Source:Wencaixin research institute

Wencaixin research institute

Macro team (Wu Chaoming, Hu Wenyan, Li Mo), financial team (Liu Xiaoting, Li Fei)

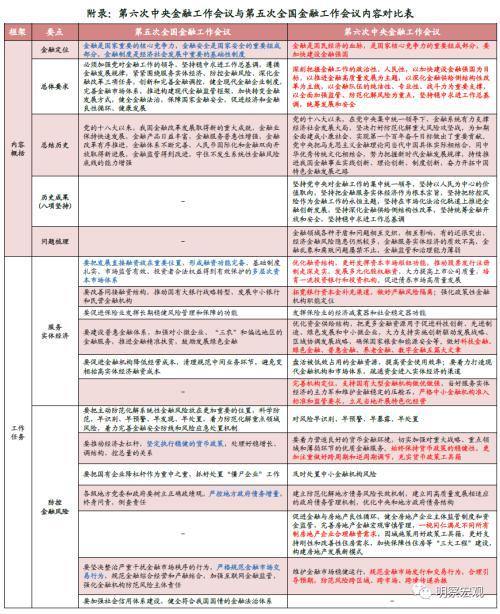

I. Review of the first five meetings: from rectifying financial order to preventing and controlling financial risks.The national financial work conference is the highest-level conference in the financial field, which has important guiding significance for the development of the financial industry in the next stage. Looking back at the first five meetings, the tone and emphasis of the meeting are different under different economic environments. From the perspective of development, the first key word is "rebirth", which mainly solves the problem of high non-performing rate in the banking industry and unloads the historical burden; The second key word is "upgrade", which enhances the competitiveness by speeding up the share reform and listing of state-owned banks and responds to financial opening; The third key word is "leak detection", marked by the listing of Agricultural Bank of China, and the share reform of the four major banks has been completed; The fourth key word is "innovation", and the shadow banking system has developed rapidly, opening a wave of financial liberalization; The fifth key word is "strong supervision", which blocks the loopholes in supervision and resolves the risks of shadow banking. The key word of this meeting is "high quality development".

Second, the background of the sixth meeting: external turmoil and change, domestic transformation and upgrading. First, from the external environment,The world has entered a new period of turbulence and change, and the global economic recovery is weak. High inflation, high interest rates and high debt have increased financial fragility, while the risk of geo-economic fragmentation has intensified.Second, from the domestic environment,China is in a critical period of economic recovery and industrial upgrading. The weakening of traditional kinetic energy leads to increasing pressure for steady growth. It will take time for new kinetic energy to grow and develop, and it is necessary to promote economic growth to return to potential growth rate to prevent short-term demand shortage from turning into long-term contradiction after the epidemic.Third, from the perspective of domestic risks,At present and in the future, the risks of local government debt, real estate and small and medium-sized banks in China need to be resolved urgently to avoid mutual infection and keep the bottom line of systemic risks.Fourth, high-quality development has become a long-term strategy to actively respond to environmental changes at home and abroad and enhance development initiative.

Third, the main points of the sixth meeting: high-quality financial development serves Chinese modernization.

(1) Orientation and goal: to promote high-quality financial development and accelerate the construction of a financial power.The primary task of building a socialist modern country in an all-round way is high-quality development. Because finance is the blood of the national economy, high-quality economic development cannot be separated from high-quality financial services. This meeting set the goal of high-quality financial development as "accelerating the construction of a financial power", which was put forward for the first time in history, highlighting the importance of high-quality financial development in the process of modernization in the future.

(II) Priority 1: Providing high-quality financial services. First, in terms of monetary policy,It is expected that in the next few years, we will maintain a stable overall tone, and at the same time grasp the new characteristics that the peak of traditional credit demand such as real estate has passed, and structurally "break slowly and establish quickly" to meet the reasonable financing needs of old fields and accelerate the cultivation of new credit demand points.Second, in terms of capital supply,Give full play to the positive role of structural monetary policy and multi-level capital market, constantly optimize the financing structure and capital investment, and do five major articles on technology and finance, green finance, inclusive finance, pension finance and digital finance.Third, in terms of stock resources,Accelerate the revitalization of the stock financial resources occupied by the government and state-owned departments, invest more stock funds in new kinetic energy areas, and improve the efficiency of capital use.Fourth, in terms of financing structure,Give full play to the function of the capital market hub and increase the proportion of direct financing.Fifth, in terms of financial openness,Pay equal attention to both "bringing in" and "going out", increase institutional opening in the financial sector, strengthen and consolidate the status of Shanghai and international finance centre, and accelerate the internationalization of RMB.

(3) Work focus 2: Strengthen supervision and reduce risks.In terms of strong supervision,Under the new regulatory pattern, future functional supervision, behavioral supervision and coordinated supervision between the central and local governments are expected to be strengthened.In terms of risks of small and medium-sized institutions,This time, "timely handling risks of small and medium-sized financial institutions" is highlighted, and it is expected that the follow-up disposal process will be accelerated.In terms of local government debt risk,Focus on establishing a long-term mechanism for debt conversion, continue to resolve local debt risks in the short term, accelerate the reform of institutional mechanisms in the medium and long term, and clarify the relationship between the government and the market, and the central and local governments; At the same time, establish a government debt management mechanism that is compatible with high-quality development, standardize the relationship between borrowing and development, and give consideration to debt conversion and high-quality goals; In the future, the central government’s leverage is expected to become a new starting point and new feature of the proactive fiscal policy.In terms of real estate risks,Emphasis is placed on promoting a virtuous circle between finance and real estate. It is expected that improving the supervision system of real estate enterprises at the regulatory end will help curb the risk spread of real estate enterprises in the short term, and the macro-prudential management direction of real estate may turn to "moderate support" in the future; The reasonable financing needs of private housing enterprises on the supply side are expected to be met; Restrictive policies in demand-side core cities are expected to be further liberalized, and at the same time, finance and finance will work together to promote the construction of the "three major projects" to be significantly accelerated.In terms of financial market risks,Domestic stock market, bond market, foreign exchange market and the probability of mutual contagion of monetary policy spillover effect and market fluctuation risk in major overseas economies increase, so it is necessary to prevent cross-regional, cross-market and cross-border transmission resonance of risks and ensure the stable operation of financial markets.

Fourth,Industry influence: localization and specialization are the ways to break the situation for small and medium-sized institutions. In terms of industry comparison,Since the Fifth National Financial Work Conference, the banking industry has been faster than the insurance industry and the securities industry in terms of net assets growth by virtue of its high leverage advantage. However, looking forward to the future, the development of the banking industry may be limited by the need to "broaden the channels for replenishing capital", while the development of the insurance industry can supplement internal capital by optimizing its business structure without resorting to external capital, and the securities industry will benefit from policies such as "giving full play to the hub function of the capital market". It is expected that the development of the insurance industry and the securities industry will be marginal in the future.In terms of industry structure,The Matthew effect of the strong will be intensified, and small and medium-sized financial institutions should be based on localization and characteristic strategies to break the game;In terms of business priorities,The "five great articles" have made clear the directional guidance for the next stage of financial exhibition industry;In terms of regulatory orientation,Under the situation of strong supervision and strict supervision, financial institutions need to improve the level of compliance risk management and firmly take the road of returning to the source.

