at, the XEL is a very recognizable and attractive sedan.

With its elegant body design, the Jaguar XEL presents a streamlined profile. The body size is 4778mm*1850mm*1429mm and the wheelbase is up to 2935mm, ensuring a spacious interior space and a comfortable ride. The front and rear wheels are 1598mm and 1582mm respectively, providing a solid foundation for body stability. The tire size is 225/45 R18, and it is matched with a delicate wheel design, which not only enhances the dynamic appearance, but also guarantees the performance and comfort of the ride.

The interior design of the Jaguar XEL is known for its exquisite and luxurious, using high-end leather materials to bring a comfortable touch to the driver. The steering wheel is wrapped in leather, which not only enhances the driver’s grip, but also supports manual up, down, and front and rear adjustment to adapt to different driving habits. A 10.2-inch high definition touch screen is equipped on the center console, which integrates multimedia system, navigation and phone functions, making it easy and intelligent to operate. USB and Type-C interfaces are reasonably distributed to facilitate passengers to connect to various electronic devices. At the same time, the front row is also equipped with wireless charging function of mobile phones to meet the needs of modern technology. In terms of seats, both the main driver and the co-pilot are made of imitation leather, providing front and rear, backrest, high and low multi-directional adjustment, and are equipped with heating functions to ensure long-term driving comfort.

The Jaguar XEL is powered by a powerful 2.0T turbocharged engine with a maximum power of 184 kilowatts and a maximum torque of 365 Nm, providing 250 horsepower output. This engine, combined with an 8-speed manual transmission, ensures smooth transitions and efficient performance in the car.

Summarizing the owner’s evaluation, the Jaguar XEL won his heart with its unique design charm and dynamic performance. Its domineering body design not only shows the elegant British style, but also caters to the pursuit of fashion and vitality of young consumers. The owner’s appreciation of the body line is undoubtedly a high affirmation of its sports aesthetics. The charm of the Jaguar XEL obviously goes beyond the simple driving experience and has become an indispensable part of the owner’s life, which is deeply loved.

Jaguar XEL is back! A model for family car appeal

If you don’t consider the later cost of the car when you buy it, you will regret it later. For example, today’s performance in this area is worth mentioning. As for the outstanding performance of this car, please take a look at it together.

First of all, from the appearance point of view, the front face design of Jaguar XEL is very personalized. The middle net uses a black mesh shape, which looks more individual and flamboyant. At the same time, the headlights show a fashionable and generous design style, and the shape is very eye-catching. The car is equipped with LED daytime running lights, automatic opening and closing, adaptive far and near light, delayed closing, etc. To the side of the body, the body size of the car is 4778MM*1850MM*1429MM, the car adopts a flamboyant line, and the side gives a very simple and generous feeling. With large-sized thick-walled tires, it leaves a feeling of very domineering and stylish. At the rear of the car, the rear line of the Jaguar XEL is clean, and the tail lights are very individual and flamboyant. The sense of neatness is in front of

Sitting in the car, the interior of the Jaguar XEL looks very domineering and stylish, and the overall design is very clean. The steering wheel of the car is beautifully designed, and it is made of genuine leather, which looks a little more avant-garde. Let’s take a look at the central control. With the 10.25-inch touch LCD central control screen, the interior design is quite layered and in line with the mainstream aesthetic. The dashboard and seats are also eye-catching. The dashboard design is remarkable, and the sports atmosphere is created in place. The car adopts imitation leather seats, equipped with functions such as electric adjustment of the auxiliary seat and electric adjustment of the seat, and the overall comfort is acceptable.

The Jaguar XEL is matched with a manual integrated (AT) gearbox, with a 100-kilometer acceleration time of 7.3s. The power performance is good, and it meets the needs of daily use.

The rear compartment of the Jaguar XEL performs reasonably well, and if some larger objects need to be installed, the rear seats also support proportional reclining, which is sufficient for household use. In addition, the car is equipped with fatigue reminders, anti-lock brakes (ABS), LED daytime running lights, brake assistance (EBA/BAS, etc.), braking force distribution (EBD) main driver airbags, passenger seat airbags, side air curtains, front side airbags and other safety features.

The Jaguar XEL introduced today is not only eye-catching in terms of space, but also has reached the mainstream level in various configurations. The driving experience and space experience are not picky. I believe this car will definitely give you and your family a good experience.

