Reporter | Wu Rong

Edit | Yun Huiyun

At the end of last year, we reported that with more and more domestic beauty products eyeing overseas markets, 2021 will be a crucial year for brands to "go out to sea".

According to the data released by the General Administration of Customs, in the first three quarters of 2020, the export volume of cosmetics in China was 752,500 tons, with an export value of US$ 3.139 billion, surpassing the export volume of cosmetics in 2018 and 2019, with the latter two being US$ 2.5 billion and US$ 2.774 billion respectively.

At present, the pace of domestic beauty brands going out to sea is still accelerating. According to the recently released data of "2021 Beauty Industry Trend Insight Report" released by CBNData First Financial Data Center and Tmall Golden Makeup Award, domestic beauty products have increased by more than 10 times.

Compared with the past, in recent years, in the wave of domestic beauty products going to sea, there are more new brands, including Perfect Diary, Flower West, Flower Know and ZEESEA Color.

Different brands will choose their countries and channels according to their own characteristics, so as to better explore the possibility of overseas development.

The perfect diary will focus on the southeast Asian market. In April, 2020, Perfect Diary was launched in overseas official website, with Chinese, English, Japanese, Russian, Thai and other languages, and supported payment in US dollars, Singapore dollars and other currencies.

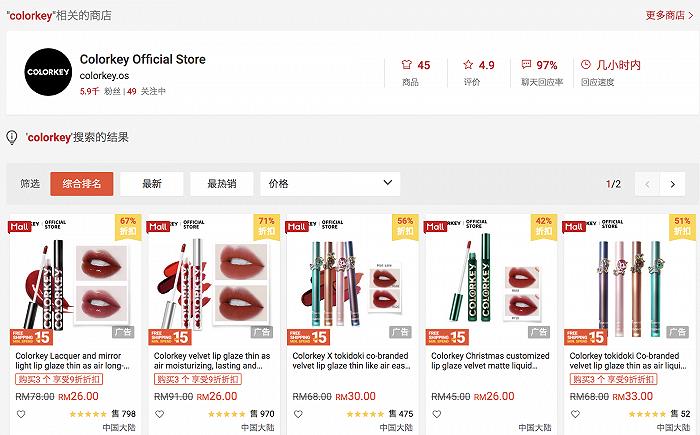

In addition to sales in official website, brands will also use other channel platforms. At present, including Perfect Diary and Hua Xizi, they all go out to sea with the help of Tmall. Another make-up brand, Laqi colorkey, has settled in Shopee, the largest e-commerce platform in Southeast Asia.

There are also offline channels.

At the end of 2018, Mary Daijia entered eight countries including Thailand, Malaysia and Singapore through the Sephora channel; Hua Zhiming has also settled in Japan’s offline beauty collection stores, including more than 300 cosme.

ZEESEA Zise also told the interface news that in addition to international e-commerce platforms such as Amazon, the brand has also settled in Matsumoto Kiyomizu, Japan’s largest cosmeceutical chain. Up to now, it has covered nearly 2,000 Matsumoto Kiyomizu stores. More than a year after its launch, its sales in Japan reached nearly 10 billion yen. According to the plan, ZEESEA Zise will reach 7,000 offline sales points in Japan by the end of 2021.

Perfect Diary, ZEESEA Zise and Ke Laqi colorkey all started in Guangzhou. Previously, we discussed in the article "Revealing the Domestic Beauty Base: Over 70% of them come from Guangzhou, and they should be positive with big brands". The relatively mature beauty industry chain, daily chemical experience and talent pool have created many phenomenal domestic beauty brands for Guangzhou. In fact, these are also important reasons for supporting the new domestic beauty products to go out.

In addition, with the development of online shopping, the progress of logistics and other infrastructure, and China’s rapid recovery from the epidemic, China’s beauty brand has attracted more attention overseas this year.

However, judging from the performance of brands at sea, it is not without challenges.

How to localize is a big problem.

Most domestic beauty brands go to sea, and the main position is generally the Southeast Asian market. However, there are more than 10 countries in Southeast Asia, and different countries have their own religious beliefs. The differences in consumer preferences are not small. It is not easy to localize products.

Nancy, CEO of Baizui Cuisine, who started planning to go to Southeast Asia in 2020, said in an interview with the media that people in different countries have different skin conditions and demands. Take sunscreen products as an example. Consumers in Southeast Asia use sunscreen to resist aging, which is not the same as the starting point for most consumers in China to prevent sunburn. In addition, in Muslim countries such as Indonesia, the policy requires that beauty products must meet halal certification.

The relevant person in charge of Hua Xizi’s public relations also admitted in an interview with Interface News that a very important challenge of China’s brand globalization is the difference in language system and communication mode. Other countries and regions are very different from China in culture, language and customs. Hua Xizi has no idea about their acceptance of China beauty cosmetics and China culture, so she needs to do a lot of pre-promotion work.

Compared with the Southeast Asian market, users in developed countries such as the United States and Japan are more mature in the use habits, discrimination and aesthetic level of cosmetics, and the standards for choosing brands are more stringent. This will undoubtedly put forward more tests for China beauty brands that set their focus on the sea as developed countries.

For example, ZEESEA has focused its overseas development on Japan and the United States, and Judy, the head of its new overseas retail, described the course of brand going out to sea in the past year as a process of "fighting monsters and upgrading". "The laws and regulations of each country are different, and Japan and the United States have their own laws and regulations. We have no teachers, no objects to learn, and we can’t avoid risks. We can only cross the river by feeling the stones. "

In terms of product selection, it is impossible to copy domestic explosives overseas, and brands need to re-develop products and adjust production lines. For example, Hua Xizi’s star color number in China is positive red, but when it is sold in the Japanese market, the color number is also "do as the Romans do", and the popular caramel maple leaf color, peach color and raspberry red are selected as the main colors.

In addition, considering the comprehensive cost, the pricing of products listed overseas is also higher than that of domestic products.

Hua Xizi’s lipstick product "Tongxin Lock Lipstick", which sells for 219 yuan in China, sells for 6,129 yen (equivalent to 371 yuan) in Amazon, Japan, which exceeds the price of Chanel lipstick in Amazon, Japan, which is 5,270 yen (equivalent to 315 yuan) in the same period.

According to Hua Xizi’s statistics, overseas pricing may be 1.7 times the domestic price. This pricing strategy takes into account the comprehensive costs of tariffs, logistics, services and operations. Similarly, the selling prices of international brands in China are also priced in a similar way.

"Due to the impact of the epidemic, the vitality of some foreign industries has not yet recovered. The next three to five years will be a good opportunity for domestic brands to enter overseas markets, especially cosmetics brands." Hu Qimu, a senior researcher at the digital economy think tank, told the interface news. Although the layout of developed countries is full of challenges, mature markets and mature users can prove brand value and operational ability more quickly. If the layout is made earlier, it will have a first-Mover advantage by breaking the circle of products and operations.

Considering that the rise of cutting-edge domestic beauty brands is still in its infancy, the beauty market is fiercely competitive, and the number of self-built supply chains is small, and most of them rely on supply chain problems such as OEM, how to improve product strength will become the key to the success of these brands. If the product quality cannot be recognized, and there is not enough high repurchase rate, user loyalty and recommendation support, going out to sea may only become simply brushing China elements to find a sense of existence.

关于作者