Event:The Central Financial Work Conference was held in Beijing from October 30 to 31, summarizing the financial work since the 18th National Congress of the Communist Party of China, analyzing the situation faced by high-quality financial development, and deploying the financial work at present and in the future.

I. Review of the first five meetings: from rectifying financial order to preventing and controlling financial risks.

The national financial work conference is the highest-level conference in the financial field, usually once every five years, and has been held five times since the first meeting in 1997. While summing up the achievements of financial work in the past, the meeting will provide guidance for major financial policies and financial reforms in the next stage, which is of great guiding significance for the development of the financial industry in the next five years. Looking back at the first five meetings, due to the different internal and external environments, the general tone of the meetings is also different, but they are basically centered on three themes: financial supervision reform, financial system reform and prevention of financial risks (see Table 1).

Specifically, the relevant background and key contents of the first five financial work conferences:

(1) The first time (November 1997): rectifying financial order and resolving financial risks are the core.

Internal and external pressures are intertwined, and it is extremely urgent to resolve financial hidden dangers.In terms of external environment, 1997 coincided with the outbreak of the Asian financial crisis, and the financial systems of some Asian countries suffered severe shocks. Whether China’s financial system can withstand external shocks has become the focus of global attention. In terms of internal environment, the non-performing loan ratio of state-owned banks is high, and their ability to resist risks is weak. In addition, the problems such as weak financial supervision and chaotic financial order at that time are outstanding. In this context, the first national financial work conference was held in November 1997, with the theme of rectifying financial order and resolving financial risks, and proposed to "strive to establish a suitable financial institution and supervision system in about three years".

Around the two main lines of financial supervision and state-owned bank reform.In terms of financial supervision, the central government accelerated institutional reform after the meeting, and established the Central Financial Working Committee in 1998 to strengthen the party’s vertical leadership over financial institutions; The People’s Bank of China abolished the original provincial branches and changed them into nine regional branches to enhance the independence of the central bank’s monetary policy and supervision; The Securities Regulatory Commission and the China Insurance Regulatory Commission shall be established to be responsible for the supervision of the securities industry and the insurance industry respectively, while the People’s Bank of China shall be responsible for the supervision of the banking industry and the trust industry, and strengthen the separate supervision. The reform of state-owned banks focuses on removing bad debts. On the one hand, it draws lessons from international experience and establishes four AMCs to receive the non-performing assets stripped by state-owned banks; On the other hand, the central government issued 270 billion special treasury bonds to supplement the capital of state-owned banks. In addition, state-owned banks have also accelerated the pace of commercialization, canceled the control of their loan limits, and implemented asset-liability ratio management and risk management.

(2) The second time (February 2002): Strengthening financial supervision and promoting the reform of state-owned banks are the key points.

It is imperative to enhance the competitiveness of the financial industry after China’s entry into WTO.In December 2001, China formally joined the World Trade Organization (WTO). For the financial industry, opportunities and challenges coexist. Although China financial institutions have the opportunity to strengthen cooperation with international financial institutions in the process of opening to the outside world, the pressure of "promising to fully open the financial services industry in stages in the next five years" forces China financial institutions to enhance their competitiveness as soon as possible. Under this background, the second national financial work conference was held in February, 2002. The conference was set as "strengthening financial supervision and promoting the reform of state-owned banks", emphasizing that "strengthening supervision is the top priority of financial work" and proposing that "banks must be turned into modern financial enterprises".

Continuing the direction of the first meeting, improving financial supervision and accelerating the reform of state-owned banks are still the main lines.In terms of financial supervision, in 2003, the Central Financial Working Committee was abolished and the China Banking Regulatory Commission was established, and the separate supervision framework of "one line, three meetings" in China was initially formed. At the same time, the reform process of the state-owned bank has been accelerated, and a leading group for the reform of the state-owned bank has been established to make overall arrangements for the reform plan; Central Huijin Company was established in 2003 to inject capital into state-owned banks and create conditions for share reform and listing; In 2005-2006, Bank of Communications, China Construction Bank, Bank of China and ICBC successively completed share reform and listing. In addition, the reform of rural credit cooperatives began, and some provinces and cities actively piloted it under the policy of adapting to local conditions and classifying guidance.

(C) The third time (January 2007): comprehensively deepening financial reform is the keynote.

The internal and external environment is relatively friendly, and the necessity of "checking and filling gaps" is strengthened.Compared with the previous two meetings, the internal and external environment of the third meeting is relatively friendly. Externally, the global economy is in an overheated period, and the subprime mortgage crisis in the United States has not yet erupted. Internally, China’s economy is in a period of rapid growth, and the financial industry is growing rapidly. However, there are still many problems in the financial field, such as the imperfect financial system and unreasonable financial structure. Therefore, the third financial work conference was set to "push the financial reform and development to a new stage and comprehensively deepen the financial reform", with the focus on "checking leaks and filling gaps" to further improve the financial reform.

Continuing to deepen the reform of financial institutions and building a financial market system are the main lines.After the second meeting, only the Agricultural Bank of China (ABC) of the four major banks has not completed the share reform. This meeting gave the final answer to the share reform model of ABC and promoted the listing of ABC in 2010. Policy banks promote reform in accordance with the principle of "one line, one policy", first of all, open the commercial operation of CDB; The construction of rural financial system was accelerated, and microfinance organizations were cultivated. In terms of financial system construction, under the guidance of "vigorously developing the capital market", the establishment of the Growth Enterprise Market in 2009 opened the first step in the construction of a multi-level capital market system; At the same time, the bond market has achieved rapid development, and the variety of bonds has expanded, and winning the bid, short-term financing and corporate bonds have emerged as the times require. In addition, in the face of the rapidly rising foreign exchange reserves, CIC was established in September 2007, specializing in the investment management of foreign exchange reserves.

(IV) The fourth time (January 2012): Emphasis was placed on the coordination of innovation and supervision to start the process of financial liberalization.

First, it proposes to resolve local debts and emphasizes the requirements of financial service entities.After the introduction of the "4 trillion" stimulus plan, hidden risks were left behind, and local debt problems began to arise. After the global financial crisis, the phenomenon of loose liquidity and the withdrawal of funds from reality to emptiness gradually appeared. In this context, the fourth meeting was held in January, 2012. For the first time, financial services to the real economy were discussed more, emphasizing the need to "adhere to the essential requirements of financial services to the real economy", effectively solving the problems of financing difficulties and expensive financing in the real economy, and resolutely curbing the social capital from reality to reality. At the same time, it first mentioned the resolution of local debts, focusing on "properly handling existing debts". Since 2014, the budget management of local governments has been gradually standardized. In 2015, with the implementation of the new budget law, local governments opened the bond swap to replace the existing debts in the form of non-government bonds by issuing local bonds.