Guangzhou Beijing BJ60 price reduction information, discount 30,000! Quantity is limited

Welcome to Autohome Guangzhou Promotion Channel, bringing you the latest promotions. At present, the high-profile car purchase promotion in Guangzhou market is not small. Buyers have the opportunity to enjoy a cash profit of up to 30,000 yuan, which brings the starting price of this hardcore SUV down to 209,800 yuan. This undoubtedly brings a very attractive car purchase opportunity to consumers in Guangzhou. If you want to take advantage of this offer and quickly lock in your favorite car friends, please click "Check the car price" in the quotation form, let’s explore more possibilities and get the best car purchase conditions together.

The exterior design of Beijing BJ60 shows the hard-nosed off-road style, the front face adopts the family-style design language, the air intake grille adopts a large area of chrome decoration, and cooperates with the square shape to show a powerful visual effect. The overall style is tough and atmospheric, and the lines are firm, highlighting the off-road characteristics of the BJ series models, bringing the driver a confident and respectful driving experience.

The Beijing BJ60 shows off its extraordinary temperament with its exquisite side design. The body size is 5040mm*1955mm*1925mm, the wheelbase reaches 2820mm, showing a spacious interior space and good stability. The front and rear wheels are 1620mm and 1640mm respectively, ensuring balance and stability in driving. The tire size is 265/65 R18, and the dynamic wheel design not only strengthens the body line, but also provides excellent grip and driving performance. Overall, the side lines of the BJ60 are smooth and powerful, showing a perfect blend of modern urban and off-road spirit.

The interior design of the Beijing BJ60 adheres to the concept of both luxury and practicality. In the cockpit, the steering wheel is wrapped in exquisite leather material, providing a comfortable grip while supporting manual up, down and back adjustments to ensure the driver’s driving experience. The 12.8-inch central control screen stands in the center, which not only displays clearly, but also integrates rich multimedia functions, such as automatic speech recognition control system, for easy user operation.

In terms of seats, the main driver’s seat is equipped with a high-grade imitation leather material, which supports front and rear adjustment, backrest adjustment, high and low adjustment (4 directions), leg rest adjustment and waist support (4 directions), providing passengers with excellent riding comfort. In addition, the driver’s seat is also equipped with a power seat memory function, which brings more convenience to daily driving. The front seat also provides additional heating, ventilation and massage functions, fully considering the individual needs of passengers. The passenger seat can also be adjusted in multiple directions, and the waist support function is also powerful, ensuring the comfort of passengers for long-distance driving. The second row of seats supports backrest adjustment, while the rear seat can be proportionally reclined, making space utilization extremely flexible. The overall interior design not only highlights the sense of luxury, but also focuses on practicality, fully meeting the needs of different users.

The Beijing BJ60 is equipped with a 2.0T turbocharged engine with a maximum power of 120 kilowatts and a maximum torque of 400 Nm, and the output is relatively stable. The engine is equipped with 163 horsepower and an 8-speed automatic transmission to provide a smooth driving experience.

Summarizing the owner’s evaluation, the Beijing BJ60 won his favor with its domineering appearance and unique body design. As a model with a strong aura, it not only meets the owner’s needs for personalized expression, but also makes him feel confident in the driving process. Undoubtedly, the BJ60 is an ideal choice for consumers who pursue unique style and strong presence.

Hua Xizi was awarded the "Excellent Case of Scientific Research and Innovation" by Xinhuanet.

Comments: Domestic brands compete for "high-quality development" and start a long-term promotion competition.

On December 3rd, on the occasion of the 2023 China Entrepreneur Blogging Forum, the second domestic brand innovation conference hosted by Xinhuanet kicked off. At the forum, the "Looking for Treasures and New Domestic Products" and a series of special plans initiated by Xinhuanet invited experts and representatives of certified enterprises to share their experiences and insights on brand innovation.

Among them, Hua Xizi, a domestic beauty brand, emerged as a typical case of high-quality domestic products with scientific research innovation and unique brand culture positioning. Thanks to the innovation of Yuyang series and its R&D system, Hua Xizi was successfully selected as the "Excellent Case of Scientific Research and Innovation" in the "Looking for Treasures and New Domestic Products" and became the only China cosmetics brand that won the prize.

From the development of large single products to the establishment of the research and development system of oriental beauty cosmetics, Hua Xizi is not only deeply cultivating traditional culture, but also constantly carrying out iterative upgrading of research and development, integrating traditional culture with modern technology. Behind this is a differentiated road guided by long-term doctrine and rooted in oriental aesthetics.