But the financial industry as a whole is still in a good development environment.Under the guidance of "adhering to the reform orientation of market allocation of financial resources" and "adhering to the development concept of coordinating innovation and supervision", financial supervision, financial system and financial system have been further deepened and improved. In terms of financial supervision, a macro-prudential evaluation system was initially established, and a regulatory framework for systemically important financial institutions was constructed. In terms of financial system, the central bank improved the RMB exchange rate formation mechanism, promoted the interest rate marketization reform, and formally introduced the deposit insurance system. In terms of financial system, under the keynote of "encouraging, guiding and regulating private capital to enter the field of financial services", the first batch of five private banks began to pilot in 2014, and private capital began to show its strength; At the same time, under the concept of supporting financial innovation, starting from the 2012 Securities Innovation Conference, China started a round of financial liberalization. On the one hand, the mixed operation of licensed institutions, mainly banks, securities, insurance and trusts, has intensified, and the shadow banking system has expanded rapidly; On the other hand, the development of Internet technology has promoted the emergence of new Internet finance formats such as third-party payment, P2P and Internet financing, which further boosted the expansion of the financial system.

(V) The fifth time (July 2017): The importance of risk prevention has been strengthened and it has entered the era of strong supervision.

With the change of macro and financial environment, the importance of risk prevention and strict supervision has been strengthened.Compared with previous meetings, the macro and financial environment faced by the fifth meeting has changed greatly. China’s economy is in the period of increasing speed and shifting gears, and the supply-side reform of "de-capacity, de-inventory and de-leverage" has been steadily promoted, and the economy has gradually entered the "new normal" from "high growth". After several years of rapid expansion, the financial industry has accumulated certain risks, the problem of "shadow banking" has become increasingly prominent, and the contradiction between financial innovation and financial supervision has become prominent. In this context, the fifth meeting was set as "serving the real economy, preventing and controlling financial risks, and deepening financial reform", emphasizing "returning to the origin" and "strengthening supervision", which opened an era of strong supervision and strict supervision of the financial industry.

Filling the short board of supervision and resolving financial risks are the main tasks.In view of the loopholes in separate supervision in financial innovation, the meeting clearly stated that "it is necessary to strengthen the coordination of financial supervision and fill the shortcomings of supervision". After the meeting, the Financial Stability and Development Committee was established, the Bank and the China Insurance Regulatory Commission were merged, and the former local government coordination agency was upgraded to a substantive regulatory agency (local financial supervision bureau), forming a new financial supervision pattern of "one committee, one line, two meetings+local supervision bureau". In view of the increased risks in the shadow banking system, new regulations on asset management were issued in April 2018, which unified the regulatory standards for asset management products and eliminated regulatory arbitrage. At the same time, the shadow banking risks were dismantled by means of breaking the rigid exchange, prohibiting mismatches, removing nesting and deleveraging.

Serving the real economy emphasizes the development of direct financing.After the indirect financing in the early stage was vigorously developed, the meeting clearly put "developing direct financing in an important position" and proposed to form a multi-level capital market system with complete financing functions and solid basic systems. After the meeting, the capital market reform was obviously accelerated. In November 2018, science and technology innovation board established and piloted a registration system; In September 2021, the North Exchange was established, and direct financing showed an accelerated development trend.

To sum up, from the perspective of development, the first key word is "rebirth", which mainly solves the problem of high non-performing rate in the banking industry and unloads the historical burden; The second key word is "upgrade", which enhances the competitiveness by speeding up the share reform and listing of state-owned banks and responds to financial opening; The third key word is "leak detection", marked by the listing of Agricultural Bank of China, and the share reform of the four major banks has been completed; The fourth key word is "innovation", and the shadow banking system has developed rapidly, opening a wave of financial liberalization; The fifth key word is "strong supervision", which blocks the loopholes in supervision and resolves the risks of shadow banking.

Second, the background of the sixth meeting: external turmoil and change, domestic transformation and upgrading

The great changes in the world in the past century have accelerated the evolution. The changes in the world, the times and the history are unfolding in an unprecedented way. China is in the critical period of building a socialist modern country in an all-round way. High-quality development has become a long-term strategy to actively respond to environmental changes at home and abroad and enhance development initiative. It is urgent for the financial system to make corresponding adaptive adjustments, so as to help the great cause of national rejuvenation and the goal of high-quality economic development with high-quality financial development. The Sixth Central Financial Work Conference is an important meeting held under this background.

(A) From the external environment, the world has entered a new period of turbulence and change.

First, the epidemic in the century has a far-reaching impact and the recovery of the world economy is weak.According to the data of the International Monetary Fund (IMF), the global GDP grew by an average of 2.3% in 2020-2022 after the epidemic, and it is expected to increase by 3.0% and 2.9% in 2023 and 2024 respectively, which are far lower than the average annual growth rate of 3.8% in the past 20 years (2000-2019), and the global economic momentum is weakening (see Figure 1).

Second, high inflation, high interest rates and high debt have greatly increased global financial fragility.Affected by frequent geopolitical conflicts, anti-globalization, aging, slowing technological progress and other medium and long-term factors, it is inevitable that the global inflation center will rise, and the duration of high interest rates may exceed expectations. The superimposed world is at the peak of the fourth debt wave, and the risk of global debt default has increased significantly, and the risk of financial market turmoil has intensified.

Third, the risk of geo-economic fragmentation has intensified. On the one hand,With the profound adjustment of the international power balance of "East Rising and West Falling", the United States is vigorously promoting the world political camp, "weaponizing" chips, high-tech, swift financial institutions, and splitting the world’s market-based industrial chain and supply chain through extreme pressure methods such as decoupling and chain breaking, which in turn leads to an increase in the operating cost of the world economy and a decline in efficiency, dragging down global trade and economic growth.On the other hand,In the face of intensified competition among big countries, the global governance deficit has increased significantly, and international chaos has emerged one after another. The Russian-Ukrainian war, the Palestinian-Israeli conflict and other local turmoil have frequently occurred, and the stability of global food, energy and other important resources has declined, further aggravating the turmoil in the global environment.

(B) From the domestic environment, China is in a critical period of economic recovery and industrial upgrading.

First, the traditional kinetic energy is weakening, and the pressure of steady growth is increasing.At present and in the future, China’s economic development is faced with hard constraints such as aging population structure, increasing resource and environment constraints, high macro leverage ratio and slowing urbanization pace. Traditional growth kinetic energy such as real estate and infrastructure, which are highly dependent on labor, capital, land and other factors, may have downward pressure. Under the background of rapid development of new kinetic energy but limited volume, the pressure of steady growth is increasing.

Second, the economic recovery after the epidemic is lower than the potential level, and the short-term demand shortage may evolve into a long-term contradiction.2023 is the first year for China to start economic recovery after three years of epidemic impact. It is estimated that GDP will increase by about 5.3% year-on-year. Since the growth rate was only 3.0% last year, the average growth rate in two years is about 4.1% after deducting the influence of low base, which is still below the potential growth rate. Among them, the unstable expectation and lack of confidence of micro-subjects lead to insufficient domestic demand. At present, it is necessary to prevent weak expectations from leading to weak effects, further strengthen the formation of negative feedback cycle of weak expectations, avoid the problem of short-term insufficient demand for a long time, and maintain sustained and stable macroeconomic growth, which is the key to break the above cycle.

Third, the new kinetic energy faces the double constraints of decoupling and breaking the chain and the weak independent innovation ability, and it will take time to cultivate and grow.In terms of stock, the added value of China’s "three new" economies (new industries, new formats and new business models) has been increasing in recent years, reaching 17.4% in 2022 (see Figure 2), but the absolute scale of new kinetic energy is still low, and it is difficult to make up for the impact brought by the decline of traditional kinetic energy in the short term. From the incremental point of view, in the face of external technology suppression and containment, it may be upgraded at any time. Under the condition that China’s independent innovation ability is not strong, it is difficult to cultivate and grow new kinetic energy overnight, which takes time and trial and error process.

(C) From the perspective of domestic risks, China’s financial risks are still in a period of high incidence.

First, the local government debt risk needs to be resolved urgently.According to estimates, at the end of 2022, the scale of generalized local government debt, including interest-bearing debt of financing platform, reached about 90 trillion yuan, accounting for 318% of local comprehensive financial resources, which was significantly higher than the international warning of 120% (see Figure 3), and the local government debt burden was obviously biased. At the same time, due to the economic downturn, the downturn in the real estate market, and the peak of debt maturity, the pressure on local government debt repayment has increased, and it is necessary to localize debt.

Second, the pressure on real estate risk resolution has increased.Real estate has great influence on economic growth, employment, fiscal revenue, residents’ wealth and financial stability. In the first three quarters of 2023, the domestic real estate sales area decreased by nearly 40% compared with the high point in the same period. The continuous downturn in the real estate market led to the three cash flow channels of real estate enterprises-sales repayment, advance payment by upstream and downstream construction enterprises and corporate financing-being in a tense or even broken state (see Figure 4). The default risk of real estate enterprises may be further exposed, and it is easy to transform into financial risk and financial institution risk, so it is necessary to keep the bottom line of systemic risk.

Third, the hidden risks of small and medium-sized financial institutions have increased.On the one hand, under the background that the downward pressure of macro-economy still exists, the default risk of housing enterprises increases, and the debt repayment burden of urban investment increases, small and medium-sized financial institutions are limited by their business areas and their own business positioning, and the risk of asset quality deterioration increases. On the other hand, due to factors such as the sinking of state-owned big banks’ business and the sharp narrowing of banks’ net interest margin, the hematopoietic capacity of small and medium-sized banks has declined, and their ability to digest the losses of non-performing assets through profits has weakened.

(D) Finance urgently needs to achieve high-quality development and provide assistance for high-quality economic development.

In the face of profound changes in the domestic and international environment, it is necessary to unswervingly promote high-quality development in order to win the advantage and initiative in the future competition and realize the goal of building a socialist modern power in an all-round way. The construction of an economic power can not be separated from the support and assistance of a financial power, and it needs the high-quality development of finance. However, at present, various contradictions and problems in the domestic financial field are intertwined and affect each other, which are mainly reflected in four aspects: first, there are still many hidden dangers in economic and financial risks; second, the quality and efficiency of financial services to the real economy are not high; third, financial chaos and corruption have been repeatedly banned; and fourth, the ability of financial supervision and governance is weak. Therefore, this meeting closely followed the four major issues and formulated prescriptions for high-quality financial development, with three paths of "strengthening the overall unified leadership of the party, providing high-quality financial services, comprehensively strengthening financial supervision and preventing and resolving financial risks" to help build a strong country and rejuvenate the nation.

Third, the main points of the sixth meeting: high-quality financial development serves Chinese modernization

(1) Orientation and goal: to promote high-quality financial development and accelerate the construction of a financial power.

The primary task of building a socialist modern country in an all-round way is high-quality development, and "finance is the blood of the national economy and an important part of the country’s core competitiveness", so the high-quality development of the economy is naturally inseparable from the high-quality service of finance. However, at present, the quality and efficiency of financial services to the real economy in China are not high, so "promoting the high-quality development of China’s finance" has naturally become a new task and mission on the new journey of "building a strong country and rejuvenating the nation" in the new era. “"High-quality financial development" not only became the key word of the Sixth Central Financial Work Conference, but also provided accurate and forward-looking positioning for future financial work.

High-quality economic development can not be separated from high-quality financial services. Similarly, a modern power can not be separated from the support and assistance of financial powers. This meeting put forward the goal of "accelerating the construction of a financial power" for the first time in history, highlighting the importance and status of finance in the process of modernization. In order to achieve the goal of becoming a financial power, the meeting made clear and definite arrangements for the current and future financial work: First, adhere to and strengthen the overall leadership of the Party; The second is to promote high-quality financial development as the theme; The third is to deepen the structural reform of the financial supply side; Fourth, it is supported by the purity, professionalism and combat effectiveness of the financial team; Fifth, focus on comprehensively strengthening supervision and preventing and resolving risks.

(2) Priority 1: Providing high-quality financial services.

1. Monetary policy: always keep steady and grasp the new characteristics of credit supply and demand.

To provide high-quality financial services, we must first "create a good monetary and financial environment". According to the contents of the meeting, at present and in the future, the key to monetary policy should grasp the following two points:

First, in terms of general tone, monetary policy will remain stable in the next few years, showing the characteristics of "stable quantity and falling price".The meeting clearly put forward that "the stability of monetary policy should always be maintained", indicating that the probability of monetary policy will not fluctuate greatly in the next few years, and the focus is on providing a suitable monetary and financial environment for stable economic growth and transformation and upgrading. In the context of economic restructuring and structural contradictions, monetary policy should not only meet the effective financing needs of the real economy, but also avoid excessive easing, increase financial risks, solidify structural distortions, and hinder the process of transformation and upgrading. Specifically, in terms of quantity, it is expected that liquidity will continue to be reasonable and abundant, and the growth rate of money supply and social financing scale will basically match the nominal economic growth rate; In terms of price, in the face of the macro-environment of increasing economic growth pressure, the meeting clearly put forward that "the financing cost will continue to decline", which means that there is still room for lowering the policy interest rate in the future, which will drive the central level of loan interest rate and deposit interest rate to continue to decline (see Figure 5).

Second, in terms of structural adjustment, we should adhere to the principle of "breaking slowly and establishing quickly" and grasp the new characteristics of weakening demand for traditional credit such as real estate.With the marginal slowdown of urbanization process and the evolution of the long-term trend of real estate, the most prominent feature of domestic credit supply and demand at present is that the demand for traditional loans such as infrastructure and real estate, which used to be large in magnitude, tends to weaken, while the volume of new kinetic energy loans is relatively small, which makes it difficult to make up for the shortage of total credit demand. Therefore, the meeting proposed "accurately grasp the law and new characteristics of supply and demand of money and credit, and strengthen the dual adjustment of total money supply and structure". It is expected that in the future, the money supply will grasp the new characteristics of the changes in credit demand of traditional kinetic energy and new kinetic energy, and adhere to the principle of "breaking simultaneously and breaking quickly". On the one hand, it will meet the reasonable financing demand of traditional kinetic energy and avoid its rapid decline (see Figure 6), which will affect the stability of total credit and economic growth; On the other hand, we should seize the favorable time window and make rational use of structural monetary policy tools to guide more resources into major strategies, key areas and weak links, and promote the cultivation and growth of new kinetic energy.