Won the Xinhua News Agency award again, and Hua Xizi’s scientific research and innovation achievements were affirmed.

In the last ten years, from foreign brands to the rise of domestic beauty brands, the beauty consumer market has undergone great changes. The wave of new domestic consumption has created more new opportunities for beauty brands, and also brought an assessment of product strength and scientific research strength. For domestic brands, in addition to adhering to the cultural core, it is more important to think about how to achieve high-quality development.

Based on this consideration, since October, the Second Domestic Brand Innovation Conference has taken the lead in launching the "2023 Plan for Searching for Treasures of Domestic Products" and a series of special plans. Xinhuanet has launched a series of special topics by means of case collection and product evaluation, aiming to actively explore treasures of domestic products and empower domestic brands to develop with high potential.

It is understood that since its establishment in 2016, China Entrepreneur Boao Forum has been successfully held for seven consecutive sessions, which has gathered the strength of the government, experts, enterprises, associations and other parties, focused on hot economic topics, and talked about China’s economic development on the principle of cutting-edge pragmatism. It is professional, targeted and constructive, with rich cross-border integration and exchange scenarios, and has attracted the attention of all sectors of society. It is known as the annual ideological and wisdom feast of China business circles.

As a sub-forum, the second domestic brand innovation conference provided a high-quality communication platform for domestic brands. During the implementation of "Looking for Treasures of Chinese Products in 2023", Xinhuanet linked its all-media matrix and launched the "People’s Vote" campaign to explore the light of Chinese products in an all-round way, and selected benchmark and pioneer brands in the field of Chinese products from the dimensions of product sales, social voice, brand reputation, R&D ability, marketing innovation and industry contribution.

Finally, according to the six dimensions of scientific research and innovation, green manufacturing, creative marketing, annual cutting-edge, sailing out to sea and commercial goodness, the high-quality domestic brands that meet the corresponding standards are selected.

Judging from the selection mechanism, multi-dimensional and all-round comparative screening tests not only the product strength and innovation, but also the value created by the brand in the industry. It is even more difficult to stand out from hundreds of China brands, which is enough to show the weight of the award.

Hua Xizi became the only brand in the beauty industry to be selected as an "excellent case of scientific research and innovation" in this selection activity of "Looking for Treasures in China in 2023". Different from other brands that focus on oriental beauty cosmetics, Hua Xizi has opened up a new path by herself and created a differentiated brand positioning from the perspective of "Oriental beauty cosmetics research and development system". In addition, the development logic of Huaxi Zi Yuyang series products and its oriental beauty makeup research and development system have also been highly recognized by the government, enterprises, experts and other parties.

TOP-level scientific research investment, the research and development system of Huaxi Oriental Beauty Cosmetics has been "effective"

"If consumers tried products with an open attitude a few years ago, now everyone will be more cautious in the process of choosing products."

With the trend of consumption degradation, the beauty market began to show obvious polarization, and the high-end market and the low-end market went their own way, and the determinants of consumer behavior became more complicated — — Public demand gradually extends from a single function to aesthetic, emotional, social and other values.

For example, the main tone of Oriental make-up puts forward multiple requirements: it should not only meet the needs of Asian users, but also have distinctive China characteristics. However, due to the far-reaching influence of the western make-up system on China’s make-up industry, the standards, rules and systems of China’s make-up industry have always been deeply branded with western make-up.

In order to meet the multi-level needs of users, domestic brands must invest a lot of scientific research as soon as possible to explore and build a brand-new brand R&D system.

1. Initiate the research and development system of Oriental Beauty Cosmetics.

In fact, since last year, Hua Xizi announced that he would invest more than 1 billion yuan in the next five years to build a comprehensive and technologically advanced research and development system for oriental beauty cosmetics. Nowadays, through the continuous layout in the fields of product innovation, basic research and applied basic research, the research and development system of oriental beauty cosmetics initiated by Hua Xizi has achieved initial results.

It is reported that the research and development system of oriental beauty cosmetics advocated by Hua Xizi is not a point-like exploration of combining oriental characteristics in formula or raw materials, but includes a whole system of research on the skin color of oriental skin, theoretical system of traditional Chinese medicine, research on oriental raw materials, research on oriental formula, research on oriental technical system, research on oriental color system, oriental materials, oriental crafts and modern applications, so as to realize the inheritance and innovation of China’s excellent traditional culture.