2. Fund supply: Optimize the investment of funds and make five major articles.

In order to improve the quality and efficiency of financial services to the real economy and promote high-quality economic development, the meeting repeatedly emphasized the investment of funds, and made it clear that five major articles on technology and finance, green finance, inclusive finance, pension finance and digital finance should be done well. To this, there are two understandings:

First, the five major articles are consistent with the logic and direction of high-quality economic development.The meeting put forward five major articles on "Optimizing the structure of capital supply", "Doing a good job in technology and finance, green finance, inclusive finance, pension finance and digital finance", which are consistent with the connotation requirements of "innovation is the first driving force, coordination is the endogenous feature, green is the universal form, openness is the only way, and sharing is the fundamental purpose" for high-quality economic development, reflecting that the inclination of financial resources to high-quality development areas is the proper meaning of high-quality financial development.

Second, it is necessary to play the positive role of structural monetary policy and multi-level capital market to do five major articles well. On the one hand,At present, China’s financial supply is still dominated by bank credit. It is necessary to give full play to the role of "precise drip irrigation" as a structural monetary policy tool, guide more funds to flow to five high-quality development areas, and continuously optimize the credit structure. Therefore, the meeting put forward a "toolbox for enriching monetary policy", and it is expected that the structural monetary policy will increase or decrease, focusing on the rational and moderate use of key areas.On the other hand,Direct financing is more suitable for the financing needs in the field of new kinetic energy. International experience shows that economies dominated by direct financing can often seize the opportunity in the transformation and upgrading of industrial structure, and the transformation process is more smooth and smooth. Therefore, it is inseparable from the vigorous development of multi-level capital market construction and direct financing to do five major articles well. It is expected that the financial business focusing on five major articles is expected to usher in rapid growth (see Figure 6), especially in the fields of pension and digital finance, which were less emphasized before, and financial institutions will increase their business layout in these fields.

3. Stock resources: accelerate the revitalization of financial resources that are occupied inefficiently, and promote increment by stock.

For the first time, the meeting specifically proposed "revitalizing the financial resources occupied by inefficiency and improving the efficiency of capital use", reflecting that optimizing the capital supply structure should not only make efforts to guide the investment of incremental funds, but also vigorously revitalize the stock financial resources occupied by inefficiency to expand effective investment in new kinetic energy fields.

There are two directions: First, there are a large number of "sleeping assets" in government departments, which need to be revitalized urgently to improve the efficiency of capital use.By the end of September 2023, the balance of government deposits (fiscal deposits and institutional group deposits) was as high as 41.3 trillion yuan, accounting for about 61% of the total government debt balance (see Figure 7), indicating that the stock assets of government departments are seriously silted up and a large number of financial resources are inefficiently occupied.Second, the state-owned sector occupies more financial resources, crowding out the private sector, which needs to be optimized and adjusted urgently.According to the data of the General Administration of Financial Supervision and Management and Wonder, the loan balance of private enterprises accounted for about 43.5% of the loan balance of enterprises (institutions) at the end of September 2022 (see Figure 8), while the bond financing balance of private enterprises still accounted for less than 10% of the bond financing balance of non-financial enterprises, both of which were significantly lower than the contribution rate of private economy to GDP of more than 60%, indicating that the financial resources occupied by state-owned enterprises were far greater than their contribution to economic and social development, and the efficiency of fund use was low. It is expected that in the future, the inefficient assets of the government and the state-owned sector are expected to accelerate the revitalization, guide more funds to flow to efficient sectors such as private enterprises and high-tech emerging industries, and cultivate new kinetic energy.

4. Financing structure: Give full play to the function of capital market hub and cultivate first-class investment banks and institutions.

Since the Fifth National Financial Work Conference put forward that "the development of direct financing should be placed in an important position", the proportion of direct financing in the stock of social financing has continued to increase. However, since 2022, the proportion of direct financing has not decreased due to the continuous increase of corporate bond financing (see Figure 9), and it is still low compared with the recognized "financial power"-the United States, which is dominated by direct financing. Therefore, this central financial work conference proposed "optimizing the financing structure, giving full play to the function of the capital market hub" and increasing the proportion of direct financing. To this end, the meeting put forward two important measures:

First, "give full play to the function of the capital market hub" and build an active capital market.On July 24th, Politburo meeting of the Chinese Communist Party made it clear that "the capital market should be activated to boost investors’ confidence", and the regulatory authorities issued a package of policies and measures from the trading side, investment side and financing side (see Table 2). In order to play the role of the capital market hub, optimize the financing structure and increase the proportion of direct financing, it is expected that in the future, the regulatory authorities will also promote the opening of pain points, vigorously promote the reform of the investment side, attract medium and long-term funds to enter the market, and guide various funds such as social security, insurance and annuity to allocate A shares.

The second is to cultivate "first-class investment banks and institutions" and build a financial power.First-class investment banks and institutions have global distribution and influence, and have strong pricing power over global financial assets and commodities, so they are also one of the important symbols of "financial power". At present, there is still a big gap between China’s head investment banks and investment institutions and internationally recognized "first-class investment banks and investment institutions" (see Figure 10-11), such as the obviously low scale of revenue and net profit. In order to be a better and stronger head investment bank, the previous regulatory authorities have put forward favorable policies such as "appropriately relaxing the capital constraints on high-quality securities companies". It is expected that the subsequent implementation of the policies will push China’s head investment banks and investment institutions to the road of "first-class investment banks and investment institutions".

5. financial opening: promoting high-level two-way opening is an inherent requirement of financial powers.

Promoting high-level financial opening to the outside world is, on the one hand, the inherent requirement of economic laws and high-quality development, and on the other hand, it is a two-way opening with equal emphasis on "bringing in" and "going out", rather than a one-way opening.

First of all,Financial opening is an important part of China’s opening to the outside world, and it is also the proper meaning of building a new development pattern and deepening the structural reform of the financial supply side;Secondly,A modern economic power needs the support and assistance of a financial power, and the construction of a financial power, besides having a modern financial institution and market system, is inseparable from the high-level opening of finance, including further improving the management mode of national treatment plus negative list before entry, expanding the institutional opening of rules, regulations, management and standards in the financial field, building an influential and competitive international financial center, and promoting the internationalization of RMB, so as to "enhance the convenience of cross-border investment and financing and attract more foreign financial institutions."Again,The high-level two-way opening of finance requires the construction of a corresponding regulatory system and the improvement of the regulatory level to control the high-level opening up, which is of course an important "talent infrastructure" and "core software" for becoming a financial power;Finally,China has become the world’s second largest economy, the world’s largest banking market and the second largest insurance market, and has the ability to "go global". It should adhere to the principle of multilateralism, actively participate in international financial cooperation and governance, and serve national strategies such as the "Belt and Road".

Because financial activities have the nature of risk, the opening-up of the financial sector will inevitably bring about the cross-border transmission of financial risks, and the risks of overseas financial markets and financial institutions may spill over to China. Therefore, the opening-up process should also "ensure the national financial and economic security" under the premise of security control.

In promoting the internationalization of RMB, according to the RMB Internationalization Report 2023 released by the central bank in October this year, the RMB accounted for 3.91% of global trade financing at the end of 2022, up 1.9 percentage points year-on-year, ranking third; In September 2023, the proportion rose to 5.8%, and the ranking also rose to second place. In terms of international payment, the share of RMB in the global market reached 3.7% in September this year, 1.5 percentage points higher than that at the end of last year (see Figure 12), but compared with China’s economic GDP accounting for more than 18% of the world, the asymmetry is obvious; From the horizontal comparison, the global market share is also at a low level (see Figure 13). These phenomena show that China still has a long way to go to become a financial power, and there is also a lot of room for two-way financial opening. There is still great potential for high-quality financial development to serve Chinese modernization.

(C) Focus 2: Strengthen supervision and reduce risks.

1. Strong supervision: Functional supervision, behavioral supervision and coordinated supervision between central and local governments are expected to be strengthened.

Continuing the theme of the fifth meeting, "strong supervision" is still the main tone of this meeting.However, different from the last meeting, this meeting put strong supervision and risk prevention together, which means that strengthening financial supervision and improving the supervision system are the premise and foundation for effectively preventing financial risks. In terms of specific formulation,One isReport to the 20th CPC National Congress, who continued the Party, mentioned that "all financial activities should be regulated according to law", indicating that in the future, financial activities must be licensed, illegal financial activities will be severely cracked down, and financial supervision will achieve "full coverage without exception".The second isRe-emphasize "comprehensively strengthen institutional supervision, behavioral supervision, functional supervision, penetrating supervision and continuous supervision", which is related to the background that the comprehensive operation of the financial industry continues to deepen and the complexity and concealment of financial risks continue to increase, aiming at comprehensively strengthening supervision and eliminating regulatory gaps and blind spots.

In order to meet the needs of the new situation, this round of supervision system reform was started in March this year, the Financial Stability Board was abolished, and the General Administration of Financial Supervision was established, forming a new supervision pattern of "one line, one bureau, one meeting" (see Figure 14).Under the new system, we can focus on three aspects:

The first is to highlight "functional supervision".In recent years, with the trend of mixed operation strengthening, the former mode of "institutional supervision" under separate operation can no longer adapt to the new financial market, but it is necessary to realize "functional supervision" across products, institutions and markets according to the functions realized by financial products. In this round of reform, the General Administration of Financial Supervision will be responsible for the supervision of the financial industry except the securities industry, which will contribute to the comprehensive unification of institutional supervision and functional supervision.

The second is to pay more attention to "behavior supervision".From the international experience, after the financial crisis in 2008, it has become an international trend to establish a "double-peak model" that separates prudential supervision from behavioral supervision, and behavioral supervision has received more attention. This reform brings the consumer protection responsibility of the central bank and the investor protection responsibility of the CSRC into the General Administration of Financial Supervision, and strengthens the concept of behavior supervision while unifying management. It is expected that the relevant supervision mechanism will be further implemented in the future.

The third is to strengthen the supervision and coordination between the central and local governments.One of the reasons for the inefficiency of China’s financial supervision is that the central and local supervisory responsibilities are unclear and their positions are contradictory. On the one hand, this reform of supervision system emphasizes the centralization of financial supervision authority to the central government and rationalizes the relationship between central and local financial supervision responsibilities; On the other hand, this meeting clearly pointed out that it is necessary to establish the financial committees and financial working committees of local party committees, implement territorial responsibilities, and achieve seamless coordination between the central and local governments in vertical supervision.

2. Risks of small and medium-sized financial institutions: the disposal process may be accelerated.

The meeting once again mentioned the risks of small and medium-sized financial institutions.In recent years, serious credit risk incidents have occurred in Baoshang Bank and Jinzhou Bank, and institutions such as Sichuan Trust and Zhongrong Trust have successively exploded, which has caused great negative impact on society. The risks of small and medium-sized financial institutions have aroused great concern. According to the rating results of financial institutions in the fourth quarter of 2022 announced by the central bank, among the 346 high-risk banks, city commercial banks, rural cooperative institutions and rural banks accounted for more than 95%. From the perspective of risk causes, the risks of small and medium-sized institutions come from many aspects: First, the macro-economic growth shift and the downward trend of the real estate industry have exerted great pressure on the operation of small and medium-sized institutions, which are facing problems such as deteriorating asset quality and declining risk compensation ability. Take the NPL ratio as an example. By the end of June this year, the NPL ratios of city commercial banks and rural commercial banks were 1.90% and 3.25% respectively, which were significantly higher than the average level of commercial banks (1.62%) (see Figure 15-16). Second, the corporate governance structure is not perfect, the ownership structure of some small and medium-sized institutions is complex, and corporate governance is flawed, which may easily lead to large shareholders occupying funds and infringing on the rights and interests of small and medium-sized shareholders, such as Baoshang Bank and Henan Rural Bank. Third, the positioning of serving the local economy makes small and medium-sized institutions have high regional concentration and weak risk diversification ability, and are vulnerable to the impact of local economic or industrial changes.

Emphasis is placed on "timely disposal" and it is expected that the follow-up process will be accelerated.At the end of April this year, Politburo meeting of the Chinese Communist Party proposed that "the reform of small and medium-sized banks, insurance and trust institutions should be done as a whole". In July this year, Politburo meeting of the Chinese Communist Party once again mentioned "steadily promoting the reform of high-risk small and medium-sized financial institutions". Compared with the two Politburo meetings, this statement highlights "timely disposal" and requires timeliness. This is because the risks of financial institutions are diffuse and contagious, which easily leads to regional or systemic risks. This formulation may indicate that the disposal process of subsequent high-risk institutions will be accelerated. In terms of disposal methods, under the premise of adhering to the classified policy of accurately defusing bombs and compacting the responsibilities of all parties, according to the "Report on Financial Work in the State Council" in October this year, it is mentioned that "promoting mergers and acquisitions, clearing out the clearing out safely", we believe that the follow-up disposal ideas: First, increase institutional integration and equity restructuring, such as the reform of provincial associations that have been piloted in Liaoning, Henan and Shanxi provinces since this year; Second, it is safe and clear. In recent years, the first trust company (Xinhua Trust), the first auto finance institution (Huatai Auto Finance) and the first financial leasing company (Tianjin Guotai Financial Leasing) have declared bankruptcy.

3. Local debt risk: accelerate the establishment of a long-term mechanism for debt conversion, and the central government may increase the leverage.

In terms of preventing and resolving local government debt risks, the formulation of the three financial work conferences in 2012, 2017 and 2023 showed important changes such as "properly handling the existing debt" → "strictly controlling the increment of local government debt" → "establishing a long-term mechanism for preventing and resolving local government debt", which reflected that the focus of local government debt in China gradually shifted from stock and increment to establishing a long-term mechanism. This is a long-term systematic project, which will standardize the government’s borrowing behavior, handle the relationship between borrowing and development, and realize the sustainability of local finance. Specifically, this meeting revealed three major debt clues.