Based on the consideration of building the research and development system of oriental beauty cosmetics, the parent company of Huaxi Zi, Yige Group, has established five research and development modules, including consumer research center, cosmetics science and technology innovation center, human skin and bioelectronics research center, industrial design and CMF research and development center, and oriental aesthetics and space innovation center. Through strong R&D resources integration ability, Hua Xizi is also constantly consolidating the R&D system of Oriental Beauty Cosmetics, and has made remarkable achievements in many innovative fields.

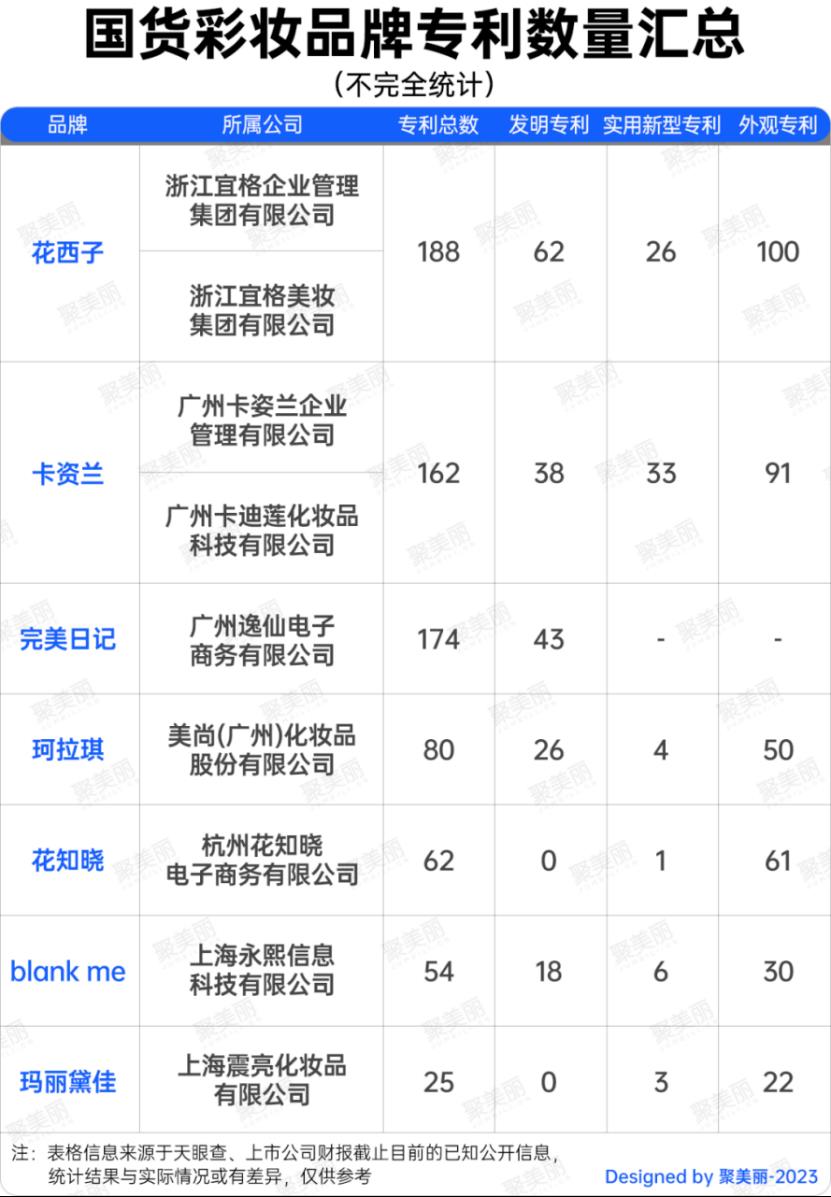

Looking back at Hua Xizi’s performance this year, with excellent product strength and innovative strength, Hua Xizi has won authoritative awards and honors many times, which is enough to show his excellent product strength and value creation ability.

On May 9th, under the guidance of Xinhua News Agency, the first China Brand Global Communication Conference hosted by Xinhua News Agency Brand Studio, Xinhua News Agency News Center and Xinhua News Agency Shanghai Branch was held in Shanghai, and the Research Report on China Brand Global Communication Power (2023) was released at the same time. Simultaneously with this report, there is also a list of "Global Communication Power of China Brands". Among them, Huaxizi, as the only beauty brand, was included in the list of "TOP10 Global Communication Power of China Brands" together with Maotai, Alibaba, Huawei and China Architecture.

In November this year, the final list of the 2023 VOGUE Beauty Awards was officially released, and Huaxizi brand won the color research and development award with the help of Little Daisha lip yarn-Mulan yarn, and made a great contribution on the international stage with "China color".