First, combine short-term, medium-term and long-term measures to establish a long-term mechanism for debt conversion. In the short term,Affected by factors such as the heavy local government debt burden, the decline in fiscal revenue due to real estate, and the peak of debt maturity, the default risk of some weak-qualified regional urban investment is prominent, and it is necessary to accelerate the resolution of local government debt risk in the short term. According to statistics, since October, the issuance scale of special refinancing bonds has exceeded one trillion yuan, and the issuance speed, scale and scope have exceeded market expectations. However, special refinancing bonds are mainly used to borrow new and repay old, and will not reduce the local debt balance, and subsequent issuance is restricted by regional debt limits (the balance of local debt limits is about 2.6 trillion yuan in 2022). It is estimated that in the future, there will be a maximum of 1.5 trillion yuan of new space for special refinancing bonds, and the role of resolving local implicit debts exceeding 50 trillion yuan is still limited. It is expected that the next step is to set up emergency liquidity financial instruments (SPV) by the central bank, add new policy financial instruments, and revitalize existing assets in various places to help resolve local debts.In the medium and long term,The key to establishing a long-term mechanism for debt conversion lies in promoting the reform of the mechanism system and clarifying the relationship between the government and the market, and between the central and local governments. On the one hand, speed up the divestiture of the government financing function of the city investment platform, promote its market-oriented transformation, and form a clear boundary between the government and the city investment platform; On the other hand, we will promote the reform of the tax system and the financial relationship between the central and local governments, and balance the administrative and financial rights of the central and local governments.

The second is to improve the government debt management mechanism, taking into account the goal of debt conversion and high quality.The meeting proposed "establishing a government debt management mechanism suitable for high-quality development". On the one hand, it reflects that local governments will not be restricted from borrowing across the board in the future. At the critical stage of economic restructuring and upgrading, it is necessary and necessary for the government to appropriately increase debt to support high-quality economic development. The key lies in standardizing the use and management of new debts, using them more in major strategies, key areas and weak links, and giving full play to the important role of finance in economic structural reform. On the other hand, a reasonable debt management mechanism is also an important guarantee for the long-term mechanism of debt conversion. While dissolving the existing debt, the effective management of incremental debt can avoid the problem of "dissolving one batch and adding another" and truly realize the long-term sustainability of debt.

Third, the central government’s leverage is expected to become a new starting point and new feature of the proactive fiscal policy.The meeting clearly put forward "optimizing the debt structure of central and local governments", indicating that under the background of tight fiscal balance of local governments and high pressure of debt resolution, the high probability of central leverage is a new starting point and new feature of active fiscal policy in the future. On the one hand, the central leverage space is larger and the cost is lower. For example, by the end of the third quarter of 2023, the leverage ratio of China’s central government was only 22.6%, while the leverage ratio of local governments’ explicit debts was 31.2%. If the implicit debts of 50-60 trillion were added, the generalized leverage ratio of local governments might be as high as 70% or more (see Figure 17). In addition, from the perspective of financing cost, national debt < local debt < urban investment debt, and central government bond issuance are also conducive to reducing the government’s debt service burden. On the other hand, the central government plus leverage is more direct and effective in stimulating demand. Compared with monetary policy easing, the central government’s leverage can not only avoid the risk of policy effect decline or even failure due to insufficient demand from micro-subjects (for example, the central bank has continuously lowered the RRR and cut interest rates since the second half of 2021, but the improvement in the growth rate of social integration and M2 is limited), but also increase the income of the private sector by expanding demand, repair its balance sheet, and truly stimulate the endogenous effective demand of the real economy.

4. Real estate risk: improve the supervision of housing enterprises and promote a virtuous circle of finance and real estate.

Affected by the resonance of multiple factors such as structure and periodicity, the real estate market continued to decline beyond expectations in the past two years, which not only greatly dragged down the macro economy, but also gradually spread its risks to the fiscal and financial fields, challenging the bottom line of systemic financial risks. Therefore, this meeting put real estate in the framework of preventing and resolving financial risks for the first time, and emphasized "promoting a virtuous circle between finance and real estate", mainly focusing on three aspects:

First, in terms of supervision, improve the supervision system of housing enterprises and optimize the macro-prudential management of real estate.On the one hand, in the face of the current situation that the three main sources of funds of real estate enterprises are in a tight balance or even broken state, and the risks of a large number of real estate enterprises are exposed at an accelerated pace, the meeting proposed for the first time to "improve the main supervision system and fund supervision of real estate enterprises", indicating that the regulatory authorities will increase supervision over the capital flow of head or high-risk real estate enterprises in the future, which will help curb the spread of risks of real estate enterprises in the short term, standardize the management of pre-sale funds and leverage levels of real estate enterprises in the long term, and identify, warn and dispose of risks early. On the other hand, the meeting proposed "improving macro-prudential management of real estate finance", indicating that under the background of major changes in the supply and demand pattern of the real estate market and short-term excessive adjustment of the real estate market, it is expected that the macro-prudential management direction of real estate will shift from "overheating prevention" to "moderate support" in the future, and the relevant rules such as "three red lines" of financing rules for housing enterprises and "two red lines" of bank real estate loans are expected to usher in adjustment and moderate relaxation.

Second, on the supply side, the financing support for private housing enterprises is expected to increase.The meeting put forward the idea of "meeting the reasonable financing needs of real estate enterprises with different ownership equally" and continued the formulation of "Article 16 on Finance" last year, indicating that the financing difficulties of private housing enterprises are still outstanding (see Figure 18). In the next step, the policy of supporting the financing of private real estate enterprises will be further implemented, and the financing of private real estate enterprises may usher in marginal improvement and support the repair of the supply side of the real estate market.

Third, the demand side, the real estate restrictive policy is expected to be further liberalized, and the "three major projects" take into account the dual functions of underpinning and transformation.On the one hand, the meeting put forward "making good use of the policy toolbox because of the city’s policy", indicating that the package of real estate stimulus policies introduced at the end of August is expected to be further implemented in various places, and the restrictive policies introduced during the overheated market in the past are expected to be gradually withdrawn or optimized. For example, according to the data of the Central Finger Research Institute, there are still 10 core cities with certain real estate restrictive policies. It is worth looking forward to further liberalizing the restrictions on purchases and loans, reducing the down payment ratio and lowering the mortgage interest rate in the future. On the other hand, the meeting emphasized "accelerating the construction of’ three major projects’ such as affordable housing and building a new model of real estate development", which is in line with the proposal of "increasing the construction and supply of affordable housing, actively promoting the transformation of villages in cities and the construction of’ public infrastructure for emergency and peace’" at the Politburo meeting in July. It is expected that the construction of the three major projects will be accelerated and the financial support will be further increased. The three major projects are conducive to stable growth and stable expectations in the short term, especially for stable investment next year; The medium and long term is an important breakthrough direction to build a new development model, which is conducive to eliminating the disadvantages of the old model of "high debt, high leverage and high turnover" and promoting the smooth transition of the real estate industry to the new development model.

5. Financial market risks: prevent risks from transmitting resonance across regions, markets and borders.

In terms of financial market risk prevention, the meeting proposed to "maintain the stable operation of the financial market" and "strengthen the management of the foreign exchange market". According to "the State Council’s Report on Financial Work" made by the leaders of the central bank at the sixth meeting of the 14th the NPC Standing Committee on October 21st, it is proposed to "guard against risk contagion in the stock market, bond market and foreign exchange market", and this financial work conference also emphasized "guard against cross-regional, cross-market and cross-border transmission resonance of risks", which is essentially the same strain.

In recent years, the downward pressure on China’s economy has increased, the external environment is complicated, and financial risks have shown some new characteristics. First, real estate adjustment leads to an increase in the risk of bond default of real estate enterprises, especially the default of overseas bonds of real estate enterprises, which not only affects the expectations of the domestic bond market, but also affects the domestic foreign exchange market and the stock market across the market, affecting the RMB exchange rate and stock price fluctuations; The second is the repayment risk of urban investment bonds under the influence of economic downturn and real estate problems. Because of the particularity of urban investment bonds, there is a risk of cross-regional transmission, which affects the operation of the bond market; Third, the risk of exchange rate instability and overshoot under the influence of multiple factors will also be transmitted to domestic capital markets and entities; Fourth, the spillover effect of monetary policy and financial market fluctuation in major overseas developed economies will have a ripple effect on domestic stock market, bond market and foreign exchange market under the background of global financial opening, and even resonate risks. Based on this, the meeting proposed to reasonably guide expectations and stabilize the operation of financial markets and exchange rate markets.

Fourth, industry impact: localization and specialization are the ways to break the situation for small and medium-sized institutions.

(1) Industry comparison: The future development of insurance industry and securities industry is expected to be marginal.

From the perspective of net assets, the development of insurance industry and securities industry has been slower than that of banking industry since the Fifth National Financial Work Conference.From the end of 2016 before the Fifth National Financial Work Conference to the end of the first half of this year, except in 2019 and 2020 (because the proportion of equity assets held by the insurance industry and the securities industry is higher than that of the banking industry, and the fluctuation of equity assets will affect the net assets, the ratio of net assets of the insurance industry and the securities industry to the net assets of the banking industry will be higher than that of the bear market), the ratio of net assets of the insurance industry and the securities industry to the net assets of the banking industry has declined as a whole (see Figure 19), mainly because the leverage of the banking industry is always higher than that of the insurance industry and the securities industry (

From the perspective of policy orientation to increase the proportion of direct financing and supplement capital to support future business development, the insurance industry and the securities industry are expected to be marginalized in the future changes in the financial structure.The development of the financial industry faces strict capital constraints. The deposit and loan business of the banking industry, the self-operated and credit business of the securities industry, and the asset and liability business of the insurance industry all need to continuously replenish capital to meet the needs of business development. In the banking sector, because the insurance industry, as the main buyer of bank capital supplementary bonds, is under pressure from its own capital, the demand for bank capital supplementary bonds is reduced, so the banking industry needs to "broaden the channels for capital replenishment", and its future development speed is limited by the capital replenishment; In the insurance industry, because insurance companies can count the future surplus of unexpired policies into actual capital, that is, insurance companies can supplement internal capital by optimizing business structure, balancing scale and value without resorting to external capital, so the future development speed of insurance industry is less affected by capital replenishment; In the securities industry, it is expected that with the supervision of "optimizing the calculation standard of risk control indicators of securities companies and appropriately relaxing the capital constraints on high-quality securities companies", the efficiency of capital use in the securities industry will be improved, self-operated and credit businesses will benefit, while investment banks and brokerage businesses will benefit from the better function of the capital market hub and the entry of medium and long-term funds into the market.

(2)Industry structure: concentration will be enhanced, and localization and specialization are the ways to break the situation for small and medium-sized institutions.

The concentration of the financial industry will be further enhanced.According to the experience of mature markets, as the economy enters the stage of stock reorganization and incremental optimization from incremental development, the cases of large financial institutions merging and reorganizing small and medium-sized financial institutions will increase significantly. It is expected that the decision-makers will judge this future development trend and superimpose the actual situation of high risk of small and medium-sized financial institutions. Therefore, they will make "perfecting the institutional positioning, supporting large state-owned financial institutions to become better and stronger, being the main force to serve the real economy and the ballast stone to maintain financial stability, strictly enforcing the access standards and regulatory requirements of small and medium-sized financial institutions, and carrying out distinctive operations based on local conditions". It is expected that with the continuous evolution of "supporting the big and limiting the small", "supporting the superior and limiting the inferior" and "deepening the structural reform of the financial supply side", the concentration of the financial industry will be further enhanced.

Small and medium-sized financial institutions need to realize localization and characteristic operation.The further increase in the concentration of the financial industry means that large financial institutions will realize the nationalization or even internationalization of their business areas and the comprehensive operation of their businesses. Only by taking advantage of their local advantages, small and medium-sized financial institutions can achieve distinctive operations in businesses that have certain comparative advantages compared with the comprehensive business layout of large financial institutions according to their own resource endowments, can they achieve the breakthrough under the improvement of industry concentration.

(C) Business Focus: "Five Great Articles" provide directional guidance for the next stage of financial exhibition industry.

The five articles "technology and finance, Green Finance, inclusive finance, Pension Finance and Digital Finance" mentioned at the meeting contain rich and broad business space, which provides clear guidance for financial institutions in the next stage. On the one hand, all kinds of financial institutions can focus on the five major articles, conduct in-depth research and planning, strengthen innovation based on their respective institutional characteristics and license advantages, continuously improve product supply and enrich service types; On the other hand, financial control group can strengthen business collaboration, promote subsidiaries to play complementary roles in differentiated operations, and cooperate with each other in business promotion to form a unique style of play.

Taking pension finance as an example, trust and insurance companies each have room for innovation in products and services. Trust companies can combine family trust, family trust and pension service, and also innovate pension service trust (such as guardianship support service trust) based on various scenarios of pension. In addition to the traditional commercial endowment insurance products, insurance companies have large exhibition space for personal tax deferred commercial endowment insurance and exclusive commercial endowment insurance. At the same time, trust and insurance institutions also have many opportunities for cross-cooperation. For example, their pension products need to be embedded with the rights and interests of pension services, which involves the screening and cooperation of pension institutions; Another example is the field of pension real estate, where insurance has a long-term financial advantage and trusts have accumulated experience in real estate business.

(IV) Regulatory orientation: firmly take the road of returning to the source and improve compliance risk management.

From comprehensively strengthening financial supervision to preventing and resolving financial risks, the meeting released a signal of strong supervision and strict supervision, which laid the tone for the exhibition industry of financial institutions in the next stage. We believe that the exhibition industry of financial institutions in the future:First, the importance of compliance risk control has increased.At present, the downward pressure on the economy is increasing, and financial risks are gradually exposed. In the past few years, some financial institutions have been affected by risk events, and the development of the whole institution has been in trouble. Therefore, it is particularly important to comply with the exhibition industry and prevent risks in advance in the current environment. Financial institutions should strengthen the awareness of compliance, improve the level of risk control, and keep the bottom line of no major risks.