In the same month, another heavy award in the industry — — The award of "2022 China Cosmetic Industry Brand (Lip Product Category)" selected by China Flavor and Fragrance Cosmetic Industry Association was also awarded to Hua Xizi, which affirmed her product strength, scientific and technological strength and brand influence. Having won numerous awards from industry authorities, Hua Xizi has always been leading the industry and constantly creating new values.

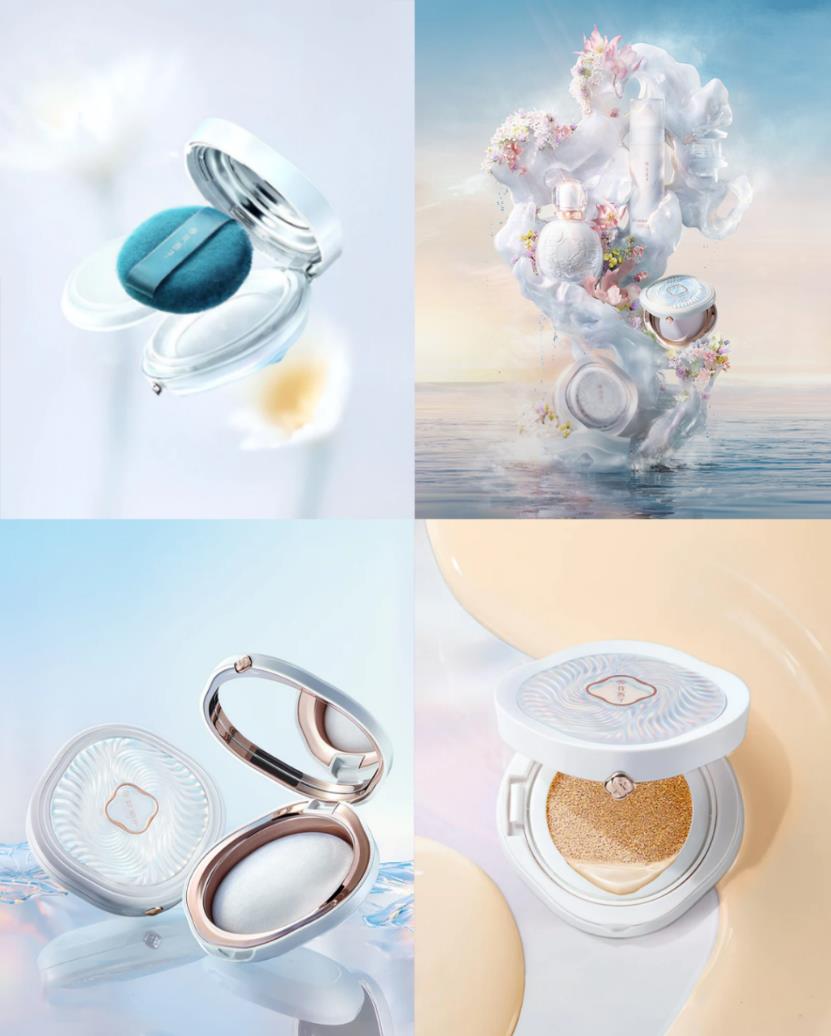

2. Expand the matrix of sensitive muscle makeup products, and forge a good reputation for the jade series.

In the "Looking for Treasures of Chinese Products in 2023", as the main case of scientific research and innovation, Huaxi Zi Yuyang series fully shows the whole link process of the brand from basic research, raw material innovation to integration into oriental beauty makeup culture, and finally transforms its product strength into product reputation.

According to reports, on March 8 this year, Hua Xizi explained the new product value it provided to users — — "Sensitive muscles apply".

From air honey powder and silk honey powder cake to air cushion, makeup liquid foundation and makeup spray, Yuyang series, as the trump card product line of Hua Xizi, firmly adheres to the category development route of makeup demand of users with sensitive muscles and gradually expands the product matrix of "makeup suitable for sensitive muscles".

Thanks to the strong innovation ability of single products, the sales volume of Huaxizi Yuyang series products has always remained stable in the "upper circle" of the industry.

According to statistics, as of November 11th, in Tmall’s beauty sub-category list, Huaxizi air honey powder is not only ranked as TOP1 in Tmall’s hot-selling list/repurchase list/praise list, but also as TOP1 in double 11’s hot-selling list under this category, with more than 112,000 people repurchased each year.